The harshest winter temperatures in a half century are prompting Uzbek authorities to accelerate approvals for renewables projects, with the government setting targets of 4 GW each of solar and wind projects for the next three years.

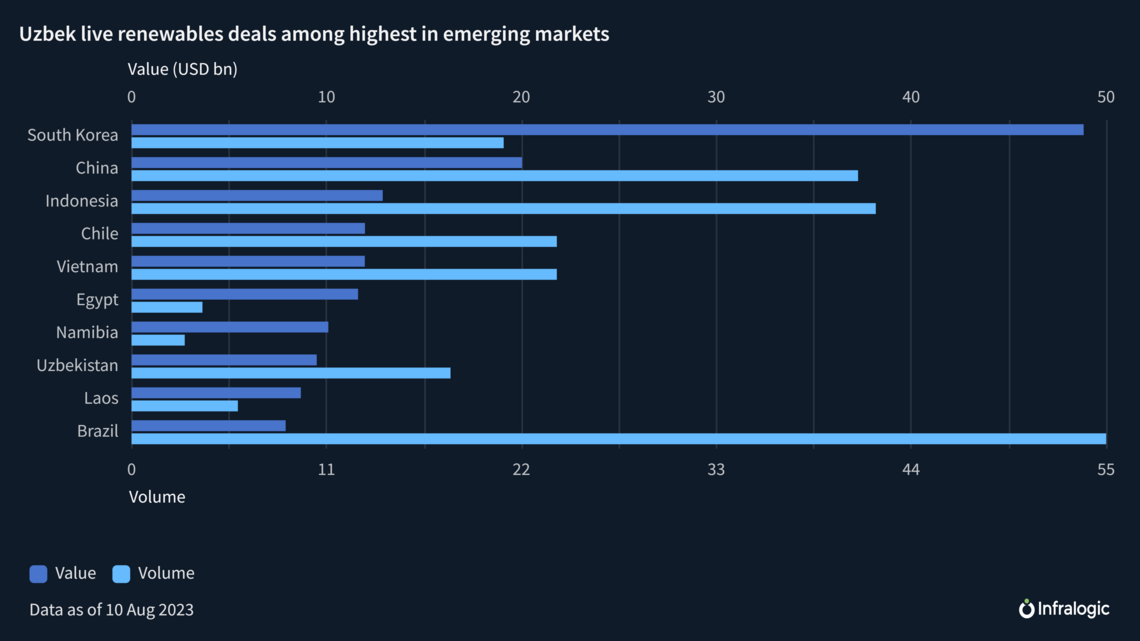

The nation currently has at least USD 9.5bn of live Greenfield Renewables deals seeking financing, the eighth-highest among emerging markets globally, according to data compiled by Infralogic. A further 1.55 GW valued at USD 1.5bn has been put up for bidding by the Ministry of Energy. Uzbekistan needs about USD 20bn of investments in generation assets and battery storage by 2030, says Bahodir Amonov, an energy specialist at the World Bank.

Last winter was one of the worst for Uzbeks, with temperatures plunging to -20 degrees celsius in the capital Tashkent and a suspension of natural gas imports from Turkmenistan impacting generation and leading to power outages. The government has stepped up the implementation of energy sector reforms that began in 2018, opening up renewables to private and foreign investors, and breaking up vertically integrated energy firms. A total of USD 2.1bn of greenfield renewables deals closed in the first half of this year, the sixth-highest globally.

“The next phase of the reform program, which envisages more privatizations including of some key state-owned companies, will add further complexity in the short term while hopefully providing a more stable environment for longer-term investments,” says Charles Whitney, a London-based partner at Norton Rose Fulbright with experience advising developers in the country.

The changes were backed by legal framework developments that included the passing of the Law On Investments and Investment Activity which defined contractual relations between parties in investment agreements, and the Law on Public-Private Partnership implemented in 2019 and revised two years later.

When combined, these changes “resulted in the opportunity to develop highly bankable project structures, stronger than in some other emerging markets”, helping Uzbekistan attract established and experienced investors, says Anton Usov, the European Bank for Reconstruction and Development's chief spokesperson for Central Asia.

The January-June period of 2023 was the first half year of investment into renewables surpassing fossil fuel-fired infrastructure, according to data compiled by Infralogic. Uzbekistan aims to achieve net zero emissions by 2050. The pipeline of 22 live projects of which six are worth USD 9.5bn contrasts with traditional power's three live projects where one is worth USD 1.2bn. The values of the other projects have not yet been disclosed.

Of the top six investors in Uzbekistan, three are Gulf developers ACWA Power, Masdar and Nebras Power. They have closed at least nine transactions overall since 2020 - worth around USD 2.8bn in onshore wind, and to a lesser extent, solar PV - and are currently preferred bidders for another nine.

Masdar has secured the lowest tariff so far at Uzbek solar auctions at 1.791 US cents per kWh for a solar PV project in Samarkand. The other three top-ranked investors are Electricite de France (EDF), Siemens and Stone City Energy. Total Eren won a bid for the Tutly 100 MW Solar Plant worth USD 87m, and Mitsui unsuccessfully bid for both the Syrdarya I 1.5 GW CCGT Plant worth USD 1.12bn and the Nur Navoi 100 MW Solar Plant that were awarded to ACWA and Masdar, respectively.

“Since these [Gulf] developers have close ties with partners in China, which manufacture renewables technology at competitive prices and are experienced in constructing related infrastructure, it is less logistically challenging for them to execute from both a project cost and delivery timeline perspective,” says Amonov of the World Bank.

Chinese energy developers occupy a significant part of the live renewables pipeline, having collectively won at least USD 5.1bn, or 54%, of the current known deals at the preferred bidder stage.

The bulk of projects by Chinese developers procured so far are gigawatt-scale plants proposed through direct investments. Amonov said that, given that auction tender timelines can take more than a year, the Uzbek government is favouring direct proposals because they can agree on competitive tariffs relatively quickly and maximise the chances of getting projects to the construction stage before the coming winter.

Multilateral lenders still play a significant role in Uzbekistan, having lent to 10 out of at least 12 greenfield energy projects that have reached financial close from the beginning of 2021. Of these, Infralogic data shows that out of at least USD 3.82bn in Uzbek infrastructure debt issued since 2020, multilateral lenders and their subsidiary funds account for 59%, while the remaining loan value was provided by commercial banks.

This proportion has since fallen to a low of 46% as of the first half of 2023. Participation from commercial banks is still often via B loan tranches that are guaranteed by the World Bank or European Bank for Reconstruction and Development.

Norton's Whitney says that the involvement of multilaterals whether as co-lenders or guarantors is necessary to support major global infrastructure lenders which typically have limited experience in this region to familiarise themselves with the market and eventually lend on an uncovered basis.

Usov says that the EBRD is “actively engaging in selling unfunded risk participations (URPs) on its portfolio facilities to private sector investors”. It sold USD 10m on the Syrdarya 1.5 GW CCGT project and is open to more URP sales, he says.

In a URP agreement, the EBRD transfers its risk exposure on a part of its emerging market loan transaction to an insurance company in exchange for a portion of the interest margin it would have earned. This allows the EBRD to increase its loan participation as constraints on the amount of risk it can take on are offset by the agreement.

Countries such as Egypt and Kazakhstan already have around EUR 200m and EUR 400m in URPs signed, according to EBRD data, potentially alluding to how much larger private sector risk – and consequently multinational debt mobilisation – could grow in Uzbekistan given the pipeline of projects.

Government subsidies for infrastructure compound the country’s status as a young emerging market, which acts to deter commercial lenders. “Although the government has been working hard to reform its tariff system, its ongoing subsidization of natural gas and electricity costs lead[s] to interest from commercial and investment banks to lend or invest their own finance”, Amonov says.