The state of the market: Australian M&A in changing times

According to Mergermarket data, Australian M&A deal volume in 2022 dropped 52%, falling to AU$140bn from AU$289bn in 2021; reflecting the increased uncertainty in the financial markets. Following a bumper year for M&A activity in the region, increasingly volatile geopolitical and economic conditions, including higher interest rates and inflation, has meant that deals have been harder to complete, and the IPO window effectively shut. With this changing environment, a correction is expected to follow. Our panel of seasoned M&A experts will discuss dealmaking in the year ahead and offer their top tips to navigate choppy waters.

- How will macroeconomic factors, including interest rate volatility, supply chain issues and inflation impact corporate activity in the region?

- Have dealmakers seen a shift in opportunities and the types of deals they have been working on?

- Which regions and sectors still show promising growth in the next six months?

- What will the next six months hold for regional M&A, and is a recession/correction expected in the year ahead?

Networking Break

Capturing opportunities in mid-market M&A

According to Mergermarket data, Australia’s mid-market accounted for 31% of all deals in 2022. Whilst overall dealmaking has declined and geopolitical uncertainties continue to persist, Australia’s strong economic fundamentals has meant that the mid-market segment remains a bright spot, as domestic and foreign investors seek out investment opportunities in the region, with inbound M&A accounting for 4084 deals in 2022. Our panel of mid-market experts will share their views on navigating the market.

- Will mid-market M&A remain a bright spot in the market and how is deal flow expected to play out in 2023?

- Which sectors have performed the best and will see the most activity in the next 12 months?

- Have private capital and pensions been a main driver of mid-market M&A activity?

- Will the region see more M&A activity as corporates reassess their business strategies?

Navigating cross-border transactions - regulatory and due diligence perspectives

Navigating cross-border transactions continues to be challenging, with geopolitical and economic volatility adding to the complexity of getting deals done. Whilst Australia continues to be seen as a deal-friendly market, regulators, particularly FIRB and the ACCC play an important role, and dealmakers must consider regulatory challenges ranging from cybersecurity to ESG compliance. Despite the challenges, Australia remains an attractive destination for foreign investors. Our senior experts share their experiences in the region and abroad.

- Foreign investment into Australia - what factors continue to drive inbound dealmaking in the region?

- What are some regulatory issues that dealmakers need to continue to be aware of, such as data privacy, cybersecurity, and ESG compliance?

- FIRB + ACCC updates - how have they affected dealmaking in the region?

- Which emerging countries and markets will be the next hotspots for getting deals done?

Networking Lunch

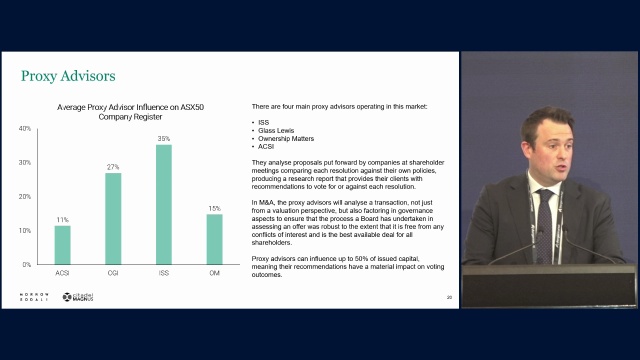

Case study: Stakeholder engagement in dealmaking

This presentation will provide top tips and case studies on how to maximise shareholder votes for M&A deals through stakeholder intelligence and engagement, including ESG and corporate governance considerations.

Sector focus: Technology M&A: an evolving market

The Australian technology M&A market has seen major shifts in the past year. Compared to record high valuations and technology megadeals in the space a year ago, lower valuations for technology firms have meant that companies have had to increasingly seek funding in the private markets to stay afloat. Whilst this shift may provide the impetus to restart merger activity in the sector, and although Australia’s middle market technology companies and expanding startup scene remain attractive to investors, buyers will tread more cautiously. Our panel of technology experts will discuss the opportunity set in the sector and debate what the future holds.

- How has the sector changed in the past year, and how are dealmakers responding to the sector volatility and impacts on valuations?

- Which tech industries have seen the most activity in the past 6 months, such as fintech and e-commerce?

- What are corporate buyers looking for in this dealmaking environment, and how have their strategies changed compared to 2021/2?

- Digitalization - what are some recent examples of companies that have acquired new technologies?

Networking break

Sector focus: Moving towards energy transition and decarbonization

Acquisition opportunities in the energy transition and decarbonization space have been seen as a bright spot in the Australian M&A market, as energy and natural resources companies divest their carbon-emitting portfolios and make investments to meet their net zero targets. Indeed, as a sector less driven by valuations and financing markets, the opportunities remain abundant in the region. Our panel of experts will discuss the opportunity set in this space and how to tap into key sectors.

- How are firms repositioning their portfolios towards energy transition and decarbonization?

- Are we likely to see more competition in this sector, both from a private equity and M&A standpoint?

- Which sub-sector has seen the most activity, such as renewables, hydrogen, battery storage and other clean technologies?

- How will ESG continue to drive investment strategies and deal activity as we move into 2023?

Australian private equity - a maturing market

Amidst global uncertainties and public market volatility, the private equity industry in Australia remains active, with an abundance of capital that is waiting to be deployed. Whilst capital continues to be raised and PE sponsors continue to be sitting on high levels of dry powder, falling rates, competition from strategic buyers, cost of debt, and the effective closure of the IPO market as an exit path all serve as obstacles that may impact getting deals done. Our panel of private equity veterans will unpack the opportunity set that remains in the region and discuss what lies on the horizon in the year ahead.

- How has the PE industry changed in Australia in the past year? Are we seeing fewer big buyouts and more trade sales, take-privates, bolt-on acquisitions, and tertiary buyouts?

- Where are offshore and regional GPs still finding the best opportunities, such as taking advantage of low valuations of small-cap software companies, and is Australia still seen as a relatively safe haven from global headwinds?

- Private equity vs strategic buyers - has there been more competition for assets?

- What is the outlook for the rest of the year including opportunities on the horizon and potential pitfalls?

End of Conference and cocktails

Confirm cancellation

An error occurred trying to play the stream. Please reload the page and try again.

CloseSign-up to join the ION Analytics Community to:

- Register for events

- Access market insights

- Download reports

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow