Physician practices have seen robust consolidation in recent years, with private equity rushing to acquire specialties ranging from dental, dermatology and vision care to orthopedics, gastroenterology and urology.

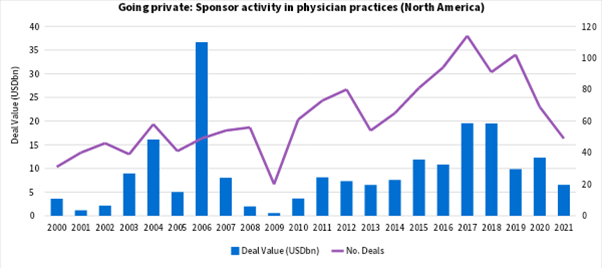

The deal making frenzy involving doctors' offices reached its zenith in 2017 when 323 transactions worth a total of USD 114bn took place and in 2018 when 244 deals totaling USD 95bn were announced.

Many physician practice management (PPM) groups that sold to private equity in that period and have since scaled and matured are now looking at an exit. They increasingly view a sale to a special-purpose acquisition company, or SPAC, as just what the doctor ordered.

Going public via a SPAC merger or a traditional IPO is attractive because it offers a more flexible earnout for doctors looking to leave, versus waiting for their practice to change hands to another sponsor.

Heartland Dental, acquired by KKR in 2018, is among the specialty groups that could be ripe for a SPAC transaction. Others include Eyecare Partners, acquired by Partners Group in 2019, and Capital Vision Services, which Goldman Sachs also acquired in 2019.

The best exit medicine

The physician space has already seen one significant SPAC transaction this year. Primary care group Cano Health undertook a reverse merger with Jaws Acquisition that gave it an enterprise value of USD 4.4bn – significantly more than private equity suitors were bidding for it. Other physician groups recently went public via traditional IPOs, including Oak Street Health [NYSE: OSH] and Agilon Health [NASDAQ:ALHC].

These newly minted public companies could eventually provide an exit for smaller physician practices, particularly as their higher valuations in the public markets allow them to make accretive acquisitions of their privately held peers. “There’s a really significant discrepancy in valuation multiples between the private and public markets,” says one healthcare services banker.

Because office-based specialties typically see only single-digit organic growth, doing acquisitions remains a major prong of growth. That means tie-ups between sponsor-backed platforms also are likely to continue.

After a freeze in deal making due to the pandemic, M&A in the physician space is ramping back up. Several sponsor-backed platforms are pursuing sale processes, including Sheridan Capital-backed Dermatologists of Central States; Chicago Pacific Founders-backed Pinnacle Dermatology; CI Capital Partners-backed Epiphany Dermatology, and Silver Oak-backed Smile Partners.

The current PPM investment boom is the second in recent history. The 1990s saw private equity firms buying up physician practices at breakneck pace, eventually taking the platforms public. Most of those, including MedPartners and FPA Medical Management, later announced bankruptcies. Many hope history won’t repeat itself because it would make those that own doctors’ offices skeptical of dealing with private equity. “It makes me nervous,” says a second healthcare banker.

Recommendations are powered by your interests. To add your interests please sign in

Scream for ice cream – Unilever and the case for a near-EUR 20bn asset sale Explore how Brazil's sports betting law brings legal certainty to investors and is expected to foster M&A M&A Activity in the UK Supermarket space Highlights from the Global M&A Dealmakers Sentiment Report 2024

Your M&A Future. Today.

Next-generation Mergermarket brings together human insights and machine intelligence to deliver groundbreaking predictive analytics.

Be the first to know with next-generation Mergermarket

Book a demo todayUnlock your M&A potential at our premier European forum!

The Langham, London

An error occurred trying to play the stream. Please reload the page and try again.

Close