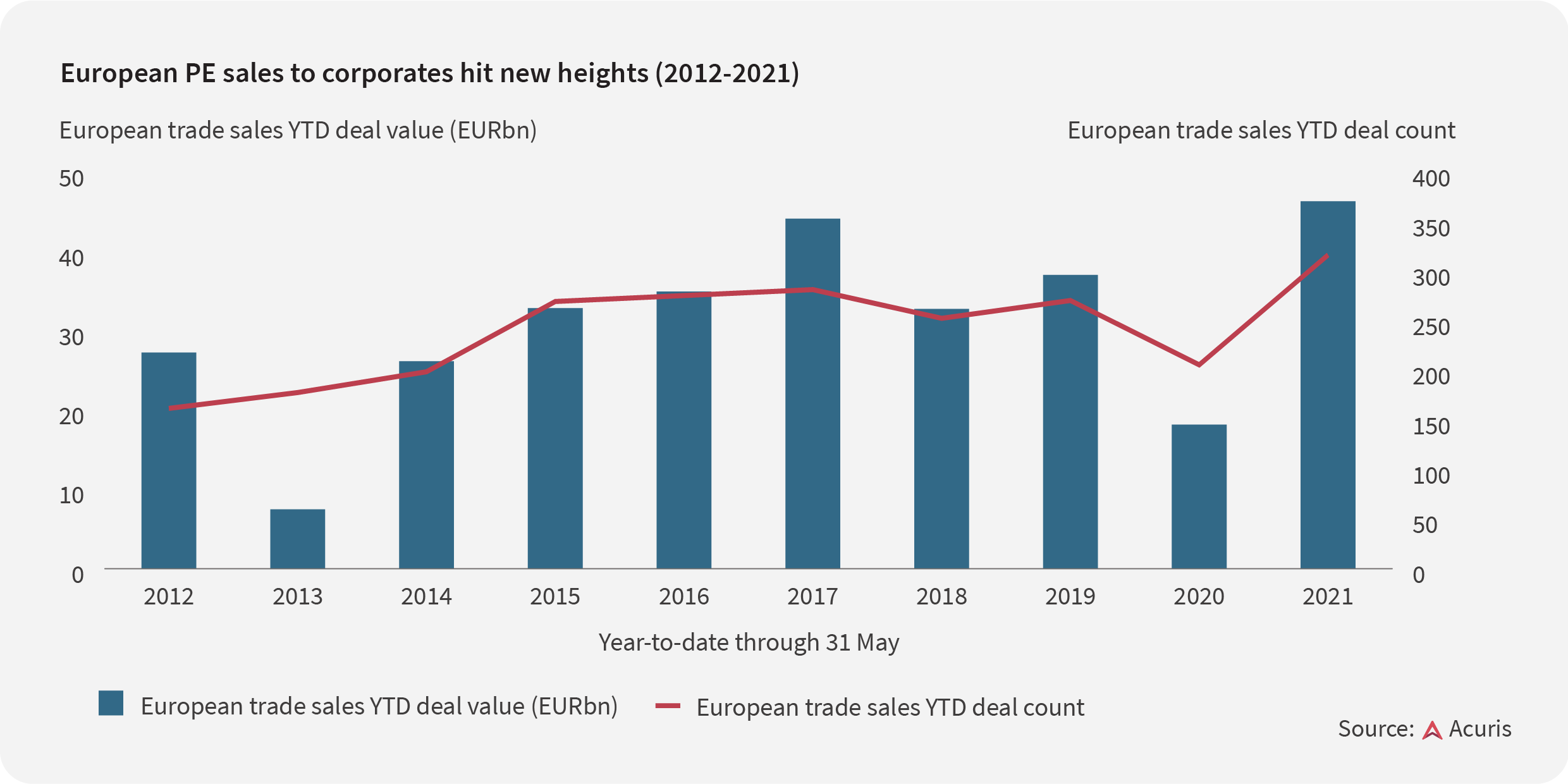

After a year in which corporates hunkered down and prepared for the worst, private equity (PE) trade sales are now firmly back on the menu. According to Mergermarket, 71% of exit value came from corporates opening their cheque books for deals, a significant jump from 49% in the same months last year as the pandemic pummelled investor sentiment.

This shouldn’t come as a surprise—PE firms are realising more assets and more investor capital than in any matching period in the past decade, spurred on by Europe's vaccine rollout and relatively optimistic economic outlook.

A corporate affair

Across the continent, there have already been 452 sales of PE-backed assets in 2021 worth a combined €65.6 billion. The last time activity came close to these levels within the same timeframe was in 2017, when funds sold 414 European assets (year-to-date) and brought home €62 billion for their LPs.

The difference this time is that the events of 2020 exposed corporate vulnerabilities on a grand scale, from weak digital channels to irrelevant product lines. Now, many of those same companies are in a mad rush to reconfigure their business models and adapt to changing demand patterns. And PE firms are reaping the benefits.

Go with the IPO flow

IPOs have been another major bright spot for PE, despite a few snags for high-profile listing candidates—just ask HgCapital’s German car sales website MeinAuto or Nordic Capital-backed Swedish online payments provider Trustly, both of which were shelved last month.

But recent inflation-related jitters over the prospects of growth assets have done little to dent PE's appetite for a good IPO.

As of 19 May 2021, 26 European portfolio companies had floated on exchanges to the tune of €12.7 billion, lifted in no small part by the public offering of AUTO1 in February with a market cap of €7.9 billion and the IPO of Oatly in New York last month, valuing the Swedish oat milk maker at US$10 billion.

This means that 2021 has every chance of beating the previous best. Currently holding the crown is 2014, which saw €23.4 billion worth of value realised via listings. If current momentum stays the course, then Europe's PE mavens will have much to celebrate come December.