Head to the gym or break a sweat from the comfort of your own living room? For the past 18 months or so, this hasn’t really been a choice—amid lockdowns, consumers turned to home workouts to stay in shape as gyms were shuttered.

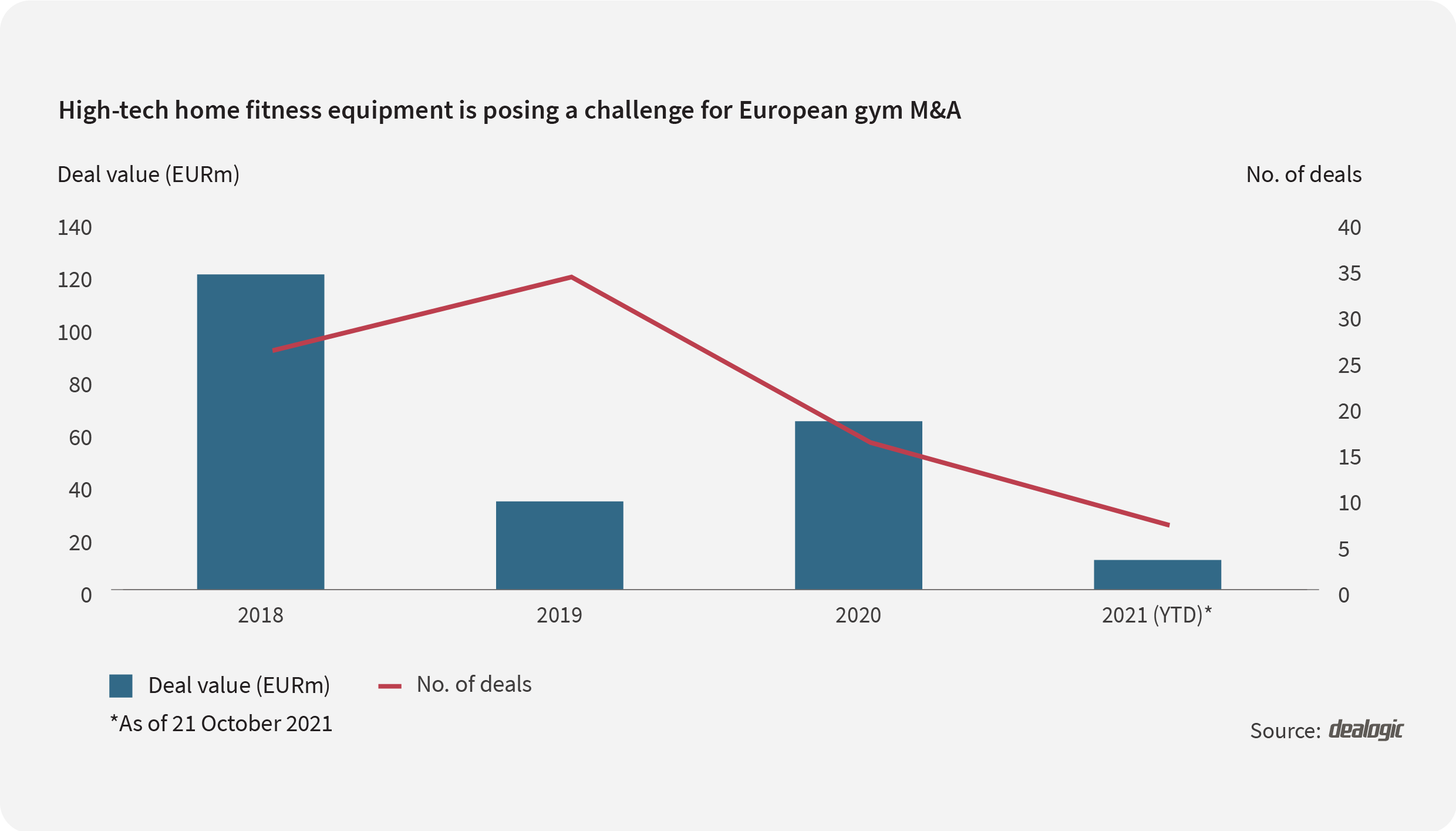

As a result, even with the prospect of a post-COVID-19 rebound, gym M&A in Europe has been thin on the ground. There have been just seven deals announced in the space so far this year, versus 16 in 2020 and 34 the year prior, with many of them marked by distress.

UK-based gym chain Virgin Active is one such case, after restructuring in May following the forced closure of its sites. In Spain, Forus, Deporte y Ocio was thrown a lifeline by JPMorgan Asset Management, which has since gone on to bolt further gyms on to the company's portfolio, including eight inherited from Virgin Active. And Belgian gym chain JIMS was taken over by Colruyt Group this past spring after a difficult 2020.

Home bound

The real M&A action in the sector has been reserved for companies enabling remote workouts. For example, Australian digital-fitness group OliveX bought UK-based fitness-app developer Six to Start in March and remains on the acquisition trail in Europe, seeking out fitness-tech deals.

Mayfair Equity Partners, meanwhile, is responsible for the largest such deal in Europe to date this year. The firm put up €35 million in growth funding for eGym, a German company that made nearly a quarter of its workforce redundant during the pandemic.

While eGym is a fitness-tech player, with workout machines connecting to wearables that track personal performance, it is relying upon the recovery of fitness studios as these are its main customers, having decided against selling to consumers.

A marriage of convenience

The eGym deal shows that gyms may be down, but they are not out. The use of home workout apps, devices and machines boomed during the pandemic, but people still want dedicated spaces in which to exercise, away from family, pets and other distractions.

This time, however, things are different. City centre chains that once benefitted from office staff seeking a local workout have been dealt a bad hand with the implosion of commuting. Instead, people are looking for cheap and convenient alternatives.

Budget gyms with affordable and flexible memberships have seen a recent surge in activity. No-frills gym chain PureGym, backed by Leonard Green & Partners, said visits this June to its facilities in the UK, Denmark and Switzerland were up 14% from December 2019.

Last month, the company put plans for a £1.5 billion IPO on hold, put off by market gyrations rather than any pullback in its operating performance. Part of that raise, when it eventually comes, is likely to go towards adding to its circa 300 sites.

Its low-cost competitor Gym Group recently pulled off a £31 million share placement, prompting speculation that the group may beef up with new sites.

Rather than killing off the gym industry, the pandemic has reshaped it. Solitary home workouts or sweat it out on-site? There's room for both, it seems.

Recommendations are powered by your interests. To add your interests please sign in

1 - KR - Welcome Remarks_Edited 2 - EN - Private markets Changing Strategies_Edited 1 - EN - Welcome Remarks_Edited 2 - KR - Private markets Changing strategies_EditedNow in its third year, the Mergermarket Private Equity Forum New York has become a must-attend event for the private equity community. It’s designed to help you navigate the complexities of dealmaking with confidence, offering exceptional insights, practical strategies, and meaningful connections. Whether you’re an LP looking to expand your portfolio, a GP showcasing your expertise, or a private equity professional seeking collaborations, the forum is your platform for success in today’s dynamic market.

An error occurred trying to play the stream. Please reload the page and try again.

Close