AVCJ Private Equity Forum 2024

Asia's premier private equity & venture event for the last 37 years

2024 AVCJ Forum Demographics

Keynotes for the AVCJ Forum include:

Highlights at AVCJ Forum 2024

Hear what our AVCJ Forum attendees say

Leading LPs attended AVCJ Forum 2024 include:

Sovereign Wealth Funds and Insurance Companies

- Abu Dhabi Investment Authority

- AIA

- AXA

- Alberta Investment Management Corporation (AIMCo)

- Allstate Investments

- China Investment Corporation

- China Ping An Insurance

- China Post Life Insurance

- China-UAE Investment Cooperation Advisory

- Cigna Group

- Fwd Life Insurance

- GIC

- Great Eastern Life Assurance

- Hanwha Life Insurance

- Hong Kong Monetary Authority (HKMA)

- HSBC Life

- Income Insurance

- Japan Investment Corporation

- Khazanah Nasional Berhad

- KIC (Korea Investment Corporation)

- MetLife Investment Management

- Mubadala Investment Company

- Nan Shan Life Insurance

- National Mutual Insurance Federation of Agricultural Cooperatives

- Peak Reinsurance

- QIC (Qazaqstan Investment Corporation JSC)

- Sompo Japan Insurance

- State of New Jersey

- YF Life Insurance International

...and many more!

Pension Funds

- APG Asset Management

- BCI (British Columbia Investment Management Corp)

- Brighter Super

- Canada Pension Plan Investment Board (CPPIB)

- Commonwealth Superannuation Corporation

- Employees Provident Fund

- Employees Retirement System of Texas

- HEST Australia

- KWAP

- LAFPP (Los Angeles Fire and Police Pensions)

- Maryland State Retirement and Pension System (MSRPS)

- National Pension Service (NPS)

- New Jersey Division of Investment

- NGS Super

- NYC Retirement Systems

- NZ Super Fund

- OMERS (Ontario Municipal Employees Retirement System)

- Ontario Teachers’ Pension Plan

- Pension Fund of Japanese Corporations

- Pensioenfonds Zorg en Welzijn (PFZW)

- PGGM Investments

- PRIM (Pension Reserves Investment Management Board)

- Qazaqstan Investment Corp AO

- Stichting Pensioenfonds

- Toshiba Pension Fund

...and many more!

Endowments and Foundations

- Brown University Investment Office

- Concordia University

- Cornell University Office of Investments

- Cystic Fibrosis Foundation

- EJS (Edmond J. Safra Foundation)

- Hasso Plattner Foundation

- Helmsley Charitable Trust

- Hong Kong Baptist University

- Indiana University Foundation

- Institute for Advanced Study

- Margaret A. Cargill Foundation

- National University of Singapore - NUS

- Northwestern University

- Robert Wood Johnson Foundation

- Singapore Management University

- Smithsonian Institution

- The Dietrich Foundation

- The Kresge Foundation

- UC Berkeley Endowment

- UCLA

- University of Hong Kong

- Weizmann Global Endowment Trust

- Wellesley College

...and many more!

Family Offices

- Aceana Group

- Alba Capital

- Avenue Family

- Fargo Wealth Group

- Flick Family Office

- Full Vision Capital

- Golden Vision Capital

- GreenBear Group

- Grifii Capital

- HT Capital

- Kemnay

- Kewalram Capital

- Khattar Holdings

- Mastery Holdings

- Miven, LLC

- Mulan V Investment

- North-East Private Equity

- Paddington St Finance

- Peninsula House

- Royal Family Office

- Rubix Capital

- Shun Hing Capital

- SQ Invest Spa

- Sterling Private Management

- Stonehage Fleming

- Strong Grace

- Ti Holdings

- Topaz Family Office

- UCEA Family Office

- WEGA Invest

- Wells Global

- Wengen Advisors

- Yuhina Capital

...and many more!

Lead Sponsors

Affinity Equity Partners

http://www.affinityequity.com/Affinity Equity Partners is an independently owned private equity fund managers established in March 2004 following the spin-off of the UBS Capital Asia Pacific team, the successful private equity arm of UBS AG in the region. Affinity raised its fourth external fund of US$6.0 billion in December 2017. Affinity Equity Partners currently advises and manages more than US$14 billion of funds and assets, with offices in Hong Kong, Singapore, Seoul, Sydney and Beijing. Since inception, Affinity Equity Partners has completed over 50 landmark transactions in eleven countries across various industries and sectors with aggregate transaction value of US$22 billion. Our Firm invests in businesses with an established track record, strong market positions, demonstrable earnings momentum and growth ambitions.

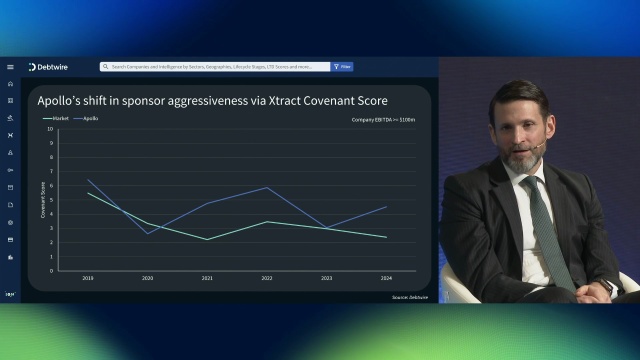

Apollo

https://www.apollo.comApollo is a high-growth, global alternative asset manager. In our asset management business, we seek to provide our clients excess return at every point along the risk-reward spectrum from investment grade to private equity with a focus on three investing strategies: yield, hybrid, and equity. For more than three decades, our investing expertise across our fully integrated platform has served the financial return needs of our clients and provided businesses with innovative capital solutions for growth. Through Athene, our retirement services business, we specialize in helping clients achieve financial security by providing a suite of retirement savings products and acting as a solutions provider to institutions. Our patient, creative, and knowledgeable approach to investing aligns our clients, businesses we invest in, our employees, and the communities we impact, to expand opportunity and achieve positive outcomes. As of March 31, 2024 Apollo had approximately $671 billion of assets under management.

Bain Capital

http://www.baincapital.com/Bain Capital, LP is one of the world’s leading private investment firms with approximately $185 billion of assets under management that creates lasting impact for our investors, teams, businesses, and the communities in which we live. Since our founding in 1984, we’ve applied our insight and experience to organically expand into several asset classes including private equity, credit, public equity, venture capital and real estate. We leverage our shared platform to capture cross-asset class opportunities in strategic areas of focus. With offices on four continents, our global team aligns our interests with those of our investors for lasting impact.

BC Partners

http://www.bcpartners.com/BC Partners is a leading alternative investment manager with over €40 billion in assets under management across private equity, private debt, and real estate. A pioneer in European buyout established in 1986, BC Partners today invests across Europe and North America.

- BC Private Equity has raised 11 successive funds totaling over €30 billion of committed capital, making 124 private equity investments, and generating significant co-investment deal-flow for its investors. It is currently investing its eleventh fund, targeting upper mid-market buyout opportunities across its four core sectors: TMT, Healthcare, Industrials & Business Services, and Consumer, in Europe and North America.

- BC Credit manages opportunistic and direct lending strategies targeting primarily direct private credit origination in the mid-market in North America, with opportunistic European exposure.

- BC Real Estate is investing its first fund, and targets value-add Office and Living opportunities in Western Europe with a focus on asset repositioning in high density locations.

Blackstone

https://www.blackstone.comBlackstone is the world’s largest alternative asset manager. We seek to create positive economic impact and long-term value for our investors, the companies we invest in, and the communities in which we work. We do this by using extraordinary people and flexible capital to help companies solve problems. Our $731 billion in assets under management include investment vehicles focused on private equity, real estate, public debt and equity, life sciences, growth equity, opportunistic, non-investment grade credit, real assets and secondary funds, all on a global basis.

Carlyle

https://www.carlyle.com/Carlyle (NASDAQ: CG) is a global investment firm with deep industry expertise that deploys private capital across its business and conducts its operations through three business segments: Global Private Equity, Global Credit and Global Investment Solutions. With $435 billion of assets under management as of June 30, 2024, Carlyle's purpose is to invest wisely and create value on behalf of its investors, portfolio companies and the communities in which we live and invest. Carlyle employs more than 2,200 people in 29 offices across four continents.

Follow Carlyle on X @OneCarlyle and LinkedIn at The Carlyle Group.

CVC

https://www.cvc.com/CVC Capital

CVC is a leading private equity and investment advisory firm with a network of 25 offices throughout Europe, Asia and the US, with approximately €137 billion of assets under management. CVC has six complementary strategies across private equity, secondaries and credit, for which we have secured commitments in excess of €165 billion from some of the world's leading institutional investors across its private equity and credit strategies. Funds managed or advised by CVC are invested in over 100 companies worldwide, which have combined annual sales of approximately €100 billion and employ more than 550,000 people. For further information about CVC please visit: www.cvc.com. Follow us on LinkedIn.

CVC Asia

CVC has one of the largest and longest-established pan-regional office networks of any private equity business in Asia and has been active in the region since 1999. CVC's Asia private equity strategy is focused on control, co-control and structured minority investments in high quality businesses in core consumer and services sectors across Asia. Typical enterprise values are between $250 million and $1.5 billion. For further information about CVC’s Asia Pacific funds please visit: www.cvc.com/private-equity/asia.

EQT

https://eqtgroup.comEQT is a purpose-driven global investment organization focused on active ownership strategies. With a Nordic heritage and a global mindset, EQT has a track record of almost three decades of delivering consistent and attractive returns across multiple geographies, sectors and strategies. Uniquely, EQT is the only large private markets firm in the world with investment strategies covering all phases of a business’ development, from start-up to maturity. EQT today has more than EUR 112 billion in assets under management including BPEA EQT across 45+ active funds within three business segments – Private Capital, BPEA EQT and Real Assets.

With its roots in the Wallenberg family’s entrepreneurial mindset and philosophy of long-term ownership, EQT is guided by a set of strong values and a distinct corporate culture. EQT manages and advises funds and vehicles that invest across the world with the mission to future-proof companies, generate attractive returns and make a positive impact with everything EQT does.

In October 2022 EQT combined with BPEA Asia to create BPEA EQT combines the private equity teams from Baring Private Equity Asia (BPEA) and EQT Asia, creating a comprehensive Asian private equity presence with local teams in eight cities across the region, a 25-year heritage, and more than USD 25 billion of capital deployed since inception.

Private Capital comprises six business lines: EQT Private Equity, EQT Future, EQT Ventures, EQT Life Sciences, EQT Growth and EQT Public Value. The Private Capital segment has grown rapidly and has EUR 68.2 billion in assets under management as of December 2022.

Real Assets – The Real Assets’ business segment comprises three business lines: EQT Infrastructure, EQT Active Core Infrastructure and EQT Exeter. The Real Asset segment has EUR 44.2 billion in assets under management as of December 2022.

Pacific Equity Partners (PEP)

http://www.pep.com.auPEP is Australasia’s oldest and largest private equity firm, with A$12 billion AUM across various investment strategies. Since its founding in 1998, PEP has made more than 200 investments including bolt-ons, has engaged in close to A$50 billion of transactions, including both acquisitions and exits, and has delivered a 28% average Net IRR p.a. across the closed end funds. These results are built on a team-based approach of apprenticeship, long term experience, aligned incentives – and a disciplined investment focus, that has delivered ‘best in class’, consistent results for our investors and partners over the last 26 years. Our long-term investors include the world’s largest and most experienced investment institutions and sovereign wealth funds, as well as private wealth investors. PEP has been the recipient of various industry awards over the past 26 years, including most recently the 2024 Firm of the Year Award from the Australian Investment Council (AIC).

TPG

https://www.tpg.comTPG is a leading global alternative asset management firm, founded in San Francisco in 1992, with $229 billion of assets under management and investment and operational teams around the world. TPG invests across a broadly diversified set of strategies, including private equity, impact, credit, real estate, and market solutions, and our unique strategy is driven by collaboration, innovation, and inclusion. Our teams combine deep product and sector experience with broad capabilities and expertise to develop differentiated insights and add value for our fund investors, portfolio companies, management teams, and communities.

Asia Series Sponsor

KPMG

https://home.kpmg/cn/enKPMG is a global network of professional services firms providing Audit, Tax and Advisory services. We operate in 147 countries and territories and have more than 219,000 people working in member firms around the world. KPMG’s Private Equity group in China provides end to end advisory and assurance services to private equity funds, venture capital funds, private credit funds, sovereign wealth and other direct investment managers. Moreover, to augment this, KPMG China and its member firms have established focused industry groups covering areas in which we have particular knowledge. Not exhaustive, but we have sector capabilities focused on Consumer Markets, Financial Services, Government, Healthcare, Industrials, Infrastructure, Logistics, Pharmaceuticals and TMT.

Learn more at: https://home.kpmg/cn/en/home/industries/private-equity.html

WeChat: http://weixin.qq.com/r/A0Po8PrE_aeGrb6T9xYR

Weibo: https://weibo.com/kpmgchina

YouTube: https://www.youtube.com/user/kpmgchinahk

Co-Sponsors

10 Bridge Capital

https://10bridge.co.th10 Bridge Capital (formerly Hatton Equity Partners), established in 2016, is a Thailand-based investment firm founded by a team of seasoned professionals with extensive local networks and expertise across various industries. The firm focuses on investments in specialty manufacturing, consumer and retail, SaaS and business services, F&B and hospitality, healthcare and pharmaceuticals, and education sectors. With a geographical preference for Southeast Asia, particularly Thailand, 10 Bridge Capital manages assets up to USD 280 million.

The firm sources over 96% of its deals through proprietary relationships developed from its deep local network and strategic partnerships. This approach enables 10 Bridge Capital to access unique investment opportunities and support the growth of businesses in the region.

Alvarez & Marsal

http://www.alvarezandmarsal.comCompanies, investors and government entities around the world turn to Alvarez & Marsal (A&M) for leadership, action and results. Privately held since its founding in 1983, A&M is a leading global professional services firm that provides advisory, business performance improvement and turnaround management services. When conventional approaches are not enough to create transformation and drive change, clients seek our deep expertise and ability to deliver practical solutions to their unique problems.

With over 10,000 people across six continents, we deliver tangible results for corporates, boards, private equity firms, law firms and government agencies facing complex challenges. Our senior leaders, and their teams, leverage A&M’s restructuring heritage to help companies act decisively, catapult growth and accelerate results. We are experienced operators, world-class consultants, former regulators and industry authorities with a shared commitment to telling clients what is really needed for turning change into a strategic business asset, managing risk and unlocking value at every stage of growth.

To learn more, visit alvarezandmarsal.com. Follow A&M on LinkedIn, Twitter and Facebook.

CDH Investments

http://www.cdhfund.com/Established in 2002, CDH Investments is one of the leading China focused alternative investment fund managers. With over $22 billion of assets under management, CDH invests across the alternative asset classes in Private Equity, Venture & Growth, Private Credit, Real Assets, and Public Equities. CDH partners with China’s leading businesses to create long-term value, supports its portfolio companies at various stages of their growth and development. CDH focuses on investing in the most attractive asset classes and adhering to a value-oriented investment mindset. We have invested in more than 350 companies and have helped more than 100 companies successfully list on international and China’s domestic stock exchanges.

Coller Capital

http://www.collercapital.comColler Capital, founded in 1990, is one of the world's leading investors in the secondary market for private assets – and widely acknowledged as an innovator at the complex end of secondaries.

The firm provides liquidity solutions to private markets investors worldwide, acquiring interests in private equity, private credit, and other private markets assets. With headquarters in London, and offices in New York and Hong Kong, Coller’s multinational investment team has a truly global reach.

In January 2021, the firm closed Coller International Partners VIII, with committed capital (including co-investment vehicles) of just over $9 billion and backing from over 200 of the world’s leading institutional investors.

In February 2022 the firm closed Coller Credit Opportunities I, with committed capital (including co-investment vehicles) of c.$1.4 billion and backing from over 30 institutional investors.

InnoVision Capital

http://www.innovisioncap.comFounded in 2016, InnoVision Capital is widely recognized as a leading next-generation Private Equity manager in Asia that has been focusing on investing in ESG space, primarily green energy / clean tech, food security and healthcare sectors for more than 20 years with strong and proven track records.

InnoVision endeavors to implement the best ESG practices among all the financial institutions with a proven track record in the pan-Asia region. The sustainable strong alpha creation comes from 3 main drivers, including investing in industry leading companies with enormous long-term growth potential and attractive entry valuation, disciplined exit strategy through multiple channels and value creation to portfolios and investors. InnoVision has obtained the UNPRI signatory and is voluntarily complied with Article 6 and supports United Nations Sustainable Development Goals, “UN SDGs”, investing in companies that align with the SDGs.

The Founder & CEO of InnoVision, Lane Zhao, a 20-year veteran in the private equity industry, has been focusing on ESG investment since his time prior to InnoVision at KKR as one of the founding stage members of the Asia business from 2006 to 2016. Lane pioneered the first ESG investment of KKR Asia, i.e. United Envirotech, a leading Membrane-based Integrated Environmental Solutions Provider headquartered in Singapore.

InnoVision currently has both USD and RMB funds under management, with deep industry knowledge, top-notch deal sourcing network, strong value creation capabilities, best-in-class internal processes, successful experiences in global capital markets, and deep insights into regulation trends.

InnoVision has had many successful investments since its inception, such as Beike (NYSE: BEKE), JD Logistics (2618.HK), China Securities (601066.SH, 6066.HK), WuXi AppTec (603259.SH, 2359.HK), Wanhua (600309.SH), Kuaishou (1024.HK), Inovance (300124.SZ), Lvkon, Eswin, 58 Group, Channel Soft, Vtown, Neurophth, CATUG Biotechnology, iCamuno Biotherapeutics, Kedu Healthcare, Butel, Swan Daojia, Lalami, etc. Historically, InnoVision founding team members have led or played significant roles in many successful investments in the ESG space, including United Envirotech (CEE.SG), Mengniu Dairy (2319.HK), Modern Dairy (1117.HK), Far East Horizon (03360.HK), Ping An Insurance (601318.SH, 2318.HK), Belle International, and CICC (601995.SH, 3908.HK).

InnoVision Capital firmly believes in the enormous growth potential within the green economy / clean tech, food security and healthcare industries. Within the green energy / clean tech industries, InnoVision specifically focuses on the EV supply chain, lithium batteries, hydrogen, AI water treatment, energy saving & eco-friendly solutions, waste management, energy storage, solar supply chain, and carbon exchange sectors. InnoVision is committed to investing in global industry leaders with the mission of making the world a better place through our investments.

Integrum

https://www.integrum.usIntegrum is an investment firm focused on partnering with technology-enabled services companies in the financial and business services sectors.

The firm was founded by a team of proven leaders with a vision to build a different type of investing platform benefiting from their diverse and complementary backgrounds and vast relationship network.

Integrum’s approach is to build a concentrated portfolio of high-conviction investments. Integrum aims to accelerate growth through investments in technology and other forms of innovation and by partnering with management teams to enhance access to talent, relationships, and capabilities.

Invest Hong Kong

https://www.investhk.gov.hkInvest Hong Kong (InvestHK) is the Hong Kong Special Administrative Region (HKSAR) Government Department responsible for attracting Foreign Direct Investment and supporting overseas and Mainland businesses to set up or expand in Hong Kong.

InvestHK has industry specialists in a range of priority sectors including: Business & Professional Services, Creative Industries, Consumer Products, Family Offices, Financial Services, Fintech, Information & Communications Technology, Innovation & Technology, Startups & Entrepreneurs, Sustainability, Tourism & Hospitality, and Transport & Logistics and Industrial, plus a network of staff and representatives based in 35 key business cities worldwide covering its target markets.

Partners with clients on a long-term basis, InvestHK team is available to help at any stage of their business development in Hong Kong. It provides free advice and customised services to help businesses succeed in Hong Kong's vibrant economy.

J-STAR

http://www.j-star.co.jp/en/J-STAR is a private equity investment company that provides solution capitals to mid-sized Japanese companies through our investment. Founded in 2006, J-STAR has served funds managing and advising over JPY 100bn across 4 vintages, consistently producing top class performance.

We are a group of over 20 experienced, local investment professionals who have abundant experience in the private equity investment since the early stage of the Japanese buyout market. Targets investment opportunities in small to mid-sized Japanese companies with established business models that are unique, established brands and / or leading positions in their market niches that need capital via creative solution.

J-STAR strives for maximization of the business values while communicating with the management teams, shareholders including founding owners, business partners, banks, etc.

L Catterton

https://www.lcatterton.comL Catterton is a market-leading consumer-focused investment firm, managing approximately $33 billion of equity capital across three multi-product platforms: private equity, credit, and real estate. Leveraging deep category insight, operational excellence, and a broad network of strategic relationships, L Catterton's team of more than 200 investment and operating professionals across 17 offices partners with management teams to drive differentiated value creation across its portfolio. Founded in 1989, the firm has made over 250 investments in some of the world's most iconic consumer brands.

Lexington Partners

http://www.lexingtonpartners.comLexington Partners is a leading global alternative investment manager primarily involved in providing liquidity solutions to owners of private equity and other alternative investments and in making co-investments alongside leading private equity sponsors. Lexington Partners is one of the largest managers of secondary acquisition and co-investment funds with $55 billion in committed capital since inception. Lexington has acquired over 3,900 secondary and co-investment interests through more than 1,000 transactions with a total value in excess of $69 billion, including $17 billion of syndications. Lexington also invests in private investment funds during their initial formation and has committed to more than 550 new funds in the U.S., Europe, Latin America, and the Asia-Pacific region. Lexington has offices strategically located in major centers for private equity and alternative investing - New York, Boston, Menlo Park, London, Hong Kong, Santiago, São Paulo and Luxembourg.

Loyal Valley Capital

https://en.loyalvalleycapital.comEstablished in 2015, Loyal Valley Capital (LVC) is a thematic, research-driven private equity firm with strong entrepreneurial culture that invests in companies positioned to benefit from the secular industry transformations in China. With over US$3.5 billion of assets under management, LVC mainly focuses on three key sectors: New Consumer, Healthcare, and Advanced Manufacturing. We pride ourselves as a trusted influential shareholder by entrepreneurs, relentlessly focused on active value creation and accelerating growth via strategic initiatives through our extensive network of business leaders in China. LVC manages capital on behalf of international institutional investors such as sovereign wealth funds, funds of funds, private banks, and family offices, as well as elite entrepreneurs and founders of China’s Fortune 500 enterprises.

Madison India Capital

http://www.madison-india.comMadison India Capital is one of India's leading independent private investment firms. Since its inception more than ten years ago, the firm has generated more than $1 billion in value, including distributions to fund of funds, financial institutions, pension funds, secondary funds, and family offices.

The firm offers liquidity to shareholders of exceptional companies and partners with both private equity managers as well as ambitious management teams of portfolio companies. Madison India Capital has been the trusted liquidity partner to top decile venture capital firms, private equity firms, founders and employees. The firm has provided liquidity to over 450 parties in India and Southeast Asia since inception.

The firm takes an active role where helpful and works collaboratively with other investors to help management achieve its growth plans. The firm has offices in Delhi, Singapore and Mauritius.

Navis Capital Partners

https://www.naviscapital.comNavis Capital Partners (“Navis”) was founded in 1998. It has over two decades of experience in partnering and growing distinctive companies in Southeast Asia. Navis has made over 90 control growth buyout investments and over 80 follow-on investments. Our 25 years of investing experience, focused on transforming and growing middle market businesses with a distinctive competitive advantage, has delivered top quartile returns.

Navis manages several private and public equity capital commitments totalling over ~USD 5 billion, and whose investors include a number of well-known US, European, Middle Eastern and Asian institutional investors and family offices.

Navis operates 6 offices across the region and has over 100 professionals comprising of 15+ nationalities. This strength in numbers and longevity in the region results in all of Navis’ companies to be leaders or near leaders in their fields. Industries/segments in which Navis has invested include healthcare, education, food processing, F&B, industrial products amongst others.

The firm contributes both capital and management expertise to its portfolio companies with the objective of directing strategic, operational and financial improvements, typically through initiatives that drive growth, margin improvement and asset efficiency. 80% of Navis’ realised returns have been driven by revenue and EBITDA growth.

Navis’ investment model places a low reliance on leverage to drive its equity returns.

Navis has launched its Navis Asia Credit platform to leverage on the firm’s extensive and deep sourcing capabilities in the region, and will seek to provide liquidity solutions to high quality middle market family owned businesses.

ShawKwei & Partners

http://www.shawkwei.comShawKwei & Partners is an international private equity fund manager based in Hong Kong, Singapore, Shanghai and San Francisco. We have been investing across Asia, the USA, and Europe for over 30 years and understand the challenges facing companies competing in today’s global markets.

We invest with mid-market industrial and service businesses capitalizing on ShawKwei’s core strengths: detailed and insightful analysis, operational skills, and transformation experience to drive business profitability and capital efficiency. ShawKwei’s partnership with management is pivotal to transforming and improving those investments.

We take significant ownership stakes in our investments coupled with our disciplined and hands-on management to assist portfolio companies to build better business and achieve long-term success. The ShawKwei strategy, methods and practices are specially crafted for businesses operating across Asia, Europe, and USA.

The Longreach Group

http://www.longreachgroup.comThe Longreach Group is an established independent private equity firm with offices in Hong Kong and Tokyo. The firm focuses on Japan and related Greater China control buyouts in the mature industrial and technology, consumer, business services and financial services sectors. The firm manages three Funds which have accumulated approximately US$2.1 billion of committed limited partner and co-investment capital and has a strong track record of portfolio company value creation and realizations.

Longreach currently has 14 investment professionals located in Tokyo and Hong Kong. The firm also enjoys the support of prominent and highly committed Advisors located in Tokyo, Taipei, Shanghai, New York, London and San Francisco.

Tor Investment Management

https://www.torinvestment.comTor Investment Management is a leading independent alternative credit manager in Asia with $2.2 billion under management across one evergreen and four closed-end funds. The firm was founded in 2012 by Patrik Edsparr, former Global Head of JP Morgan’s Proprietary and Principal Investing Division, and Chris Mikosh, former Head Trader of Goldman Sachs’ Asian Special Situations Group (ASSG), to provide investors with access to the Asia-Pacific credit markets in opportunities ranging from high yield to bank debt and private financings. Based in Hong Kong and Singapore, the platform consists of 45 employees, including an investment team of 18 professionals with 17 years of average experience. Tor Investment Management's global institutional investor base includes public and corporate pension plans, sovereign wealth funds, endowments, foundations, outsourced CIOs and family offices.

VIG Partners

http://www.vigpartners.comVIG Partners (formerly known as Vogo Investment Group), founded in 2005, has comprehensive experience and expertise in the Korean mid-market buyout sector, with successful track records across a diverse range of industries, including financial services, consumer goods, online and mobile commerce, and household appliances. Over the 18-year period, VIG Partners has invested over $3.6 billion of capital across 27 portfolio companies in Korea, with shareholding control in 24 of these companies. The firm’s investments include Kundal (leading personal care brand), Eastar Jet (leading low cost carrier), Preed Life(#1 funeral service company), Auto Plus(#2 used car retailer), Star Vision (#1 beauty contact lens brand), Bonchon (global Chicken QSR brand), Foodist (leading food service company), BKR (master franchisee of Burger King), Samyang Optics (leading interchangeable lens manufacturer), Bodyfriend (#1 massage chair manufacturer), Enuri.com (leading e-commerce portal), and Hiparking (#1 parking management company).

Investment Summit Legal Sponsors

Baker McKenzie

https://www.bakermckenzie.comBaker McKenzie is a transactional powerhouse with unmatched private equity focus and expertise. We work with some of the world’s largest financial sponsors on acquisitions, exits and portfolio company needs. We help structure deals to minimise risk and ensure that clients achieve their goals.

With over 300 private equity lawyers, we have more experts in more markets than any other private equity practice and work seamlessly across borders to deliver innovative advice wherever it may be. Seamless, global operation is part of our DNA.

Our full service firm and breadth of practices enables us to address all aspects of the transaction, bringing specialists that are best in class in their fields.

The combination of our deep sector local expertise, and our ability to work seamlessly across each of the countries and specialisations means we can add unique value in shaping, negotiating and closing the deal. We are a true partner in the investment process, from initial investment to exit, that can help structure financing, incentivise management, create value in the portfolio company and execute a successful exit.

The results speak for themselves - we lead and close complex deals - every day.

Morrison Foerster

https://www.mofo.comWith over 1,000 lawyers across 17 offices, Morrison Foerster is a global law firm that has been active in Asia for over 40 years, with 50+ dedicated Private Equity/Mergers & Acquisitions (PE/M&A) lawyers in Asia.

Ranked as a Band 1 law firm for Asia Pacific: Corporate/M&A: Private Equity by Chambers Asia-Pacific 2024, and a Tier 1 law firm for China: Private Equity by The Legal 500 Asia Pacific 2024, we have handled over 200 PE/M&A deals in Asia with an aggregate asset value of over US$265 billion in the past five years. Additionally, we have over 20 years of unrivaled experience in Environmental, Social, and Governance (ESG) standards, helping clients with sustainable investment strategies to reflect their impact goals and increase profitability.

Sign up for the MoFo PE Briefing Room to receive our latest analyses and event invitations exploring the hottest topics in the global PE space.

Rajah & Tann Asia

https://www.rajahtannasia.comRajah & Tann Asia is one of the largest regional networks that brings together leading law firms and more than 1,000 fee earners across Cambodia, China, Indonesia, Lao PDR, Malaysia, Myanmar, Singapore, Thailand, Philippines and Vietnam; with each offering the highest standards of service to locally based clients while collectively having the capability to handle the most complex regional and cross border transactions, we are able to provide excellent legal counsel seamlessly across the region. RTA's geographical reach also includes Singapore based regional desks focusing on Brunei, Japan and South Asia.

A member of the VIMA (Venture Capital Investment Model Agreements) working group, our Private Equity and Venture Capital (PEVC) Practice is a highly integrated, multidisciplinary group of recognised experts who work closely with other practices across the firm and network. The team has extensive experience in providing comprehensive solutions through every stage of the PEVC investment cycle, including fund establishment and formation, fundraising, buyouts, distressed deals, exit planning, restructuring and financing.

At Rajah & Tann Asia, our commitment is delivering exceptional legal expertise across all regions and practices, meeting clients' needs promptly and effectively. In essence, we are Lawyers who know Asia.

PE Leaders Summit Sponsors

A&O Shearman

https://www.aoshearman.comA&O Shearman is an international firm built to achieve unparalleled outcomes for its clients on their most complex, multijurisdictional matters — everywhere in the world. With nearly 4,000 lawyers located in an extensive network of 29 countries and 48 offices, the firm is equally fluent in English law, U.S. law, and the laws of the world's most dynamic markets.

Our global private capital team advises fund managers, fund investors, portfolio companies and management teams across the full investment lifecycle. We provide unparalleled expertise in the design and execution of complex and innovative cross-border structures and transactions, supporting private capital clients at the most senior level.

We act on everything from fund formation to financing and capital markets deals, M&A, regulatory issues, tax matters, disputes, financial restructurings and insolvencies, leveraging our unrivalled expertise, creativity, and industry knowledge, to deliver outstanding results for our clients.

We provide strategic counsel to funds pursuing a range of strategies, including private equity, private credit, infrastructure, real estate, and special situations. We also act for the world’s leading sovereign wealth funds, pension funds, family offices and insurance companies.

With an extensive network of 13 offices across Asia Pacific, our lawyers have a deep understanding of the challenges and opportunities facing the private capital industry in this complex and evolving region, offering expert advice where clients need it.

Stay informed by subscribing to our updates and events here.

Apex Group

https://www.apexgroup.comApex Group Ltd., established in Bermuda in 2003, is a global financial services provider. With over 80 offices worldwide and 11,000 employees in 38 countries, Apex Group delivers an expansive range of services to asset managers, financial institutions, private clients and family offices. The Group has continually improved and evolved its capabilities to offer a single-source solution through establishing the broadest range of services in the industry; including fund services, digital onboarding and bank accounts, depositary, custody, super ManCo services, corporate services including HR and Payroll and a pioneering ESG Ratings and Advisory solution. Apex Group’s purpose is to be more than just a financial services provider and is committed to driving positive change to address three core areas; the Environment and Climate Change, Women’s Empowerment and Economic Independence, Education and Social Mobility.

Carta

https://carta.comThrough a connected ecosystem of tools, Carta links together the key players in private equity and venture — from investors and LPs to their portfolio companies.

Carta’s world-class fund administration platform supports nearly 7,000 funds and SPVs, and represents nearly $130B in assets under management.

Trusted by more than 40,000 companies, Carta helps private businesses in over 160 countries manage their cap tables, valuations, taxes, equity programs, compensation, and more.

Today, Carta is setting a new standard as the end-to-end platform connecting private capital. Our fund management platform seamlessly integrates a suite of tools and insights purpose-built to support the strategic impact of the fund CFO.

Carta has been included on the Fortune Best Large Workplaces in Financial Services and Insurance list, Forbes’ list of the World's Best Cloud Companies, Fast Company's Most Innovative list, and Inc.'s Fastest-Growing Private Companies list.

J.P. Morgan Asset Management

https://am.jpmorgan.com/hk/en/asset-managementJPMorgan Chase & Co. (NYSE: JPM) is a leading financial services firm based in the United States of America (“U.S.”), with operations worldwide. JPMorgan Chase had US$4.2 trillion in assets and US$346 billion in stockholders’ equity as of September 30, 2024. The Firm is a leader in investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing and asset management. Under the J.P. Morgan and Chase brands, the Firm serves millions of customers in the U.S., and many of the world’s most prominent corporate, institutional and government clients globally.

J.P. Morgan Asset Management, with assets under management of USD 3.5 trillion (as of September 30, 2024), is a global leader in investment management. J.P. Morgan Asset Management's clients include institutions, retail investors and high net worth individuals in every major market throughout the world. J.P. Morgan Asset Management offers global investment management in equities, fixed income, real estate, hedge funds, private equity and liquidity.

With more than 60 years as an alternatives investment manager, US$240 billion in assets under management and more than 800 professionals (as of March 31, 2024), J.P. Morgan offers strategies across the alternative investment spectrum including real estate, private equity, private credit, hedge funds, infrastructure, transportation, timber and liquid alternatives. Operating from offices throughout the Americas, Europe and Asia Pacific, our independent alternative investment engines combine specialist knowledge and singular focus with the global reach, vast resources and powerful infrastructure of J.P. Morgan to help meet each client's specific objectives.

Linnovate Partners

https://www.linnovatepartners.comLinnovate Partners is a leading asset services provider focused on driving innovation in the alternative investments industry. With expertise across the entire fund lifecycle, Linnovate Partners goes beyond traditional fund administration to provide value-added services and technologies that empower asset and fund managers to excel in their operations. Its six core service areas include:

- Fund Administration

- Investor Relations

- Regulatory Compliance

- Portfolio Monitoring

- Reporting Services

- Consulting Services

Powering these services is a proprietary, cloud-based platform, RAISE, that provides all the functions of alternative investing in a single ecosystem and enables seamless integration and accessibility. With offices globally, Linnovate Partners currently administers over $120 billion in assets across more than 600 private equity and venture capital funds. As an innovation-focused disruptor, Linnovate Partners combines deep industry expertise and the latest technologies to drive better outcomes for alternative investment managers and investors worldwide.

VC Summit Sponsors

CCV Capital

https://www.ccvcap.com/CCV Capital is a global venture capital firm deeply rooted in the Silicon Valley ethos, specializing in early-stage investments while upholding the esteemed legacy of KPCB. Founded by Wei Zhou, the former Managing Partner of KPCB China, alongside the original technology investment team, we seamlessly merge Silicon Valley’s innovative spirit with a broad global presence. We operate from offices in Singapore, Silicon Valley, and Beijing, investing in pioneering global technologies.

With assets under management approaching $2 billion, our founding team leverages extensive entrepreneurial expertise to identify and cultivate high-potential startups. Within our first decade, we achieved a 35% unicorn formation rate and led Series A rounds for 80% of our ventures, elevating many to become trailblazers in their sectors and achieve successful public offerings.

Our prestigious portfolio includes notable companies such as JD.com (NASDAQ:JD), VenusTech (002439), CreditEase (NYSE:YRD), Rong360 (NYSE:JT), Arrail Dental (HKSE:06639), SYS Water Doctor (301372), and TanTan (acquired by NASDAQ:MOMO). We also back innovators like Ximalaya FM, Shukun Technology, JD Digital, Transsnet Financial, MetaApp, U POWER, Cowa Robot, and IceKredit.

CCV Capital's Partners have been repeatedly recognized in Forbes' Top 100 Most Influential Global Chinese and Top 30 Venture Capitalists, included in Fortune's Top 30 Most Influential Investors of the Year, and has received numerous accolades, including Best Venture Capitalist by China Venture and Best Technology Fund Manager by The Asset. Additionally, CCV Capital has been consistently acknowledged as a leading venture capital firm globally.

East Ventures

https://east.vc/East Ventures is a pioneering and leading sector-agnostic venture capital firm headquartered in Singapore. Founded in 2009, East Ventures has transformed into a holistic platform that provides multi-stage investment, including Seed and Growth for over 300 companies in Southeast Asia.

An early believer in the startup ecosystem in Indonesia, East Ventures is the first investor of Indonesia's unicorn companies, namely Tokopedia and Traveloka. Other notable companies in the portfolio include Ruangguru, SIRCLO, Kudo (acquired by Grab), Loket (acquired by Gojek), Tech in Asia, Xendit, IDN Media, MokaPOS (acquired by Gojek), ShopBack, KoinWorks, Waresix, and Sociolla.

East Ventures was named the most consistent top performing VC fund globally by Preqin, and the most active investor in SEA and Indonesia by various media. Moreover, East Ventures is the first venture capital in Indonesia to sign the Principles of Responsible Investment (PRI), supported by the United Nations (UN). East Ventures is committed to achieving sustainable development and bringing positive impacts to society through its initiatives and ESG-embedded practices.

Instagram: https://www.instagram.com/eastventures/

Globis Capital Partners

http://www.globiscapital.co.jp/enGlobis Capital Partners is one of Japan's leading independent venture capital firm that primarily invests in Japanese startups from early stage to pre-IPO stage. Globis has managed seven funds totaling over JPY 180 billion, including latest Globis VII (final closed in March 2023 at JPY 72.7billion). All closed funds were ranked in the top quartile in global VC benchmarks in their respective vintage years, and it has multiple unicorn and unicorn potential startups in its current portfolio. About 90% of LPs are institutional investors both from and outside of Japan.

Globis almost always leads rounds and provides hands-on management support to its portfolio companies through board participation by its capitalists as well as tactical support by its value-add team GCP X. In addition, in April 2023 Globis opened a new office in San Francisco to strengthen support for the global expansion of its portfolio companies.

With its unique combination of western style investment expertise obtained through a joint venture with Apax Partners and Japan-local business expertise through Globis Group, which runs No.1 MBA program in Japan, Globis continues to lead the VC market in Japan.

Ince Capital

https://www.incecap.comFounded on July 1, 2019, INCE Capital is a venture capital firm with an investment focus on early to expansion stage companies that spearhead innovation in technology, Internet, and consumer industries.

The letters “IN” embody the firm’s commitment to make intelligent innovative investment decision, or “CE” in Chinese. INCE’s mission is to “empower the future greats”.

INCE now has more than US$1 billion in commitments under management across its managed funds. The investor base consists of the world’s leading university endowments, foundations, family offices, and funds of funds.

INCE closed its first fund in October 2019, raising a total of $351,888,000, and announced the final closing of its second US dollar-denominated fund with around US$700 million in commitments across two funds in January 2022.

INCE’s founding partners, JP Gan, Steven Hu, Stella Zhou and Paul Keung are supported by teams in Shanghai, Beijing, and Hong Kong, China.

MSA Capital

https://www.msacap.comMSA Capital is a global private equity and venture capital firm founded in 2014 that focuses on early and growth stage investments. The firm manages over USD 2 billion and invests in highly innovative and disruptive companies in the biotech, core tech, and consumer sectors. Notable portfolio companies include Meituan, Boss Zhipin, NIO, BGI, Yidu Cloud, Cloudr, Pyrotech, Cider, and Sironax. MSA’s LP base composed of regional and global institutional investors, as well as leading entrepreneurs from China.

TH Capital

http://www.thcapital.com.cnTH Capital was founded in 2007 as part of Tsinghua University ecosystem in Beijing. Owned and managed by the founding partners, the company has become a leading GP in China, investing growth capital in China’s most innovative and advanced high-tech companies. To date, TH Capital has invested minority shares in over 100 rapidly growing and highly profitable hard-tech companies across China, financing their development in their home market and beyond.

Based on 15 years of track record as an investor in industrial high-tech, our investment focus and ability are aligned with China’s top-level development goals, concentrating on Advanced Manufacturing, Next-Generation Technologies, Decarbonization and Frontier Technologies.

Investors in TH Capital’s funds include leading private market asset managers and financial institutions from China and abroad. Our 50 investment and research professionals execute our investment model based on proprietary in-house top-down industry research and unique resources of the Tsinghua ecosystem. With China Roots and a global vision, we have built strong value-add capabilities in China and abroad, supporting portfolio companies from offices in Beijing, Shenzhen and Zurich. Understanding the regulatory impact and strategic direction of China, TH Capital has developed an investment model investing across China’s strategic high-tech industries and exits its investment through IPOs on the stock exchanges in China.

With AUM exceeding RMB 20bn across 5 funds raised, TH Capital is raising its first USD fund in 2023 to provide international investors with unique access to the biggest growth investment opportunities across China’s high-tech industries.

TTGG Ventures

http://ttgg.com.cn/en/Founded in 2000, TTGG Ventures is one of the longest-running domestic fund managers in China. With over $1.3 billion in assets under management, TTGG capitalizes on opportunities in manufacturing, technology, and healthcare amidst China's structural transformation.

As of 2023, our investments have reached $3.28 billion, and 50 portfolio companies have successfully gone public. Our seasoned investment team, with over two decades of experience, delivers unparalleled market acumen and a forward-looking approach. Notably, we identified and began investing in the New Energy sector as early as 2014, placing us at the vanguard of industry shifts.

Demonstrating consistent outperformance, TTGG has maintained its position among the top quartile of RMB funds, particularly excelling in DPI over the past decade.

VC Summit Legal Sponsor

Cooley

http://www.cooley.comCooley LLP is an international law firm representing clients in a wide range of industries. Cooley has more than 1,500 lawyers across 17 offices in Asia, Europe and the United States. The firm represents 6,000+ high-growth new economy companies, 500+ venture fund families and closes over 2,000 venture and growth investments per year.

In Asia, Cooley has offices in Beijing, Shanghai, Hong Kong and Singapore. Cooley is broadly recognized for its powerhouse technology, life sciences and venture capital practices. We represent some of Asia’s most innovative and dynamic companies and leading investors, advising on their financings, M&As and joint ventures, IPOs and other strategic transactions at all stages of their growth.

Our dedication to Asia's fund industry is unparalleled and unrivaled by any other law firm. Cooley has been advising on Asia-related matters over three decades, dating back to 1989, when the firm advised on the formation of the first institutional venture capital fund investing in China. Today, we are counsel to more than 500 private investment fund organizations worldwide, including more than 90 fund managers with their primary operations in China and other Asia countries and numerous other managers outside of the region making investments in portfolio companies in Asia. We form considerably more dollar-denominated Asia venture capital and growth equity funds in dollar terms than any other law firm worldwide. We have a team of more than 40 specialist fund formation lawyers and dozens of other practitioners dedicated to serving our clients headquartered and doing business in Asia. Multiple members of our team are Mandarin-speaking, Chinese native fund formation specialists who assist our China funds clients and their investors in both USD and RMB fund formation matters.

LP Summit Sponsors

Adams Street Partners

http://www.adamsstreetpartners.comAdams Street Partners is a global private markets investment manager with investments in more than thirty countries across five continents. Adams Street’s 90+ investment professionals focus on five strategies: primary fund partnerships, secondary transactions, co-investments, direct growth equity company investments, and private credit deals. Adams Street strives to generate actionable investment insights across market cycles by drawing on 50 years of private markets experience, proprietary intelligence, and trusted relationships. The firm is 100% employee-owned and has $51 billion in assets under management. Adams Street maintains a worldwide presence with offices in Austin, Beijing, Boston, Chicago, London, Menlo Park, Munich, New York, Seoul, Singapore, and Tokyo.

HarbourVest

https://www.harbourvest.comHarbourVest is an independent, global private markets firm with 40 years of experience and more than $125 billion assets under management as of December 31, 2023. Our interwoven platform provides clients access to global primary funds, secondary transactions, direct co-investments, real assets and infrastructure, and private credit.

LGT Capital Partners

https://www.lgtcp.comLGT Capital Partners is a leading alternative investment specialist with over USD 80 billion in assets under management and more than 600 institutional clients in 43 countries. An international team of over 650 professionals is responsible for managing a wide range of investment programs focusing on private markets, liquid alternatives and multi-asset class solutions. Headquartered in Pfaeffikon (SZ), Switzerland, the firm has offices in New York, San Francisco, Raleigh, Dublin, London, Paris, Vaduz, Frankfurt am Main, Luxembourg, Dubai, Beijing, Hong Kong, Tokyo and Sydney.

ESG Summit Lead Sponsor

KKR

http://www.kkr.comKKR is a leading global investment firm that manages multiple alternative asset classes, including private equity, energy, infrastructure, real estate and credit, with strategic partners that manage hedge funds. KKR aims to generate attractive investment returns for its fund investors by following a patient and disciplined investment approach, employing world-class people, and driving growth and value creation with KKR portfolio companies. KKR invests its own capital alongside the capital it manages for fund investors and provides financing solutions and investment opportunities through its capital markets business. References to KKR's investments may include the activities of its sponsored funds. For additional information about KKR & Co. Inc. (NYSE: KKR), please visit us on Twitter @KKR_Co.

ESG Summit Co-Sponsors

LGT Capital Partners

https://www.lgtcp.comLGT Capital Partners is a leading alternative investment specialist with over USD 80 billion in assets under management and more than 600 institutional clients in 43 countries. An international team of over 650 professionals is responsible for managing a wide range of investment programs focusing on private markets, liquid alternatives and multi-asset class solutions. Headquartered in Pfaeffikon (SZ), Switzerland, the firm has offices in New York, San Francisco, Raleigh, Dublin, London, Paris, Vaduz, Frankfurt am Main, Luxembourg, Dubai, Beijing, Hong Kong, Tokyo and Sydney.

Navis Capital Partners

https://www.naviscapital.comNavis Capital Partners (“Navis”) was founded in 1998. It has over two decades of experience in partnering and growing distinctive companies in Southeast Asia. Navis has made over 90 control growth buyout investments and over 80 follow-on investments. Our 25 years of investing experience, focused on transforming and growing middle market businesses with a distinctive competitive advantage, has delivered top quartile returns.

Navis manages several private and public equity capital commitments totalling over ~USD 5 billion, and whose investors include a number of well-known US, European, Middle Eastern and Asian institutional investors and family offices.

Navis operates 6 offices across the region and has over 100 professionals comprising of 15+ nationalities. This strength in numbers and longevity in the region results in all of Navis’ companies to be leaders or near leaders in their fields. Industries/segments in which Navis has invested include healthcare, education, food processing, F&B, industrial products amongst others.

The firm contributes both capital and management expertise to its portfolio companies with the objective of directing strategic, operational and financial improvements, typically through initiatives that drive growth, margin improvement and asset efficiency. 80% of Navis’ realised returns have been driven by revenue and EBITDA growth.

Navis’ investment model places a low reliance on leverage to drive its equity returns.

Navis has launched its Navis Asia Credit platform to leverage on the firm’s extensive and deep sourcing capabilities in the region, and will seek to provide liquidity solutions to high quality middle market family owned businesses.

Nio Capital

http://www.niocapital.comEstablished in 2016, NIO Capital seeks to invest in the extensive opportunities created by innovative technologies and business models that are reshaping the mobility, energy, logistics and other adjacent industries in a transformative manner. The firm’s investment approach combines value investing with comprehensive industry resources, deep knowledge and hands-on portfolio management. NIO Capital has assembled an experienced and multi-disciplinary team with solid skillsets and blue-chip backgrounds hailing from top investment and professional services firms, internet giants and automotive companies. The firm is headquartered in Shanghai, China, with additional offices in Beijing.

“Eve ONE” is the flagship USD-denominated VC strategy vertical of NIO Capital. The inaugural fund in its series, Eve ONE Fund I, was established in 2018 with support from global blue-chip institutions, including sovereign wealth funds, global insurance companies, pension funds, fund-of-funds, corporates, and family offices. Fund I has demonstrated top-quartile performance with early investments into category leaders such as Momenta, Pony.ai, Innovusion, Inceptio, etc.

Starquest Capital

http://www.starquestcap.com/enFounded in 2017, Starquest Capital is one of the largest RMB private equity funds in China, which is managed by several highly experienced entrepreneurs and investors with over 20+ years investment, deal making experience. Starquest Capital focuses on New Economy through direct investment and FOF investment with initial AUM of around RMB 30 billion.

Focusing on opportunities in Healthcare, Digital Consumer, Intelligent Manufacturing and Technology in the new economy, Starquest Capital is on the lookout for future unicorns and for private equity investment opportunities across the entire value chain. Starquest deploys capital through reputable GPs and leading firms in various industries. With a purpose to create value for every stakeholder in the private equity industry, Starquest operates an investment process informed by its proprietary system of big data analytics and artificial intelligence and is supported by a localized professional team with global experience in direct investment and fund of funds management.

Starquest highly values green investing and sustainability principles. It was the first RMB FoF/PE investor to have joined the UNPRI and to become a signatory of the Green Investment Principles (GIP) for the Belt and Road, initiated by the China Green Finance Committee. Starquest is committed to long-term and sustainable development of the Chinese private equity industry.

Awards Sponsors

Alvarez & Marsal

http://www.alvarezandmarsal.comCompanies, investors and government entities around the world turn to Alvarez & Marsal (A&M) for leadership, action and results. Privately held since its founding in 1983, A&M is a leading global professional services firm that provides advisory, business performance improvement and turnaround management services. When conventional approaches are not enough to create transformation and drive change, clients seek our deep expertise and ability to deliver practical solutions to their unique problems.

With over 10,000 people across six continents, we deliver tangible results for corporates, boards, private equity firms, law firms and government agencies facing complex challenges. Our senior leaders, and their teams, leverage A&M’s restructuring heritage to help companies act decisively, catapult growth and accelerate results. We are experienced operators, world-class consultants, former regulators and industry authorities with a shared commitment to telling clients what is really needed for turning change into a strategic business asset, managing risk and unlocking value at every stage of growth.

To learn more, visit alvarezandmarsal.com. Follow A&M on LinkedIn, Twitter and Facebook.

K&L Gates

https://www.klgates.comK&L Gates is a global law firm with more than 2,000 attorneys and 48 offices across five continents. With nearly 30 years of presence in Asia and a strong footprint in Australia, our 400+ attorneys operate in 11 cities across Asia Pacific. For more than 50 years, we have built strong relationships with private capital providers and the companies, management teams, and entrepreneurs who leverage private capital to acquire, create, and grow businesses.

Our global asset management team of 160+ lawyers offer expert advice to a diverse range of clients, including: Private equity and buyout funds; Venture capital funds; Infrastructure and real estate funds; Sovereign wealth funds; ESG and sustainability-focused funds; Private REITs; Hedge funds; Hybrid funds; Emerging manager platform funds; and Emerging market ETFs.

We provide comprehensive services for all types of investment vehicles. Our offerings include the formation, structuring, and management of investment funds, as well as guidance on downstream investments, buyouts, venture financing, and exit strategies. We combine insightful business advice with a strong understanding of fiduciary duty.

Our team is well-versed in fund marketing and investor risk communication, with a keen awareness of regulatory and compliance issues affecting both funds and investors. We speak multiple languages and have extensive experience navigating the complexities of the region, having advised many first-time funds and innovative transactions.

LP Breakfast Sponsor

Asia Alternatives

https://www.asiaalt.comAsia Alternatives is a solution platform dedicated to helping institutional investors make investments in private equity across Asia. The Firm currently manages approximately $15.5 billion of regulatory assets under management across Asia Alternatives Capital Partners, LP (“AACP I”) ($515 million), Asia Alternatives Capital Partners II, LP (“AACP II”) ($950 million), Asia Alternatives Capital Partners III, LP (“AACP III”) ($908 million), Asia Alternatives Capital Partners IV, LP, along with its sleeve fund focused on investments outside of Japan, AACP IV Ex-Japan Investors, LP ($1 billion), Asia Alternatives Capital Partners V, LP along with its parallel fund, Asia Alternatives Capital Partners V (ERISA), LP ($1.515 billion), and Asia Alternatives Capital Partners VI, LP and its related parallel funds ($1.1 billion), Asia-focused private equity Funds-of-Funds (FoF), plus other related fund vehicles. Asia Alternatives invests with top performing private equity fund managers across Asia, primarily in Greater China (Mainland China, Taiwan, and Hong Kong), Japan, Korea, South East Asia, India and Australia, and is diversified across buyout, growth and expansion, venture capital and special situations funds. The Firm currently has over 50 professionals and offices across Hong Kong, Beijing, Shanghai and San Francisco.

Networking Coffee Break Sponsor

Intralinks

https://www.intralinks.comIntralinks, an SS&C company, is a leading financial technology provider for the global dealmaking, alternative investments and capital markets communities. As pioneers of the virtual data room, our technology enables and secures the flow of information, empowering our customers to work more productively and with complete confidence. Intralinks facilitates strategic initiatives such as mergers and acquisitions, corporate lending, debt sales, capital raising and investor reporting. Our solutions enhance these activities by streamlining operations, reducing risk, improving client experiences and increasing visibility. We’ve earned the trust and business of more than 99 percent of the Global Fortune 500 and have executed over $35 trillion in financial transactions on our platform.

Gala Cocktail Sponsor

A&O Shearman

https://www.aoshearman.comA&O Shearman is an international firm built to achieve unparalleled outcomes for its clients on their most complex, multijurisdictional matters — everywhere in the world. With nearly 4,000 lawyers located in an extensive network of 29 countries and 48 offices, the firm is equally fluent in English law, U.S. law, and the laws of the world's most dynamic markets.

Our global private capital team advises fund managers, fund investors, portfolio companies and management teams across the full investment lifecycle. We provide unparalleled expertise in the design and execution of complex and innovative cross-border structures and transactions, supporting private capital clients at the most senior level.

We act on everything from fund formation to financing and capital markets deals, M&A, regulatory issues, tax matters, disputes, financial restructurings and insolvencies, leveraging our unrivalled expertise, creativity, and industry knowledge, to deliver outstanding results for our clients.

We provide strategic counsel to funds pursuing a range of strategies, including private equity, private credit, infrastructure, real estate, and special situations. We also act for the world’s leading sovereign wealth funds, pension funds, family offices and insurance companies.

With an extensive network of 13 offices across Asia Pacific, our lawyers have a deep understanding of the challenges and opportunities facing the private capital industry in this complex and evolving region, offering expert advice where clients need it.

Stay informed by subscribing to our updates and events here.

Gala Dinner Sponsor

Affinity Equity Partners

http://www.affinityequity.com/Affinity Equity Partners is an independently owned private equity fund managers established in March 2004 following the spin-off of the UBS Capital Asia Pacific team, the successful private equity arm of UBS AG in the region. Affinity raised its fourth external fund of US$6.0 billion in December 2017. Affinity Equity Partners currently advises and manages more than US$14 billion of funds and assets, with offices in Hong Kong, Singapore, Seoul, Sydney and Beijing. Since inception, Affinity Equity Partners has completed over 50 landmark transactions in eleven countries across various industries and sectors with aggregate transaction value of US$22 billion. Our Firm invests in businesses with an established track record, strong market positions, demonstrable earnings momentum and growth ambitions.

SUPPORTING ORGANISATIONS

AIGCC

https://aigcc.net/AIGCC works to create awareness and encourage action among Asia’s investors about the risks and opportunities associated with climate change.

AIGCC members:

- From 11 different markets in Asia and internationally,

- Include asset owners and managers

- More than US$28 trillion in combined AUM

The AIGCC network has a strong international profile and engages with government pension and sovereign wealth funds, family offices, and endowments. AIGCC represents the Asian investor perspective in the evolving global discussions on climate change and the transition to a net zero emissions economy.

Alternative Investment Management Association

https://www.aima.org/The Alternative Investment Management Association (AIMA) is the global representative of the alternative investment industry, with around 2,100 corporate members in over 60 countries. AIMA’s fund manager members collectively manage more than US$3 trillion in hedge fund and private credit assets.

AIMA draws upon the expertise and diversity of its membership to provide leadership in industry initiatives such as advocacy, policy and regulatory engagement, educational programmes and sound practice guides. AIMA works to raise media and public awareness of the value of the industry.

AIMA set up the Alternative Credit Council (ACC) to help firms focused in the private credit and direct lending space. The ACC currently represents over 250 members that manage over US$1 trillion of private credit assets globally.

AIMA is committed to developing skills and education standards and is a co-founder of the Chartered Alternative Investment Analyst designation (CAIA) – the first and only specialised educational standard for alternative investment specialists. AIMA is governed by its Council (Board of Directors).

Beijing Private Equity Association (BPEA)

北京基金业协会成立于 2008 年 6 月 20 日,是由私募基金行业人士自愿联合发起成立,经北京市民政局核准登记的非营利性社会团体法人。协会以“标准化、市场化、国际化”为宗旨,专注于为私募基金行业各方提供独立、专业的咨询服务,致力于促进行业环境建设,维护会员合法权益,研究行业发展动向,培养相关专业人员,组织内外交流合作,助力行业蓬勃发展。

Beijing Private Equity Association (BPEA) is a non-profit social group, which was established by the equity investment fund industry in a voluntary joint initiative on June 20, 2008.With the tenet of “standardization, marketization and internationalization”, BPEA focuses on providing independent and professional information consultation, investment consulting and fundraising services for all parties in the private equity investment industry in China, through professional training, research consulting, conference services, investment and financing docking and other services which will help the industry to flourish. BPEA committed to: promote the issuance of preferential policies for PE industry, safeguard the legitimate rights of members, research development trends of PE industry, train relevant professional individuals and cooperate with domestic and overseas institutions.

CAIA Association

The CAIA Association is a global professional body dedicated to creating greater alignment, transparency, and knowledge for all investors, with a specific emphasis on alternative investments. A Member-driven organization representing more than 12,000 professionals in more than 100 countries, CAIA Association advocates for the highest ethical standards. The organization provides unbiased insight on a broad range of investment strategies and industry issues, key among them being efforts to bring greater diversification to portfolio construction decisions to achieve better long-term investor outcomes. To learn more about the CAIA Association and how to become part of the organization’s mission, please visit https://caia.org/.

Contact:

LinkedIn: https://www.linkedin.com/showcase/caia-apac

Website: https://caia.org/

Email: apac@caia.org

CVCA

中华股权投资协会(CVCA)成立于2002年,是大中华区成立最早的创业投资和私募股权投资行业协会组织。协会依托国际化的背景,秉持独立性、专业性的理念,通过市场化运作,致力于推动创业投资和私募股权投资在大中华地区的健康、可持续发展。CVCA现有逾百家会员公司,囊括了一大批国际国内最知名最具影响力的机构,包括凯雷、KKR、华平、TPG、鼎晖、贝恩、弘毅、高盛、红杉、高瓴、IDG、启明创投、中信资本等等。截止目前,CVCA会员机构管理的大中华地区美元基金约390支,总额约为六千多亿美元;人民币基金约1,290支,总额超一万亿人民币。他们拥有世界一流的投资经验和金融人才,经过全球不同地区和不同经济周期的历练,回归深耕中国市场,并成功投资于大中华地区的众多行业领域;他们致力于在中国大陆推动中国私募股权市场的繁荣和行业发展,同时也为众多最具创新性和成长潜力的公司带来快速发展机会。

Founded in 2002, the Hong Kong-based China Venture Capital and Private Equity Association (CVCA) is the oldest and longest-running trade group representing the venture capital and private equity investment industry in Greater China. Through reliance on its international team of experts, while upholding its independence and professional integrity, CVCA is committed to promoting the healthy and sustainable development of the venture capital and private equity industry in Greater China through market-oriented operations. CVCA has more than 100 regular members and associates, including a number of the most renowned and influential firms in China and the world at large, e.g., Carlyle Group, KKR & Co., TPG Capital, Warburg Pincus, CDH Investments, Hony Capital, Goldman Sachs Group, Sequoia Capital, IDG Capital, Qiming Venture Partners, and CITIC Capital. To date, CVCA members run over 390 U.S dollar-denominated investment funds in Greater China, with a total of US$600 billion in assets under management (AUM); and 1,290 RMB-denominated funds, with more than RMB¥1 trillion in AUM. With a wealth of investment experience and a proven track record in deal-making globally and across varying economic cycles, these institutions are firmly committed to the Chinese market, successfully investing in many industries in Greater China. Their substantial investment in Mainland China not only contributes to the prosperity of the Chinese private equity market and industry development, providing opportunities for many of China’s most innovative companies, these investments also align with China’s economic development strategy, contributing to the advancement of China’s real economy and its economic transformation.

The Global Private Capital Association (GPCA)

https://www.globalprivatecapital.org/The Global Private Capital Association (GPCA), which was founded as the Emerging Markets Private Equity Association (EMPEA) in 2004, is a non-profit, independent membership organization representing private capital investors who manage more than USD2t in assets across Asia, Latin America, Africa, Central & Eastern Europe and the Middle East.

United by a long-term investment approach, GPCA’s members include institutional investors across private equity, growth equity, venture capital, private credit, real assets, pension plans and sovereign wealth funds, among others.

With headquarters in New York and Singapore, GPCA includes LAVCA, the Association for Private Capital Investment in Latin America, which operates as a parallel membership organization with its own dedicated team and board.

Hong Kong Green Finance Association

https://www.hkgreenfinance.org/Hong Kong Green Finance Association (HKGFA) aims to unite experts to advise the HKSAR Government on green and sustainable finance. Established in September 2018, HKGFA fosters green and sustainable finance in Hong Kong, GBA, and globally, engaging the public and private sectors. It drives policy development, fosters innovation in financial institutions, and aims to position Hong Kong as a leading international green tech and green finance hub. Aligned with global sustainability goals, HKGFA operates through five working groups, promoting sustainable finance through events, certifications, and research. By engaging over 160 members, including financial institutions and corporations, HKGFA advances green and sustainable finance locally and internationally, contributing to the UN SDGs and the Paris Agreement.

HKIFA

The Hong Kong Investment Funds Association (“HKIFA”) is a non-profit-making organization that represents the asset management industry in Hong Kong. We have two major roles, namely consultation and education. On consultation, we work closely with the authorities to relay the views of our members on issues that have implications for the asset management industry. On education, we spearhead initiatives to enable Hong Kong people to understand more about the risk/return characteristics of mutual funds; and to use them effectively for retirement investment and other financial planning purposes (www.hkifa.org.hk).

HKSTP

Hong Kong Science and Technology Parks Corporation (HKSTP) has for 20 continuous years committed to building up Hong Kong as an international innovation and technology hub to propel success for local and global pioneers today and tomorrow. HKSTP has established a thriving I&T ecosystem that is home to three unicorns and Hong Kong’s leading R&D hub with over 11,000 research professionals and over 1,000 technology companies focused on healthtech, AI and robotics, FinTech and smart city technologies.