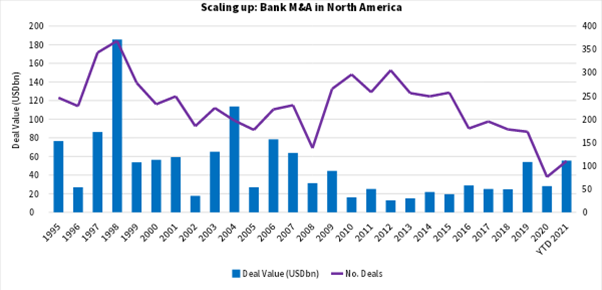

Banking sector mergers and acquisitions have reached their highest level since 2007, when the financial crisis forced several banks to merge to stay alive.

Year to date (20 October), North America’s banks have announced mergers worth USD 55.5bn.

That is already almost double last year’s USD 28.2bn when uncertainty sowed by the pandemic led to a 50% drop in deal making on 2019, another big year for deal making. This year could end up outpacing 2007, when deals worth USD 63.8bn were done.

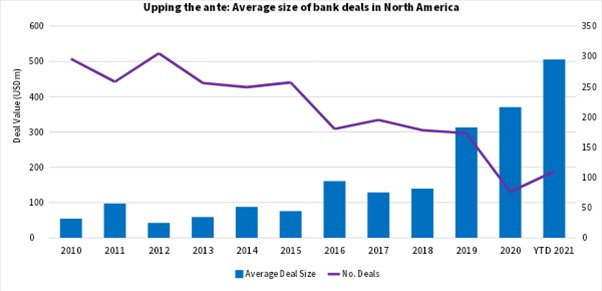

While there are fewer deals, they tend to be much bigger, involving larger regional banks. This year, 11 deals have exceeded USD 1bn, led by the USD 8bn purchase of California-focused MUFG Union Bank by US Bancorp [NYSE:USB], the USD 7.5bn acquisition of New England-focused People’s United Financial by M&T Bank [NYSE:MTB], and the USD 5.2bn merger of Oregon’s Umpqua [NASDAQ:UMPQ] with Washington state’s Columbia Banking System [NASDAQ:COLB].

No wonderful life

Community banking in the US has undergone a multi-decade decline, from 17,000 institutions in 1984 to less than 5,000 today. People no longer crave the high-touch banking immortalized in ‘It’s a Wonderful Life’, where George Bailey spends his life building relationships with the town’s folk. Instead, they prefer banking by phone.

The rise of non-bank fintech companies, which offer loans at much lower rates and conduct the whole process online, has put the greatest pressure on banks to merge.

To compete with them, banks need better technology. But to justify the costly investment, banks need sufficient customer throughput and scale. “Small banks can’t afford the technology. It would ruin their returns,” says Dick Bove, an analyst at Odeon Capital. “It’s merge or fail.”

Banks also must follow stricter rules on keeping capital reserves and meeting stress tests than non-bank financial institutions, which eats into profits. Furthermore, record low interest rates are hurting the ability of banks to lend profitably.

Banks that hold less than USD 25bn in assets must team up with others to gain the scale that would justify the technological investments needed, says Bove. Some of the biggest banks in that category include Arkansas’ Simmons Bank (USD 23.4bn in assets), Atlanta’s Ameris Bank (USD 21.8bn), California’s Pacific Premier Bancorp (USD 20.5bn), and Montana’s Glacier Bancorp (USD 20.5bn).

But bigger banks in the US interior could get swept up by the super-sized banks on the coasts. Regions Financial [NYSE:RF], the last major regional bank standing in Alabama after a spate of consolidation there, could eventually sell to an institution like US Bancorp, says Bove. The Midwest should consolidate its overabundance of banks, adds Bove, pointing to a trio of Ohio-based banks: Huntington Bancshares [NASDAQ:HBAN], KeyBank [NYSE:KEY] and Fifth Third [NASDAQ:FITB]. “Does Ohio need that many? I don’t think so.”

Add the following topics to your interests and we'll recommend articles based on these interests.

Recommendations are powered by your interests. To add your interests please sign in

Scream for ice cream – Unilever and the case for a near-EUR 20bn asset sale Explore how Brazil's sports betting law brings legal certainty to investors and is expected to foster M&A M&A Activity in the UK Supermarket space Highlights from the Global M&A Dealmakers Sentiment Report 2024

Your M&A Future. Today.

Next-generation Mergermarket brings together human insights and machine intelligence to deliver groundbreaking predictive analytics.

Be the first to know with next-generation Mergermarket

Book a demo todayUnlock your M&A potential at our premier European forum!

The Langham, London

An error occurred trying to play the stream. Please reload the page and try again.

Close