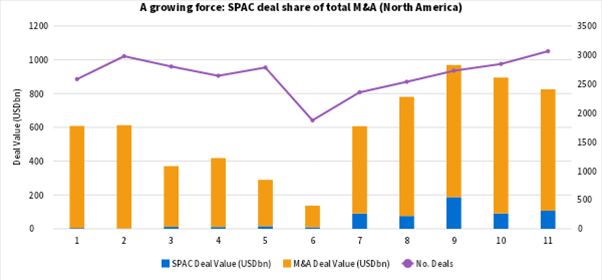

Deal making in North America has hit record levels, reaching USD 2.3tn in the first nine months of 2021 and accounting for more than half the world’s total.

Low interest rates combined with trillions of dollars in fiscal and monetary stimulus drove much of that. But a third factor – mostly absent before the pandemic – played a major role: the special purpose acquisition company (SPAC).

Blank check companies, as they are also known, accounted for 17% of overall M&A activity in North America during 1Q-3Q21, compared to just 0.3% in 2019.

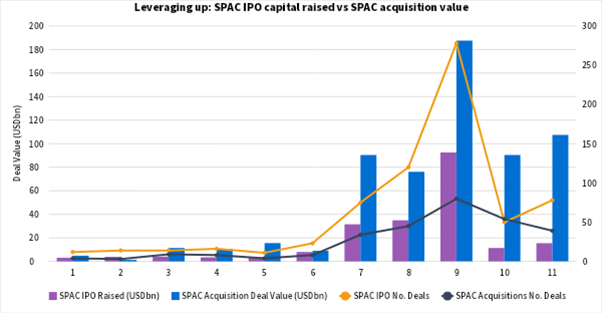

SPACs typically have two years from their creation as public companies to find their acquisition target. Currently, 417 US-listed SPACs, which have raised a combined USD 123.6bn in their IPOs, are still searching, according to Dealogic. Most were created in 4Q20 and 1Q21 before extra regulatory scrutiny on the asset class led to a sharp drop in SPAC issuance in 2Q21 onwards. It means most of the 417 must announce a deal over the next 12 to 18 months or face the unwanted prospect of returning unused capital to investors.

So far this year, SPAC acquisitions have averaged USD 2.52bn. Given that is 8.5 times the average SPAC IPO, it suggests the current crop of target-hunters could drive in excess of USD 1tn in deal making over the next year or so. Such immense buying power, combined with the time constraints for a deal, will lead to continued valuation inflation.

“You have a new competitor with a thirst and capability to do a deal at a valuation beyond current valuations,” says Brian Levy, PWC’s global deals industries leader. “It’s making the market super competitive.”

One upshot is that strategics will have to pay higher valuations to outbid SPACs for the most innovative companies they typically target. To justify the richer multiple, strategics will have to use revenue growth rather than the traditional cost-cutting play, says Levy.

Another upshot is after SPACs have acquired a company and de-SPACed, their true test awaits: Can they deliver double-digit returns on capital going forward? That’s a tough ask when your starting point is the higher valuations prevalent today. But if they don’t, the whole SPAC business model could be questioned, leading to a loss of investor appetite in the asset class.

It also could lead to a whole new generation of publicly listed “zombie” companies because SPACs often ignore flimsy fundamentals in favor of disruptive technologies. Such companies will face a reckoning, says one deal maker, which could lead to discounted buying opportunities down the road. “I don’t think it’s long-term sustainable.”

Add the following topics to your interests and we'll recommend articles based on these interests.

Recommendations are powered by your interests. To add your interests please sign in

1 - KR - Welcome Remarks_Edited 2 - EN - Private markets Changing Strategies_Edited 1 - EN - Welcome Remarks_Edited 2 - KR - Private markets Changing strategies_Edited

Your M&A Future. Today.

Next-generation Mergermarket brings together human insights and machine intelligence to deliver groundbreaking predictive analytics.

Be the first to know with next-generation Mergermarket

Book a demo todayNow in its third year, the Mergermarket Private Equity Forum New York has become a must-attend event for the private equity community. It’s designed to help you navigate the complexities of dealmaking with confidence, offering exceptional insights, practical strategies, and meaningful connections. Whether you’re an LP looking to expand your portfolio, a GP showcasing your expertise, or a private equity professional seeking collaborations, the forum is your platform for success in today’s dynamic market.

An error occurred trying to play the stream. Please reload the page and try again.

Close