Media mania is back, following several major deals this year.

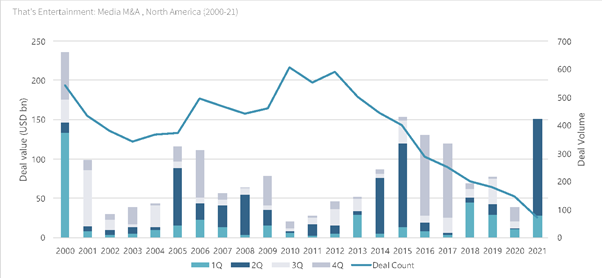

In 1H21, M&A in North America’s media sector reached USD 152bn by value, breaking the previous 1H highwater mark of USD 147bn in 2000, the year of AOL’s blockbuster Time Warner merger.

The number of deals has declined from a peak of 608 in 2010 to 147 in 2020, showing transactions are getting far bigger.

Two factors are driving the frenzy. First, telecoms are unwinding unsuccessful forays into media content and redeploying proceeds into expensive 5G infrastructure. That led to AT&T spinning off WarnerMedia to Discovery in a USD 96bn deal in May, less than three years after acquiring it, and Verizon jettisoning AOL, Huffpost and Yahoo.

Second, cord cutting and on-demand streaming snowballed during the pandemic. To win wallet share in an increasingly crowded field pioneered by Netflix, streaming companies now need a constantly refreshed pipeline of compelling content. That led to Amazon paying USD 8.5bn for movie studio MGM in June. Apple also was reportedly interested in acquiring independent movie studio A24 or Reese Witherspoon’s production company Hello Sunshine. It shows Big Tech has the capital and appetite to acquire content creators, who now command a premium.

But questions remain over older content creators like AMC Networks and Lions Gate’s Starz, which are losing revenue from declining cable syndication fees while also being under pressure to refresh content. After past attempts at selling, can they find a dance partner?

The winners and losers among streaming players and business models are yet to be determined. Ad-supported platforms like Tubi, Xumo and PlutoTV – acquired by Fox, Comcast and ViacomCBS, respectively – remain attractive to budget conscious consumers. Subscription-based streaming companies need scale and branding, in addition to the compelling content, to keep up with leaders Netflix, Amazon and Disney. Could teaming up with FuboTV, which offers live sports, help?

Other areas in media attracting interest include podcasts, gaming and advertising technologies. Spotify, iHeartMedia and SiriusXM have been acquiring podcast assets, amid speculation the latter two may combine. Zynga continues to consolidate mobile gaming, something Netflix plans to offer. Several adtech companies like Outbrain and Teads have been looking at going public, while another to watch is StackAdapt, a fast-growing programmatic ad exchange.

Then there is the elephant in the room: what is Comcast’s next move? Antitrust authorities would likely nix a combination with ViacomCBS given they own two of the US’s four largest broadcast networks in NBC and CBS. Comcast also has reportedly shown interest in acquiring streaming platform Roku. A third possibility is whether Comcast - or other media giants - acquire a combined Discovery/Warner Media down the road. Time Warner and its various iterations have passed hands for vast sums so many times, that last scenario will hardly come as a surprise. Hot Hits: Top 10 Media Deals, North America (2000-21)

Hot Hits: Top 10 Media Deals, North America (2000-21)

Source Dealogic

Add the following topics to your interests and we'll recommend articles based on these interests.

Recommendations are powered by your interests. To add your interests please sign in

1 - KR - Welcome Remarks_Edited 2 - EN - Private markets Changing Strategies_Edited 1 - EN - Welcome Remarks_Edited 2 - KR - Private markets Changing strategies_Edited

Your M&A Future. Today.

Next-generation Mergermarket brings together human insights and machine intelligence to deliver groundbreaking predictive analytics.

Be the first to know with next-generation Mergermarket

Book a demo todayNow in its third year, the Mergermarket Private Equity Forum New York has become a must-attend event for the private equity community. It’s designed to help you navigate the complexities of dealmaking with confidence, offering exceptional insights, practical strategies, and meaningful connections. Whether you’re an LP looking to expand your portfolio, a GP showcasing your expertise, or a private equity professional seeking collaborations, the forum is your platform for success in today’s dynamic market.

An error occurred trying to play the stream. Please reload the page and try again.

Close