With the Indian grassroots economy just beginning to see a recovery from COVID-19’s debilitating third wave, and an almost nationwide lockdown, M&A is down about 5% year to date (YTD, to 20 September) at USD 81bn, a far cry from its peak of USD 102bn in 2018.

But pop in private equity (PE) investments and quite a different picture emerges.

Far from being driven away, PE firms over the last two years – especially veteran India investors like Sequoia Capital, Accel, General Atlantic, KKR and Blackstone – have upped their India game, enticed by future growth potential and an expected recovery. Together, financial sponsors have plugged in a total of USD 32bn YTD – an all-time high despite more than three months of the year remaining – and clearly eking out FY20’s erstwhile record of USD 20bn. The big deals were e-commerce firm Flipkart Internet’s USD 3.6bn fundraise with investors include GIC, Softbank Vision Fund 2 and CPPIB and Blackstone [NYSE:BX] 26% stake in technology services provider Mphasis.

The reason for the surge is twofold: first, with the advent of COVID-19, India’s online penetration has grown to roughly 45% as compared to about 27% five years ago, according to data provider Statista. This has had a massive impact on sectors such as retail, education, and banking and a new wave of entrepreneurs have risen to the challenge to build client-facing technologies. Second, India’s regulatory board – the Securities and Exchange Board of India (SEBI) – has created a platform know as Innovators Growth Platform (IGP) which facilitates the listing of companies especially in e-commerce, data analytics and biotechnology which will recognize and enable exits for early investors.

Source: Mergermarket; correct as of 20 September 2021

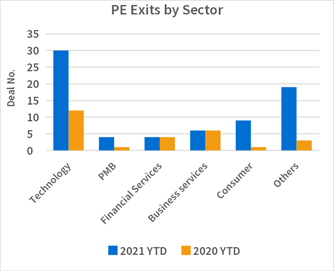

Exits, which all but dried up to USD 5.4bn in 2020, saw a resurgence with USD 20bn, as business services and technology exits rose again to pre-pandemic levels after a brief hiatus in 2020. Ant Group-backed restaurant aggregator Zomato’s [NSE:ZOMATO] closely followed IPO was subscribed by institutional and retail investors; it is up 66% from its debut price, as compared to India’s benchmark index SENSEX which is up 23% YTD.

Meanwhile, in 2021, many other PE firms also took advantage of strategic interest in their portfolios with a clutch of investors including Alibaba Group and Abraaj Capital selling online payment gateway BillDesk to Prosus [AMS:PRX] while sponsors including Temasek and General Atlantic sold online food and grocery store Supermarket Grocery Supplies to Tata Digital.

Source: Mergermarket; correct as of 20 September 2021

That 2021 will go down as PE’s heyday in India is clear. Those whom have exited portfolios at attractive valuations can breathe a sigh of relief. But for sponsors who plugged money into a market where valuations were already soaring, will they be able to exit with profits or will they struggle when the market corrects, as it is bound to do?

Mergermarket has identified the following companies that either are in play or could be attractive targets in the foreseeable future.

Add the following topics to your interests and we'll recommend articles based on these interests.

Recommendations are powered by your interests. To add your interests please sign in

1 - KR - Welcome Remarks_Edited 2 - EN - Private markets Changing Strategies_Edited 1 - EN - Welcome Remarks_Edited 2 - KR - Private markets Changing strategies_Edited

Your M&A Future. Today.

Next-generation Mergermarket brings together human insights and machine intelligence to deliver groundbreaking predictive analytics.

Be the first to know with next-generation Mergermarket

Book a demo todayNow in its third year, the Mergermarket Private Equity Forum New York has become a must-attend event for the private equity community. It’s designed to help you navigate the complexities of dealmaking with confidence, offering exceptional insights, practical strategies, and meaningful connections. Whether you’re an LP looking to expand your portfolio, a GP showcasing your expertise, or a private equity professional seeking collaborations, the forum is your platform for success in today’s dynamic market.

An error occurred trying to play the stream. Please reload the page and try again.

Close