Private-equity (PE) funds and technology giants are in an investment race for Indian unicorns, as they look to capitalise on hefty valuations from IPOs.

Fund-raising deals in India galloped ahead to a record 196 transactions worth USD 18.4bn since the start of the year, the highest annual deal value on Dealogic record and almost double the amount in the whole of 2020 (USD 10bn across 563 transactions).

Source: Dealogic

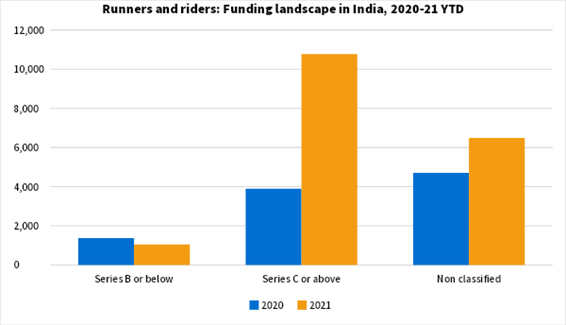

The value stampede corresponds with a 58.5% year-on-year (YoY) fall in the number of fund-raising deals. Investors are increasingly placing their bets on later-stage companies that have a greater chance of being listed, taking advantage of India’s more mature start-up ecosystem and a bountiful primary market.

Indian fund-raising deals branded as Series C or above in 2021 year-to-date (YTD) account for 58.5% of the total fund-raising deal value and 34.7% of the total fund-raising deal count. Conversely, these deals made up only 39.96% of deal value and 15.81% of deal count in 2020.

The technology sector has been whipping up a frenzy for Indian fund-raising, with 142 transactions – mostly relating to software companies and internet platforms – worth USD 15.7bn. It has brought home 85.04% of deal value and 72.45% of transactions – a higher proportion than a year before.

Source: Dealogic

Beijing’s regulatory crackdown on Chinese internet giants has spurred international investors to pull back from China and add more Indian peers to their portfolios.

Nine out of the top 10 fund-raising deals in India are grouped in this sector. Leading the field this year is a USD 3.6bn funding round secured by Flipkart, an Indian e-commerce firm, from GIC and other investors at a post-money valuation of USD 37.6bn.

Last spring, Think & Learn – an online education provider trading as Byju – harnessed a USD 1bn funding round from a stable of investors. In October, the company raised an additional USD 296m in a follow-up action ahead of a planned IPO in India or the US.

Bundl Technologies – which operates Indian food-delivery firm Swiggy – roped in USD 800m in April and USD 450m in July via two separate funding rounds. Meanwhile, Swiggy’s rival, Dunzo, is said to be in discussions with Indian mobile network operator Jio to bag between USD 200m and USD 300m at a valuation of nearly USD 800m. Another peer, Zomato, secured USD 1.3bn through an IPO in July.

The only transaction among the top 10 that is not driven by the tech sector – it is classified as “professional services” – is a USD 650m fund-raising by Eruditus Learning Solutions, a provider of executive education programs, although it is tech-heavy and has a significant online presence.

Meanwhile, 12 Indian technology companies – including digital payments firm Paytm, which counts China’s fintech giant Ant Group and Japan’s SoftBank among its backers – have landed a combined USD 3.5bn through IPOs since the start of the year compared with eight tech-related IPOs worth only USD 402.6m in 2020.

Another card of larger fundraising deals is expected to get underway soon. Two-wheeler manufacturer Ola Electric is chasing USD 200m in fresh funding at a valuation of more than USD 5bn. Investcorp India’s portfolio companies, Xpressbees and Fresh-to-Home, are said to be in the hunt to raise capital at unicorn valuations, and plan to launch IPOs in the coming 12 to 18 months.

Other companies reportedly jockeying for big-ticket funding include: digital consumer goods company, GlobalBees; the direct-to-consumer (D2C) arm of Lenskart; the electric-vehicle arm of TVS Motor Company; and B2B medical supplies e-marketplace, Medikabazaar.

Add the following topics to your interests and we'll recommend articles based on these interests.

Recommendations are powered by your interests. To add your interests please sign in

Scream for ice cream – Unilever and the case for a near-EUR 20bn asset sale Explore how Brazil's sports betting law brings legal certainty to investors and is expected to foster M&A M&A Activity in the UK Supermarket space Highlights from the Global M&A Dealmakers Sentiment Report 2024

Your M&A Future. Today.

Next-generation Mergermarket brings together human insights and machine intelligence to deliver groundbreaking predictive analytics.

Be the first to know with next-generation Mergermarket

Book a demo todayElevate your strategic capital allocation journey

The Pierre, A Taj Hotel, New York

An error occurred trying to play the stream. Please reload the page and try again.

Close