Japan’s technology M&A landscape is expected to see a surge in deal activity, fuelled by renewed corporate appetite in outbound deals, as well as rising interest in Japanese start-ups with cutting-edge technologies.

Tech deal activity in the country in 2021 is dual-sided. While major players such as industrial/electrical giants Hitachi [TYO:6501] and Panasonic [TYO:6752] are actively seeking to invest billions of USD overseas in technology firms, Japan’s domestic tech industry has finally emerged, with US online payment company PayPal seizing local payment start-up Paidy and its ‘buy now, pay later’ technology.

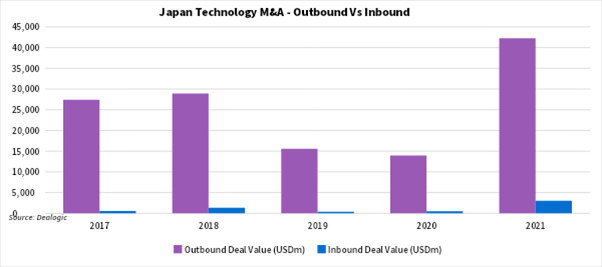

The value of Japan’s tech outbound M&A has rocketed to USD 42.3bn in 2021 year to date (YTD) across 112 buyouts compared with USD 13.9bn in 2020 from 138 deals. Spurring the increase is two major deals: Hitachi’s USD 9.6bn takeover of US software developer GlobalLogic and Panasonic’s USD 7.1bn acquisition of Blue Yonder, a US developer of supply-chain management systems, according to data from Dealogic.

The spike in cross-border buy-outs in 2021 reflects Japan’s persistent hunger for overseas growth in light of the country’s own dwindling population and fewer domestic opportunities.

PayPal’s almost USD 2.7bn (JPY 300bn) acquisition of Paidy in 2021, which contributed to a spike in Japan’s inbound tech deals by value, shook markets, heralding fresh interest by overseas players in shopping for the country’s most promising tech ventures.

Unlike overseas markets, Japan has few unicorns. Nevertheless, industry experts and dealmakers believe the latest moves could lead foreign tech peers to consider the country as one region in which they could identify potential targets going forward.

Japan’s unicorns include Preferred Networks (a developer of practical applications for deep learning), SmartNews (a developer of smart phone apps) and Mobility Technologies (which runs tax dispatch apps).

Japan currently has a pipeline of major tech deals that should help support the country’s tech M&A spree, including Kioxia (formerly Toshiba Memory Holdings, a chip maker backed by Bain Capital), Yayoi (a software developer for small businesses, fully owned by Orix [TYO: 8591]), and Kokusai Electric (formerly Hitachi Kokusai Electric, backed by KKR).

Kioxia is seeking an IPO this year, but merger talks with California-headquartered Western Digital [NASDAQ:WDC] still linger, while Orix is mulling the sale of Yayoi, which generates EBITDA of JPY 10bn.

Meanwhile, private equity (PE) investors are actively hunting for tech M&A deals to scale up to increase competitiveness in the market, says a Japan-based PE firm’s managing partner, according to a report recently released by Morrison & Foerster.

“There is momentum among international PE funds,” says Nozomi Oda, a partner at MoFo’s Tokyo Office, in the report. “I would expect a strong finish to 2021, especially when it comes to acquisitions of Japanese tech assets.”

Add the following topics to your interests and we'll recommend articles based on these interests.

Recommendations are powered by your interests. To add your interests please sign in

Scream for ice cream – Unilever and the case for a near-EUR 20bn asset sale Explore how Brazil's sports betting law brings legal certainty to investors and is expected to foster M&A M&A Activity in the UK Supermarket space Highlights from the Global M&A Dealmakers Sentiment Report 2024

Your M&A Future. Today.

Next-generation Mergermarket brings together human insights and machine intelligence to deliver groundbreaking predictive analytics.

Be the first to know with next-generation Mergermarket

Book a demo todayOur flagship event for key players in the German private equity and M&A market

Marriott Hotel, Frankfurt, 60486

An error occurred trying to play the stream. Please reload the page and try again.

Close

Noz joined Mergermarket in July 2008 to run financial services, TMT and private equity fields. He has covered non-core divestitures by Japanese blue-chip firms, cross-border M&A as well as PE buyouts and exits. Prior to joining Mergermarket, He had worked for various news services and foreign banks, including International Financing Review (Thomson Reuters’ capital market magazine) as well as AFX News (financial news unit of Agence France-Presse) to cover a variety of topics ranging from Japanese corporates global fundraising via equities and syndicated lending, Japanese government bonds, corporate earnings to macro-economic news. At Mergermarket, he has broken scoops on Calsonic Cansei, Hitachi, Panasonic, Takeda Pharmaceutical, Toshiba, JT, Fujitsu, Accordia Golf, Wanbishi and Clarion, among others.