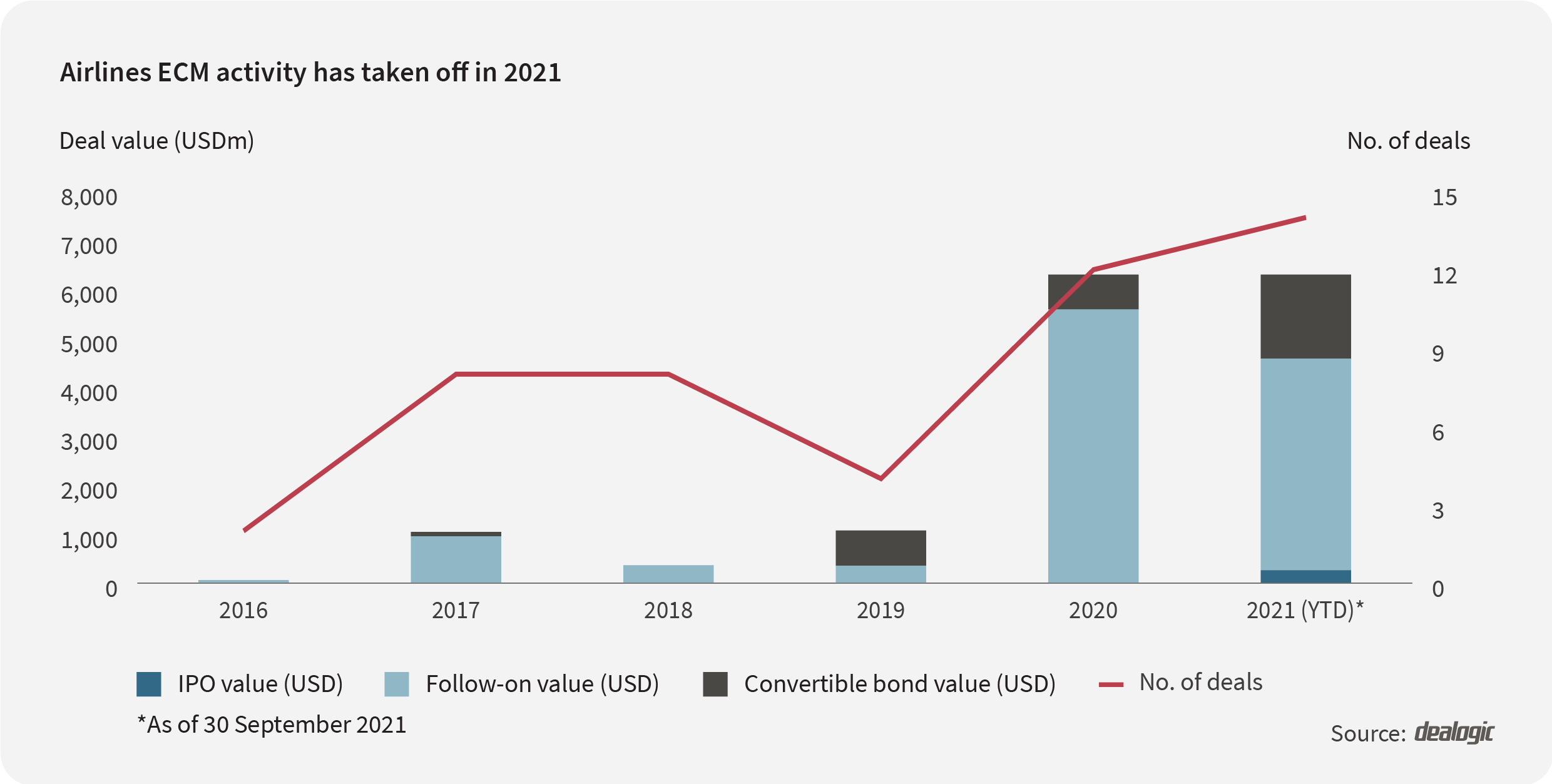

Last year, European stock markets offered airliners a welcome reprieve as their planes were grounded and they burned through their cash reserves. As much as 89% of equity capital market activity in the sector was accounted for by follow-ons, with investors throwing incumbents a much-needed lifeline.

This year, airlines have already raised as much cash from Europe's stock markets as they did in all of 2020. Last month's US$1.7 billion rights issue by easyJet took market activity by European airlines to US$6.3 billion, tying last year’s total, according to Dealogic.

Even more notably, with the skies having since reopened, these raisings now look decidedly different than they did last year.

Follow-ons still dominate, claiming 69% of total value, well above the 47% share for all pre-pandemic years but transactions in 2021 also include accelerated bookbuilds by JET2 for US$583 million, Wizz Air for US$555 million, Deutsche Lufthansa for US$395 million and Norwegian Air for US$102 million.

But the real story is that IPOs are back, underscoring the change in fortunes for a sector that was all but off limits in mid-2020. Three European budget carriers—Flyr, Norse Atlantic and Fly Play—have floated this year, the first public offerings from the sector for over five years.

While on the small side (the three IPOs totalled just US$264 million), the fact that any IPOs are happening at all is a strong vote of confidence for the sector's recovery. During months of isolation and distancing, European holidaymakers had plenty of time to plan their next escapes.

In August, TUI, the world's largest travel operator, reported that demand for holidays in Europe was “unabatedly high”, with 1.5 million additional bookings made since May. This has been welcome news for airliners, including those with designs on the stock market.

According to Mergermarket, one such company is AirBaltic, which is on course for a privatisation and will seek advisors this year ahead of a potential listing. Avia Solutions is also eyeing a possible IPO in 2023 as sector valuations rebound, sources have said.

Only a year ago, many airliners found themselves in the brace position. Now it looks like things are set to take off once more.

Add the following topics to your interests and we'll recommend articles based on these interests.

Recommendations are powered by your interests. To add your interests please sign in

1 - KR - Welcome Remarks_Edited 2 - EN - Private markets Changing Strategies_Edited 1 - EN - Welcome Remarks_Edited 2 - KR - Private markets Changing strategies_EditedNow in its third year, the Mergermarket Private Equity Forum New York has become a must-attend event for the private equity community. It’s designed to help you navigate the complexities of dealmaking with confidence, offering exceptional insights, practical strategies, and meaningful connections. Whether you’re an LP looking to expand your portfolio, a GP showcasing your expertise, or a private equity professional seeking collaborations, the forum is your platform for success in today’s dynamic market.

An error occurred trying to play the stream. Please reload the page and try again.

Close