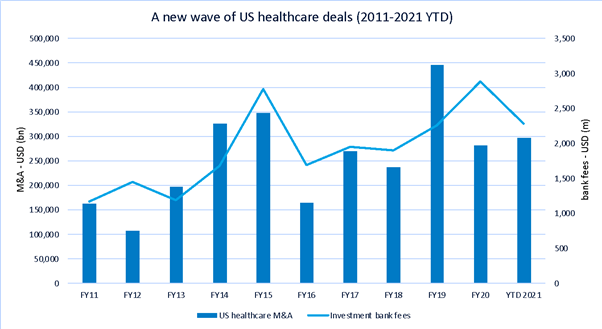

Flashback to pre-pandemic times – the year of 2019 – when pharmaceutical M&A in the US reached a peak of almost USD 450bn. That year, pharma majors aggressively sought to consolidate portfolios, conquer new markets, and acquire companies focused on drug development.

This year has been different.

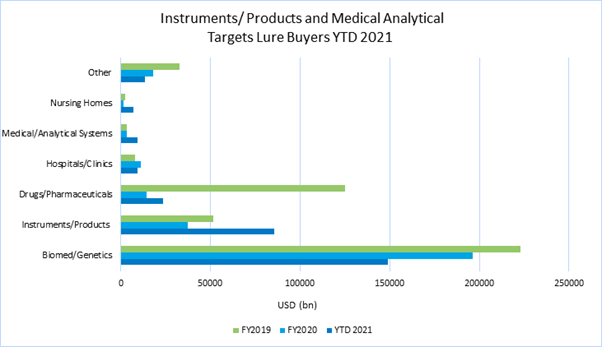

Gone – for now – are Big Pharma’s mega deals aimed at filling drug pipelines. Instead, buyers are focused on the need of the day: clinical research for speedy approvals of vaccines and other therapies; an ability to manufacture those vaccines and other cutting-edge drugs; and ensuring hospitals and clinics are properly supplied with medications and equipment.

Several mega deals in 2021 have shown this shift. Financial behemoths Hellman & Friedman, Carlyle and Blackstone clubbed together in June to pay USD 30bn for a majority stake in Medline, a family-held manufacturer and distributor of medical supplies. Two other mega deals involved contract research organizations (CROs), which help manage clinical trials such as for the COVID-19 vaccines. One of those was PPD, which agreed to sell to Thermo Fisher for USD 17.4bn in April, and the other was PRA Health Sciences. Other major deals included Baxter’s acquisition of medical equipment company Hill-Rom for almost USD 12bn and Danaher’s USD 9.6bn acquisition of Aldevron, a manufacturer of plasmid DNA, mRNA and proteins used in vaccines and gene therapies.

Those deals helped US healthcare M&A reach USD 297bn year-to-date, already eclipsing the whole of 2020. Deal making in US healthcare is second only to the country’s technology sector, although its proportion of total M&A in the US has slipped to 14% from around a quarter in 2019. Investment banks have netted USD 2.28bn in healthcare fees, led by stalwarts in the space Goldman Sachs, Morgan Stanley, JPMorgan and Centerview Partners.

Source: Dealogic

Consistently, for the past four years, US healthcare targets have been the focus of domestic strategic and financial sponsors. This year, 84% of all announced deals involved a US-based buyer. Over the past two years, there has been a flurry of buy-side interest from Europe, especially Ireland, Switzerland, France and Germany, who have replaced 2019’s suitors from Japan, Canada and China.

The biggest inbound deal this year was the USD 12.3bn sale of PRA Health, the afore-mentioned CRO, to Ireland’s ICON in February. Another large inbound was Paris-based Sanofi’s USD 3.2bn acquisition of Translate Bio, which specializes in mRNA therapeutics for vaccines and therapies. Last December, the UK’s AstraZeneca agreed a USD 39bn deal for Alexion Pharmaceuticals, which specializes in orphan drugs to treat rare diseases, in just the kind of big pharma deal that has gone missing in 2021.

What deals next?

As the Delta variant continues to spread among the unvaccinated, and an icy winter looms, the big question is: how long before we see a return of the mega drug development deals? Or will deals for contract research companies, clinical diagnostics, instruments, lab testing and genome therapy continue to grow?

Mergermarket has identified the following healthcare companies that either are in play or could be attractive targets in the foreseeable future.

Source: Dealogic

Add the following topics to your interests and we'll recommend articles based on these interests.

Recommendations are powered by your interests. To add your interests please sign in

1 - KR - Welcome Remarks_Edited 2 - EN - Private markets Changing Strategies_Edited 1 - EN - Welcome Remarks_Edited 2 - KR - Private markets Changing strategies_Edited

Your M&A Future. Today.

Next-generation Mergermarket brings together human insights and machine intelligence to deliver groundbreaking predictive analytics.

Be the first to know with next-generation Mergermarket

Book a demo todayNow in its third year, the Mergermarket Private Equity Forum New York has become a must-attend event for the private equity community. It’s designed to help you navigate the complexities of dealmaking with confidence, offering exceptional insights, practical strategies, and meaningful connections. Whether you’re an LP looking to expand your portfolio, a GP showcasing your expertise, or a private equity professional seeking collaborations, the forum is your platform for success in today’s dynamic market.

An error occurred trying to play the stream. Please reload the page and try again.

Close