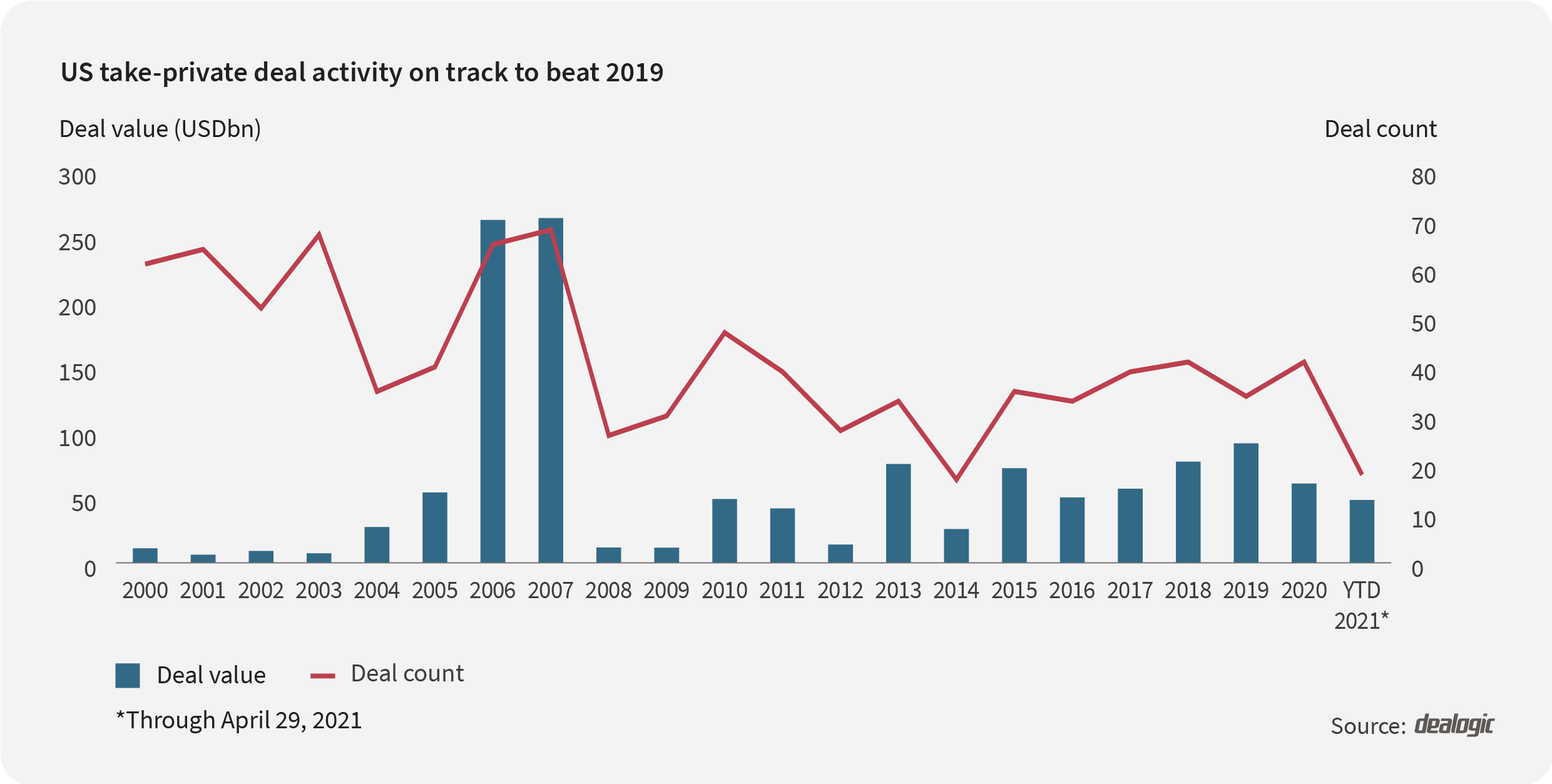

In the first four months of 2021, PE firms in the US have already pulled 18 companies off the public markets for a total of US$48.1 billion. When it comes to take-privates, don’t be surprised if this year turns out to be one for the record books.

What's behind PE's foray into the public arena? The fact is, it’s more of a return to form after the COVID-19 slowdown—funds have been moving in on stock markets for a while. For example, there were 34 take-privates in 2019, worth US$91.4 billion, making it the best year since the mega buyout boom of 2007.

It’s a cyclical thing

Basically, PE firms are victims of their own success, having raised frankly ridiculous amounts of capital. At last count, North American PE firms were sitting on almost US$1 trillion in reserves, according to Preqin.

And in the race to deploy this unspent cash, everything is looking pricey. In the US, PE firms paid an average 13.2x EBITDA for leveraged buyouts, according to Refinitiv estimates—an all-time high, set amid a global pandemic.

At a premium

Why are PE firms going this route? After all, private companies are usually meant to be cheaper targets. All else being equal, the liquidity and transparency that businesses in the public spotlight offer means they should trade at a premium to their private equivalents—in theory.

But private multiples have been edging higher as PE raised more and more capital, which means that price gap has been closing.

In January 2020, just before the pandemic tanked the market, the average enterprise value-to-EBITDA multiple for the S&P 500 was 14.2x. This has meant fund managers have been able to find assets on the open markets whose price tags they're willing to meet, even with a control premium baked into their calculations.

Parsing clouds

When you think of bargains, technology is hardly the first sector that springs to mind. But PE loves software-as-a-service cloud businesses for their recurring revenues, low capex costs and scalability, and there are still bargains to be had.

When Thoma Bravo pulled Proofpoint off the Nasdaq last month for US$12.3 billion—the largest private equity cloud deal in history—it paid around 11.7x the email security firm's 2020 turnover. By comparison, the median revenue multiple of the BVP Nasdaq Emerging Cloud Index is 18.6x.

With the recent tech sell-off, the likelihood of take-privates like Proofpoint and Thoma Bravo's other recent cloud plays, RealPage and Talend, increases.

Want a clue which cloud assets might be on PE’s radar right now? Look for names trading at attractive multiples with revenue growth that has tapered off. PE has an opportunity to turn these public businesses around, away from prying eyes.