While Australia weighs resistance to the transition to clean energy, either voluntarily or by obligation, the country’s electricity power sector has become a magnet for M&A deal-makers, both on the generation side and those looking to get into transmission/distribution.

In terms of deal value in the year to date (YTD), the power sector Down Under has become super-charged, with USD 21bn invested across 16 deals, surging from USD 2.9bn spread across 19 deals in 2020, according to Dealogic data.

Source: Dealogic

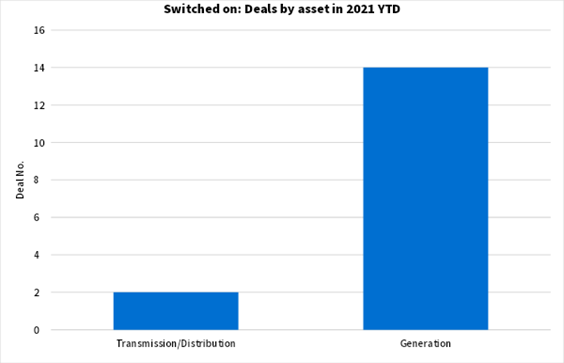

A closer look at the deal chart shows activity is being sparked by two different, sometimes overlapping themes.

One is the ever-increasing appetite for renewable energy assets amid a global push for clean and renewable energy. On the electricity-generation side, deals primarily involve renewables, such as wind and solar farms. Of 16 deals YTD, 14 feature electricity-generating companies, all in renewable energy.

Source: Dealogic

According to John Brewster, Ashurst’s Australian Co-Head of Corporate Transactions, renewables investors are attracted by the prospect of financial returns, but also the current social agenda for wanting to invest in cleaner energy. “That is influencing all categories of investors – superannuation funds, private-equity (PE) funds, corporates – they all want to have some renewable assets on their balance sheet,” he says.

The second theme driving sector activity is the pursuit of large-scale and long-term investment opportunities by infrastructure investors and pension funds, which typically results in large deals on the electricity transmission and distribution side.

Indeed, the biggest move in Australia’s electricity industry in 2021 arrived just last week, as Canadian infrastructure investor Brookfield jolted the market with its AUD 17.8bn (enterprise value) acquisition of Ausnet [ASX:AST]. Ausnet owns and operates more than AUD 11bn of electricity and gas network assets, including the Victorian electricity transmission network and an electricity distribution network.

The fusion of renewables and infrastructure and pension funds manifest in the NZD 3.2bn acquisition of Tilt Renewables [ASX:TLT] by a Powering Australian Renewables (PowAR) consortium backed by AGL [ASX:AGL], Queensland Investment Corp (QIC) and Australia’s sovereign wealth fund, Future Fund. With 20 operational or under-development wind farms, Tilt presents a rare opportunity to grab a sizeable portfolio of renewable electricity-generation assets. Little surprise, then, that competition for the company has been red hot, with Canadian pension fund CDPQ also bidding and the PowAR consortium having to juice up its offer.

Another electricity transmission and distribution assets business igniting interest, Spark Infrastructure [ASX:SKI], has a renewable energy platform, with its 100MW Bomen Solar Farm in New South Wales (NSW) and a development portfolio of wind, solar, storage and green hydrogen projects. Spark is being snapped up by KKR, Ontario Teachers’ Pension Plan (OTPP) and PSP Investments for an enterprise value of AUD 10.1bn.

Historically, investment in Australian renewable energy has not been driven by pension funds, as assets are usually smaller and have been seen to carry too much development risk. However, as these assets have developed and secured long-term contracts, interest and investment from pension funds is starting to light up. Though Australia still has a long way to go in the country’s energy transition, with renewables projects continuing to develop, M&A activity is set to carry on.

Assets currently on the market include Meridian Energy Australia (MEA), part of New Zealand’s Meridian Energy [NZX:MEL]. Marketed by Lazard, MEA owns and operates wind and hydro assets, and has reportedly been valued at AUD 1bn. Moreover, Australia has plenty of smaller energy companies, and investment is flowing into renewable generation and storage projects.

It is a different story on the transmission and distribution side. There are only a limited number of these assets around the country, and deals are typically driven by existing investors seeking to exit or cut down their exposure. For example, Ausgrid shareholder AustralianSuper is seeking a buyer for a 16% stake in the largest electricity distributor in New South Wales, as it looks to reduce its current 25% holding, while Malaysia’s YTL is selling its 33.5% holding in South Australia’s ElectraNet transmission network.

Recommendations are powered by your interests. To add your interests please sign in

Scream for ice cream – Unilever and the case for a near-EUR 20bn asset sale Explore how Brazil's sports betting law brings legal certainty to investors and is expected to foster M&A M&A Activity in the UK Supermarket space Highlights from the Global M&A Dealmakers Sentiment Report 2024

Your M&A Future. Today.

Next-generation Mergermarket brings together human insights and machine intelligence to deliver groundbreaking predictive analytics.

Be the first to know with next-generation Mergermarket

Book a demo todayUnlock your M&A potential at our premier European forum!

The Langham, London

An error occurred trying to play the stream. Please reload the page and try again.

Close