Southeast Asia M&A: The year ahead

According to Dealogic data, Southeast Asia M&A deal value in 2022 dropped to US$86 billion, almost half of the 2021 value, reflecting the growing macroeconomic uncertainty in the financial markets. Notwithstanding the market challenges, there is still cause for optimism as corporate carveouts and distressed opportunities driven by the need of corporates to streamline operations could drive M&A activity. Our panel of leading M&A advisors will provide insights on dealmaking in 2023 and their pick of strategies to steer away from trouble.

How much is the macro environment affecting Southeast Asia’s corporate activity?

Which sectors offer the best opportunities for deals?

How much is the region benefiting from supply-chain re-alignment, and what opportunities does it create for deals?

What is the outlook for the rest of 2023 and beyond?

Networking break

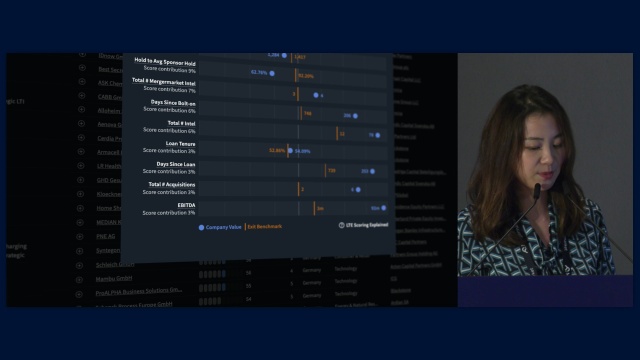

Private equity in Southeast Asia dealmaking

Amid significant economic headwinds and diminished M&A activity, private equity, which has been less affected by external market factors, continues to be a more reliable source of deals. Although deploying capital and returns might be more challenging, the opportunities for PE are there to be taken, albeit with an increased focus on operational efficiencies, value creation, and digitalisation. Our panel of leading private equity managers will share their views on the current market opportunities.

How big is the role of private equity in regional dealmaking?

Which emerging sectors are capturing the interest of private equity?

Is there more competition for assets between private equity and strategic buyers? Is there space for collaboration instead of competition?

What challenges are likely to affect deals?

Networking lunch

Technology deals: Now and the future

Despite the difficult macroeconomic environment, tech activity in Southeast Asia remains robust. The booming ecosystem is not bullet-proof by any means, but the foundations of the digital economy in the region remain sound with significant room to grow in sectors such as financial services, digital health, and climate solutions. Our panel of technology dealmakers will discuss the opportunity set in the sector and what the future holds for the main growth engine in the region.

What is the outlook for tech activity in the region?

Which subsectors are most likely to shine?

Are the region’s stock exchanges becoming more attractive for listings? Which avenues for exits will dominate in 2023, if any?

Have corporate strategic priorities changed this year?

Cross-border deals: Opportunities and challenges

Southeast Asia cross-border dealmaking has vast potential, and the region continues to draw significant interest from Japan, India, and China as strategic buyers and private equity look to strengthen their positions in existing markets and develop a presence in new ones. Our panel of experts will share their views on how to navigate cross-border transactions in the current climate and their pick of hotspots for the year.

Which sectors in the region are most attractive to overseas dealmakers?

How significant is the India-Southeast Asia linkup?

What markets in the region offer the best deal opportunities?

What are the key challenges for executing cross-border deals this year?

Networking break

Sector focus: Healthcare-showing resilience

The healthcare sector is showing incredible resilience amid macro headwinds – especially digital health, which is playing an ever-increasing role in Southeast Asia’s burgeoning population. The outlook for deals remains strong, as in addition to existing opportunities, the region benefits from investors diversifying from other markets. Our expert panel will share their experiences of operating in this sector, including the role of digitalisation and the best tips for deal sourcing.

How robust is the sector, and where are the opportunities in 2023?

How significant is the role of digitalisation in the opportunity set?

What are they key challenges in executing deals this year?

What is the outlook for the sector?

ESG and corporate strategy

Southeast Asia is vulnerable to the effects of climate change due to its geography, and as recognition of the associated risks increase, so too does the awareness of ESG. As ESG comes to the forefront of corporate strategy, businesses are changing the way they approach potential acquisitions from a due diligence, financing, and risk perspective. Our expert panel will look at the impact of ESG on corporate strategy and how this changes the approach to dealmaking.

What are the key ESG and stakeholder considerations in 2023? How might this change their dealmaking approach?

What can businesses do to ensure that they are on top of their regulatory and reporting requirements?

What are some examples of ESG-compliant assets that corporates are acquiring?

How can businesses access sustainability-linked financing?

Forum close and Cocktails

Confirm cancellation

An error occurred trying to play the stream. Please reload the page and try again.

CloseSign-up to join the ION Analytics Community to:

- Register for events

- Access market insights

- Download reports

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow