Shopping centres in Europe may be running out time, if the lack of M&A activity this year is anything to go by.

The sector saw the lowest dealmaking figures in this arena since Dealogic records began more than 20 years ago, with the €1 billion mark yet to be claimed.

A total of €646 million has been spent across nine deals to date, the largest being Unibail’s sale of a 60% stake in Slovakian mall Aupark Bratislava to Wood & Co and Tatra Asset Management, valuing the asset at €450 million. This year’s only other similarly sized deal is Turkish bank Akbank’s circa €260 million acquisition of the Istanbul-based Palladium AVM mall to cover a debt owed by vendor Tahincioglu Holding.

What does this mean for the future of retail in Europe? And what lessons should corporates in other sectors learn from these developments?

Property owners can’t just blame the pandemic for the sub-sector's misfortunes. Retail's pain has been Jeff Bezos' gain, with the rise of online shopping steadily undercutting malls’ core proposition—and discouraging M&A—for the past five years.

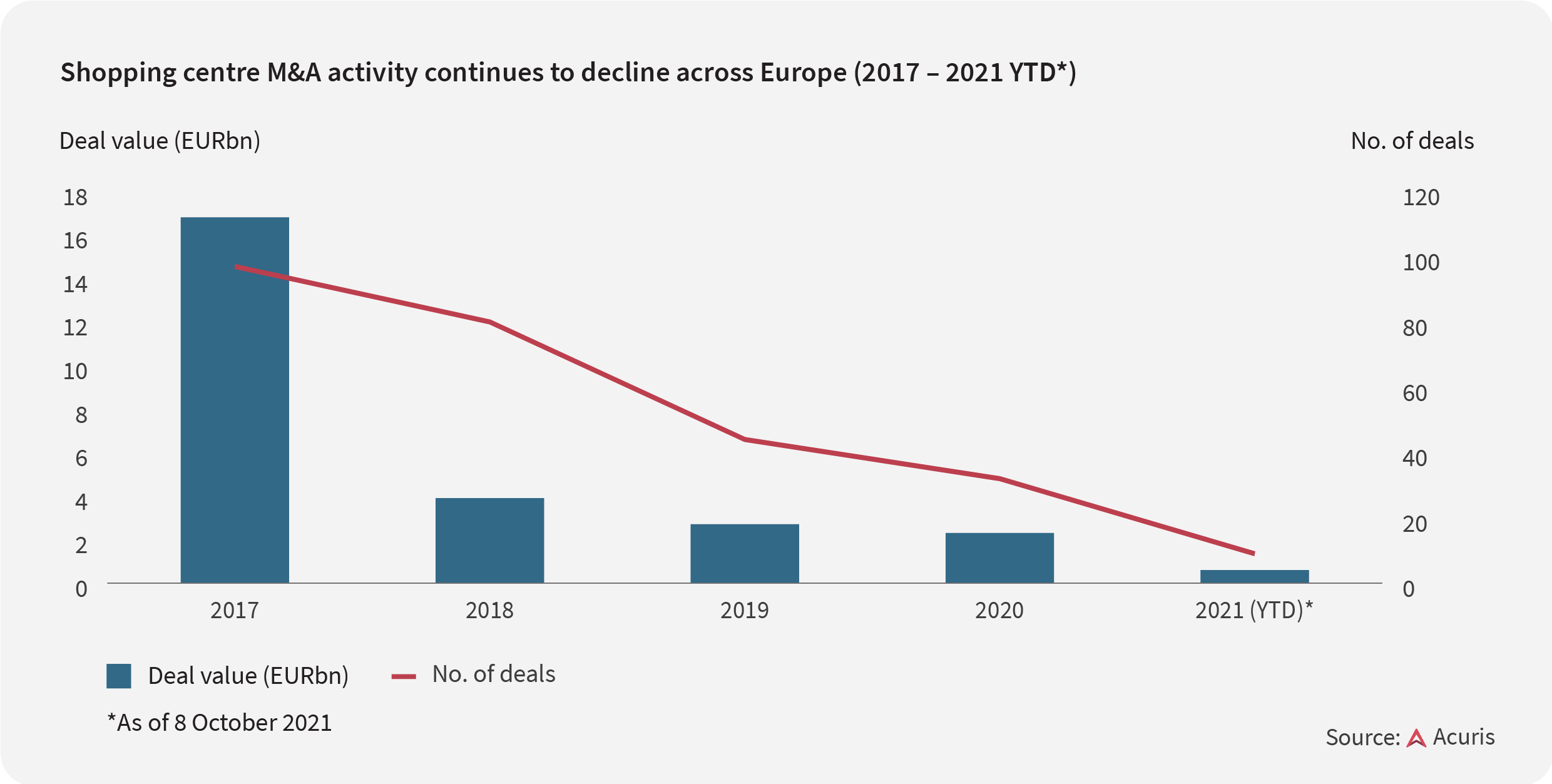

The value and volume of M&A in the European mall space has fallen steadily every year since 2017, when €16.8 billion was invested across 97 deals. These figures tumbled to €3.9 billion spent across 80 deals in 2018 and €2.7 billion across 44 deals in 2019.

In fact, the deal market was already so weak that the pandemic barely made a dent: 2020 saw just €2.3 billion invested in 32 takeovers. For property owners looking at these numbers, the writing has been on the wall for some time.

Faced with the online shopping megatrend and this less than positive outlook for malls, many investors are rethinking their strategy. Some are pivoting into warehousing and logistics, the back end of retail being boosted rather than cannibalised by the Amazon effect as distribution networks have expanded, even during the pandemic.

Case in point: in March 2021, Starwood took over RDI REIT, which had already made the move into logistics.

Blackstone has been highly active in the shopping mall space and continues to forge deals, but only when they still make sense—in January, the PE house became the largest mall operator in India with the acquisition of Prestige Group’s retail portfolio. But in Europe, Blackstone has focused instead on delivery. It established a pan-continental last-mile logistics platform called Mileway and has been snaffling assets. In March, the firm invested €290 million in a portfolio of logistics assets in the UK and France from InfraRed Capital Partners.

Meanwhile, Allcargo Logistics has said it wants to invest in the space in Europe, while in May property firm LondonMetric raised £100 million for UK deals.

For previously agnostic retail investors, Europe's shopping malls are not where the deals are to be found, unless they are in prime city centre locations or have cornered monied luxury buyers. Today, logistics is the retail play.

Add the following topics to your interests and we'll recommend articles based on these interests.

Recommendations are powered by your interests. To add your interests please sign in

1 - KR - Welcome Remarks_Edited 2 - EN - Private markets Changing Strategies_Edited 1 - EN - Welcome Remarks_Edited 2 - KR - Private markets Changing strategies_EditedNow in its third year, the Mergermarket Private Equity Forum New York has become a must-attend event for the private equity community. It’s designed to help you navigate the complexities of dealmaking with confidence, offering exceptional insights, practical strategies, and meaningful connections. Whether you’re an LP looking to expand your portfolio, a GP showcasing your expertise, or a private equity professional seeking collaborations, the forum is your platform for success in today’s dynamic market.

An error occurred trying to play the stream. Please reload the page and try again.

Close