Private equity (PE) firms and other asset managers can no longer afford to drag their feet on environmental, social and governance (ESG) issues when it comes to their investments. If they decide to back companies that spoil the planet, fail to diversify or cheat society, they will be seen as guilty by association, which does not make for an especially viable long-term strategy.

The pandemic has only further laid bare the work that is required, exposing the costs and injustices of inequality as poorer countries continue struggle to access vaccines.

New research from IHS Markit (based on a survey conducted by Acuris) shows that PE firms are taking positive steps to address the issue. Over three-quarters (80%) of asset managers and PE firms surveyed believe ESG factors will become even more critical to their investment decisions in the next two years, including 63% who say these issues will become significantly more important.

For 83% of respondents, their efforts to clean up their act and back companies with strong ESG credentials is about brand image and reputation. Almost three-quarters (73%) also point to the business risks that ESG failures now constitute, from litigation to commercial losses.

It's not all about risk mitigation and optics. Various research has shown sustainability and strong governance also correlates with improved financial returns.

This isn’t much of a surprise—an ESG focus can drive performance, from aligning products and services that address changing consumer habits to developing corporate strategies that benefit from the direction and momentum of policymaking.

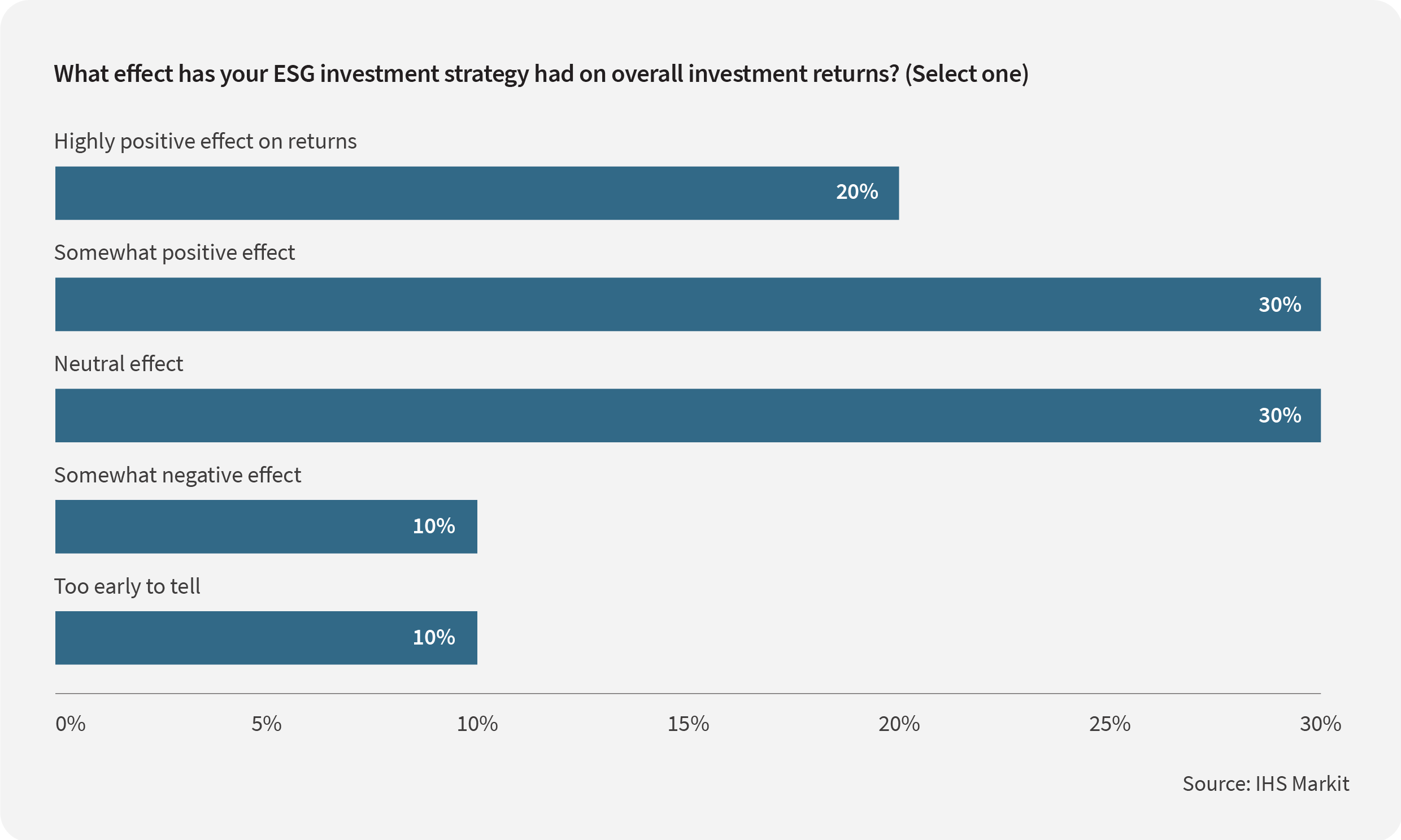

The results may not always be immediate, but half of respondents in this report say that their ESG approach has already had a positive net effect on returns, including 20% who say the impact has been highly positive. One in ten concede that it's too early to tell and a further 10% say the effect has been negative, suggesting a J-curve that may take some time to work through before gains are realised.

In the pursuit of outperformance, 43% of respondents say ESG factors have become part of their search for deals. The strategy may not be working for everyone, but the needle is clearly moving in the right direction.

Policymakers are increasingly focusing on the role that financial services (including PE and asset managers) play in driving positive change—and 87% of respondents in the report cite political pressure as one issue that is driving the ESG agenda.

However, top-down pressure is not the only thing forcing their hand. Their own clients are demanding change. Nearly two-thirds (63%) say investor appetite is an ESG agenda driver and there is a recognition that firms will need to adapt. Just over half (53%) point to the need to diversify their fund product range to cater to more discerning clients.

But not all institutional investors are created equal. Those clamoring for change are largely endowments and pension funds—cited by 34% and 30% respectively—both of which report to fiduciary beneficiaries. Sovereign wealth funds and insurance companies, on the other hand, are far less likely to emphasize the importance of ESG, cited by just 10% and 3% of respondents as being agents of change.

Still, if asset managers can truly demonstrate outperformance by backing ESG leaders, it won't be long before sovereign funds and insurers wake up and smell the responsibly sourced coffee.

Add the following topics to your interests and we'll recommend articles based on these interests.

Recommendations are powered by your interests. To add your interests please sign in

1 - KR - Welcome Remarks_Edited 2 - EN - Private markets Changing Strategies_Edited 1 - EN - Welcome Remarks_Edited 2 - KR - Private markets Changing strategies_EditedNow in its third year, the Mergermarket Private Equity Forum New York has become a must-attend event for the private equity community. It’s designed to help you navigate the complexities of dealmaking with confidence, offering exceptional insights, practical strategies, and meaningful connections. Whether you’re an LP looking to expand your portfolio, a GP showcasing your expertise, or a private equity professional seeking collaborations, the forum is your platform for success in today’s dynamic market.

An error occurred trying to play the stream. Please reload the page and try again.

Close