Chinese electric-vehicle (EV) makers are increasing tapping into private-equity (PE) money to fuel their growth, as IPO routes to grab cash become bumpier.

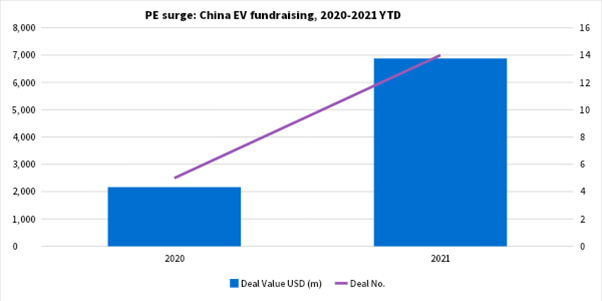

According to Dealogic data, EV-related fundraising deals totaled USD 6.9bn as of 2 November – about 3.2x the amount for the whole of 2020 – while the volume of transactions almost tripled from a year earlier.

Source: Dealogic

An increasing number of players is charging to join the fray, including Xiaomi, one of the world’s largest smartphone makers, and Taiwan-based Foxconn, the world’s biggest contract electronics manufacturer.

However, technology’s new gold rush could well take the shape of a Squid Game-like competition. In September, China’s Ministry of Industry and Information Technology (MIIT) called for consolidation of the country’s EV sector, citing overcapacity and the presence of smaller players unable to compete.

The powerful industry regulator has signaled that the time for letting “a hundred flowers bloom” might be over, and China looks set for a more Darwinian landscape, where only the strongest players go the distance.

Cash is king to survival hopes, but IPO routes are getting harder to navigate. Excluding the dual listings of high-profile Chinese EV car makers Li Auto [NASDAQ:LI; HKG:2015] and Xpeng [NYSE:XPEV; HKG: 9868] in Hong Kong, electric carmakers have so far generated only a meager USD 315.8m this year compared with USD 2.97bn last year.

Source: Dealogic

Companies face all sorts of headwinds in their drive to reach stock exchanges. WM Motors, Geely and Evergrande New Energy sought to list on the STAR Market – the NASDAQ-style, tech-heavy board of the Shanghai Stock Exchange. However, Chinese regulators have set a high bar for listing, and the three EV manufacturers came up short of IPO requirements.

Undeterred, Tencent-backed WM Motors opted to tap PE capital to refill its coffers. Earlier this month, the company raised USD 300m in a Series D1 round.

Geopolitics and tighter regulations on both sides on the Pacific are closing another avenue for IPO cash. In 2018, NIO [NYSE:NIO] listed in New York, while peers Li Auto and Xpeng followed suit in 2020. However, deteriorating relations between Washington and Beijing are leading Chinese tech companies to reroute their efforts towards safer destinations.

One of these appears to be Hong Kong. Li Auto and Xpeng finalized their dual listing in the Asian financial hub this year, and NIO is expected to do the same. WM Motors is also reportedly planning to raise USD 100m through an IPO in Hong Kong next year. For earlier-stage players, a further venue for listing could be the soon-to-be-launched Beijing Stock Exchange.

For the time being, tapping the deep pockets of PE funds – which offer higher valuations and less regulatory scrutiny – looks to be the roadmap of choice for China’s EV makers.

Add the following topics to your interests and we'll recommend articles based on these interests.

Recommendations are powered by your interests. To add your interests please sign in

Scream for ice cream – Unilever and the case for a near-EUR 20bn asset sale Explore how Brazil's sports betting law brings legal certainty to investors and is expected to foster M&A M&A Activity in the UK Supermarket space Highlights from the Global M&A Dealmakers Sentiment Report 2024

Your M&A Future. Today.

Next-generation Mergermarket brings together human insights and machine intelligence to deliver groundbreaking predictive analytics.

Be the first to know with next-generation Mergermarket

Book a demo todayUnlock your M&A potential at our premier European forum!

The Langham, London

An error occurred trying to play the stream. Please reload the page and try again.

Close