Shippers, airlines and global supply-chain players ground to a halt last year in the wake of COVID-19. Despite this, Asia’s logistics industry lived to tell the tale, posting a solid 238 deals in 2020. Having weathered the worst storms in living memory, logistics M&A is here to stay.

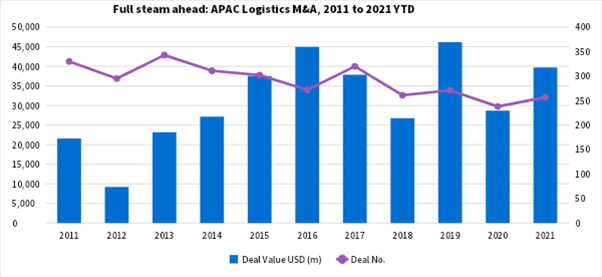

In 2021, the industry has forged ahead, grabbing USD 39.68bn of M&A transaction value in the year to date (YTD) – close to pre-pandemic levels – from 257 deals. This compares with USD 28.66bn pocketed last year, according to Dealogic data.

Hong Kong has been a regional flag-bearer in 2021, led by SF Holding’s [SHE:002352] 51.8% stake acquisition in Kerry Logistics Network [HKG: 636] for USD 3.9bn. Unsurprisingly, China tops the national league table, with 105 deals sealed worth USD 18.4bn thus far. Singapore sails into third place by deal value, bolstered by Temasek’s takeover offer for SembCorp Marine [SGX:S51], followed by India and South Korea.

That’s not all. In August, Hong Kong-based logistics real-estate developer ESR Cayman [HKG: 1821] created a splash when it announced a takeover of Singapore’s ARA Asset Management [SGX:D1R], which adds a whopping USD 5.19bn to the kitty.

In a post-COVID world, supply bottlenecks have boosted freight rates for container shippers. Online shopping has elevated demand for logistics and delivery companies to sky-high levels. Airlines are seeking respite from passenger travel restrictions by turning to cargo.

But COVID is not the only driver.

With the click of a button, consumers can buy more today than in the early 2000s. To meet this need, companies need to pack and move goods faster and cheaper than ever. COVID only caused a temporary blip to supply chains, but historical demand for logistics never waned. Stay-at-home consumers only got hungrier.

How can companies meet this demand? Through consolidation and cutting deals.

The value of logistics deals has only risen, despite a gradual dip in volumes, over the past 10 years.

Source: Dealogic

It is not only trade between Asia and the rest of the world. Growing consumerism and disposable income among Asian economies is fueling the market for intra-Asian logistics.

The region is set to represent around half of the world’s trade growth by 2030, according to a report by McKinsey & Co. Asia’s e-commerce logistics market is forecast to contribute 57% of total market growth between 2020 and 2025.

European acquirors have already been knocking on Asia’s door. In Denmark, shipping company Maersk [CPH:MAERSK] has shown interest in a takeover of Hong Kong-headquartered LF Logistics, as reported by Mergermarket. Switzerland’s Kuehne+Nagel [SWX: KNIN] snapped up Hong Kong-based freight forwarder Apex International for USD 1.5bn in February this year. The Swiss company has since hinted that it is greedy for more Asian M&A gains.

Meanwhile, deals are brewing from Chinese trucking companies. Didi Freight is adding jewels to its M&A war chest through a USD 500m fund-raise, while Full Truck Alliance [NYSE:YMM] is tapping bank opinions on a Hong Kong listing.

As Asia navigates itself to becoming a global logistics hub, the stage is set for more deals.

Add the following topics to your interests and we'll recommend articles based on these interests.

Recommendations are powered by your interests. To add your interests please sign in

Scream for ice cream – Unilever and the case for a near-EUR 20bn asset sale Explore how Brazil's sports betting law brings legal certainty to investors and is expected to foster M&A M&A Activity in the UK Supermarket space Highlights from the Global M&A Dealmakers Sentiment Report 2024

Your M&A Future. Today.

Next-generation Mergermarket brings together human insights and machine intelligence to deliver groundbreaking predictive analytics.

Be the first to know with next-generation Mergermarket

Book a demo todayUnlock your M&A potential at our premier European forum!

The Langham, London

An error occurred trying to play the stream. Please reload the page and try again.

Close