After some nervous months, "For Sale" signs are starting to spring up across EMEA, especially in the technology, media and telecom (TMT), consumer, and industrials sectors. Management teams and sponsors are now seeking to attract investors to continue their growth trajectories or restore dented business plans.

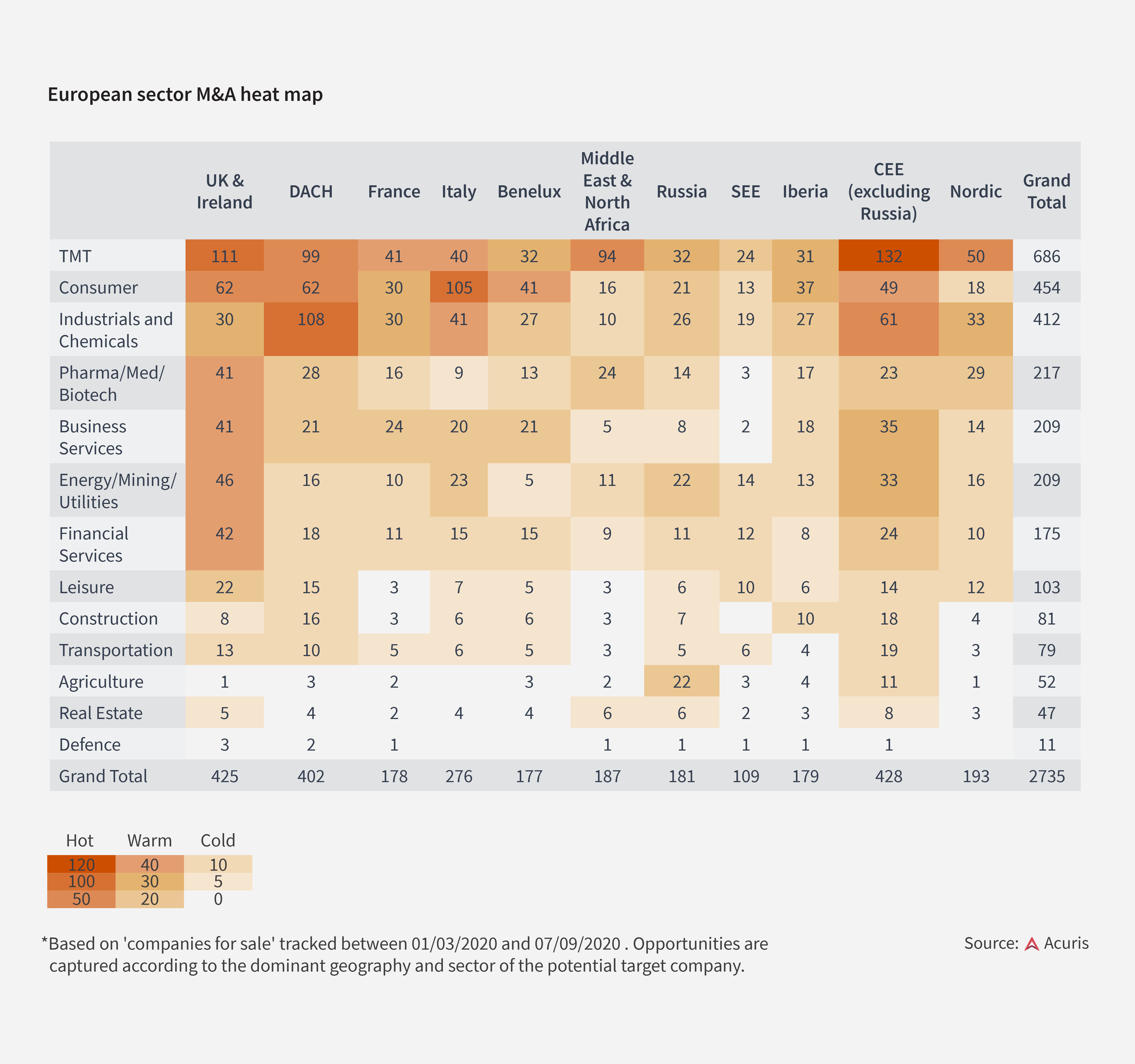

This is the story revealed in Mergermarket’s European sector M&A heat map, charting the hottest sectors boasting the largest number of identified targets.

Homeworking and the increased importance of domestic entertainment during COVID-19 lockdowns and subsequent social distancing regimes have shown telecom infrastructure to be insulated from the ravages of the pandemic.

With 686 targets identified across EMEA—111 in the UK alone and 99 across DACH (Germany, Austria and Switzerland)—TMT is the healthiest pipeline by far.

And the pool of investors seeking to deploy capital in the space has remained deep. Telefonica’s sale of its fibre optic unit; Play Communications’ towers carve-out; and Swiss Open Fibre, a fibre-to-the-home joint venture between Sunrise Communications and Salt Mobile, are all garnering attention from infra funds.

Activity in the TMT sector is gearing up most strongly across Central and Eastern Europe (excl. Russia), with 132 TMT names on the block.

Czech artificial intelligence start-up GoodAI, for example, is embarking on a US$24 million capital raise and is one of several companies in the region pulling the trigger on funding drives.

However, a sale is the last card some companies are able to play following unremitting revenue decline through the second quarter and into Q3.

Many management teams are having to deal with distressed sale situations. The consumer sector—already battling the decline of high street shopping—has been particularly hard hit by COVID-19 lockdown measures. It takes the second spot, with 454 targets identified across EMEA – largely bearing rather less of a growth profile than the TMT cases.

A number of interested parties are circling Dutch retail chain Hema, for example, which has been placed on the market by its creditor owners. The UK retail space has seen similar debt-restructuring related sales, such as that of Debenhams and New Look.

Meanwhile, Italy has seen a high number of companies raise the "For Sale" sign, likely driven by lacklustre demand for high-end fashion. Some 105 Italian consumer players are now potential targets.

These companies could make savvy buys for those corporates and financial investors with capital to acquire. Though balance sheet scars are real and shifts in consumer spending patterns online have undoubtedly been accelerated by COVID-19, high street demand will come off current lows. Prudent debt management, consolidation and strategic realignment conducted now will bear fruit.

It’s back to school time for C-suite decision makers with a mandate to acquire and keen to execute on those opportunities that have fermented over the long months of merger hiatus.

Recommendations are powered by your interests. To add your interests please sign in

Scream for ice cream – Unilever and the case for a near-EUR 20bn asset sale Explore how Brazil's sports betting law brings legal certainty to investors and is expected to foster M&A M&A Activity in the UK Supermarket space Highlights from the Global M&A Dealmakers Sentiment Report 2024

Your M&A Future. Today.

Next-generation Mergermarket brings together human insights and machine intelligence to deliver groundbreaking predictive analytics.

Be the first to know with next-generation Mergermarket

Book a demo todayThe must-attend event for the Nordic private equity and M&A community!

Hotel At Six, Stockholm

An error occurred trying to play the stream. Please reload the page and try again.

Close