For years Netflix [NASDAQ:NFLX] CEO Reed Hastings has cautioned about video games like Fortnite posing a greater threat to the streaming service than peers such as HBO Max, Disney+, Hulu or Amazon Prime.

This month, it finally launched its own mobile games service, having snared its first video gaming developer, Night School Studio, maker of the supernatural thriller Oxenfree, in late September for undisclosed terms.

“Netflix moving into gaming in such an aggressive manner shows just how much heat is in the gaming sector,” says Bernard Kim, president of publishing for Zynga [NASDAQ:ZNGA], a highly acquisitive mobile gaming company. “We are all fighting for eyeballs from a generation of customers that are also gamers.”

Mergers and acquisitions of North America-based software gaming platforms have hit new highs in each of the past three years: in 2020, deals worth USD 27.4bn were announced, beating the previous record of USD 17bn set in 2019. This year to date (10 November), even though deal value has dipped to USD 14.4bn, the 57 deals done have already matched last year’s record haul.

Wynn Resorts [NASDAQ:WYNN] has scored this year’s biggest hit, merging its mobile gaming subsidiary with a special purpose acquisition company (SPAC) in a USD 3bn deal in May. Second place on the leaderboard was February’s USD 2.5bn sale of mobile games developer Glu Mobile to Electronic Arts [NASDAQ:EA], followed closely by August’s USD 1.55bn acquisition of Golden Nugget Online Gaming by Boston-based fantasy sports operator, DraftKings [NASDAQ:DKNG].

Source Dealogic

M&A consoled by new releases

While the pandemic is one oft-cited factor in last year’s record haul – the locked-down masses spent more time than ever before playing video games – many of those deals eventually would have happened anyway. For example, Zynga had Istanbul-based Peak Games in its sights for several years before paying USD 1.8bn for it in June 2020. The pandemic accelerated many deals, with developers induced to sell when the strains of designing games from home became too much.

The release of new gaming consoles also drives M&A: Microsoft [NASDAQ:MSFT] released its latest Xbox and Sony [TYO:6758] launched its newest PlayStation last November, their first refresh in seven years.

The huge market opportunity is perhaps the biggest lure – Newzoo estimates 2021’s global games market will top USD 180.3bn of revenue, with mobile games capturing USD 93.2bn, followed by console gaming (USD 50.4bn) and PC games (USD 36.7bn).

One emerging area is blockchain and integrating non-fungible tokens (NFTs) into gameplay. Zynga this month hired a new vice president to lead that effort. Among future possible targets is blockchain-based gaming platform Forte Labs, which in May raised USD 185m at a USD 1bn valuation.

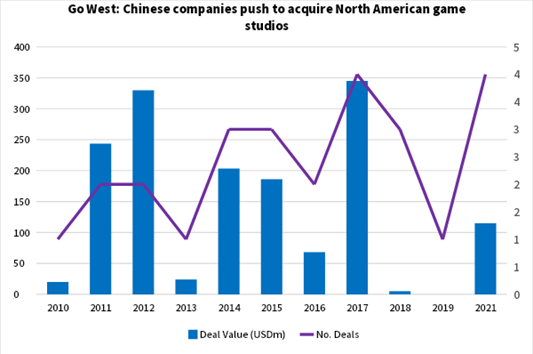

Another shift in the past five years has been the emergence of China’s game developers, such as Tencent [HKG:0700], as buyers beyond their borders. After Beijing in August restricted minors from playing video games for more than three hours a week, efforts to seek growth abroad could heat up.

Netflix and other streaming services also could continue plugging in acquisitions to give themselves a platform for success.

“Deal-making is more competitive today than a couple of years back,” says Kim. It has resulted in higher multiples. “I don’t see it slowing down.”

Source Dealogic

Source Dealogic

Add the following topics to your interests and we'll recommend articles based on these interests.

Recommendations are powered by your interests. To add your interests please sign in

1 - KR - Welcome Remarks_Edited 2 - EN - Private markets Changing Strategies_Edited 1 - EN - Welcome Remarks_Edited 2 - KR - Private markets Changing strategies_Edited

Your M&A Future. Today.

Next-generation Mergermarket brings together human insights and machine intelligence to deliver groundbreaking predictive analytics.

Be the first to know with next-generation Mergermarket

Book a demo todayNow in its third year, the Mergermarket Private Equity Forum New York has become a must-attend event for the private equity community. It’s designed to help you navigate the complexities of dealmaking with confidence, offering exceptional insights, practical strategies, and meaningful connections. Whether you’re an LP looking to expand your portfolio, a GP showcasing your expertise, or a private equity professional seeking collaborations, the forum is your platform for success in today’s dynamic market.

An error occurred trying to play the stream. Please reload the page and try again.

Close