Breakfast masterclass: An introduction to CLOs

If you’re unfamiliar with the CLO asset class or get lost in the soup of acronyms this education session will bring you up to speed. Our expert journalists will provide a brief overview of the CLO market, how CLOs are structured and the parties that come together to make each deal happen. From key risks to investment strategies this masterclass will give you the background you need to make the most of the day.

What is a CLO? Who are the participants and how does it happen?

Understanding the key cashflows and tests

CLO debt and equity investment strategies

How the secondary CLO market works

Please note: This session will not be live streamed but will be available to watch on-demand.

Registration & coffee

Panel: Allocators outlook

It might not have been a record year for the CLO market, but 2022 still saw $114 billion of new issuance. But it was a harder time for CLO investors, with the Creditflux index of CLO fund performance down 7.7% YTD (as of the end of November). Our panel of expert allocators will talk us through how structured credit in general, and CLOs in particular, fits into their portfolios. How do they deal with the complexities of the asset class, and what advice do they have for new pension funds and insurance companies coming into the asset class for the first time?

How will CLO strategies perform over the next twelve months?

Should investors look at US or European CLOs, and should they keep to vanilla deals or look at more unusual structures?

How should LPs approach manager selection?

What are the pitfalls to avoid when pitching a CLO allocation to your board?

Coffee & networking break

Panel: Loan market outlook

An investment in CLOs is an investment in leveraged loans, and this panel will look into how the collateral underlying the CLO market has performed in the last 12 months, and how it will fare over the year to come. Challenging macroeconomic conditions have already begun to weigh on the market as rating agency downgrades outstrip upgrades, but is this a temporary blip or a warning of deeper trouble to come? Is this an opportunity for loan managers to snap up some bargains or a year to play it safe?

How will leveraged loans perform over the next twelve months?

Should investors have serious concerns about credit quality with the space?

Are the best opportunities in the primary or secondary loan markets?

Have we solved the SOFR problem?

Dispatches from the CLO trenches

Two of the top lawyers in the market sit down with Creditflux to discuss what they’ve been seeing. What are the burning legal issues that investors in the CLO space need to take notice of?

Networking lunch

Fund structures

It may seem like the last stage in the process, but choosing the right vehicle to invest in CLOs is critical to success. From dedicated CLO or structured credit funds, through separately managed accounts to new alternatives like interval funds there are no shortage of options available for investors. This panel will discuss the different options available for LPs looking to access the CLO market, including topics like:

- How big should you be before you consider direct investing?

- What are advantages and disadvantages of captive equity funds?

- How do interval funds compare with traditional fund structures for CLOs?

- Is there a place for liquid options like CLO ETFs?

ESG and CLOs

Investing in the CLO market remains a headache for LPs with ESG criteria. An increasing number of CLO managers market themselves as ESG compliant, but the market remains skeptical about how genuine they are – the recent Creditflux CLO Census revealed that the most common answer to which is the most ESG-aware US manager was “no-one”. What’s the solution for the growing number of LPs that need to track this metric in detail?

- How much pressure do US LPs really feel on ESG?

- Where is the CLO market on ESG criteria, and how do US and European CLOs differ?

- Are CLO funds able to provide the metrics that LPs need?

- How can the industry standardize reporting to reduce the duplication of effort, and are ESG ratings one answer?

The fall and rise of the CFO structure

An old structure is making new waves in the credit market with the return of the CFO (collateralized fund obligation). CFOs have been around for close to two decades, but the asset class is no longer investor-led, as it used to be, and is proving attractive particularly for private credit managers. New CFOs were issued last year by managers including Tikehau, Churchill and Nassau Corporate Credit. This panel will introduce this new kid on the block, explore the structure and look at prospects for the rest of the year.

- How does a CFO work?

- What assets are currently being securitized, and what could be added in the future?

- What are the key structural differences from a CLO?

- What are the attractions for both investors and issuers?

Coffee & networking break

CLO investor outlook

From electronic trading in the secondary market to growing tranche downgrades, these are “interesting times” for investors in the CLO market. This session will gather together a diverse group of traders and investors to discuss anything and everything that’s on their mind. There are no shortage of issues to choose from, but some of the topics that might make the list include:

- What will issuance look like in 2023?

- How worried should investors be about CLO tranche downgrades?

- Where’s the best relative value at the moment?

- Is electronic trading the future of the CLO secondary market?

Art or science? How technology is transforming CLO investing as well as management

The impact of machine learning on how CLO managers approach portfolio management is frequently covered, but what does that mean for CLO investors? New technologies to accelerate and improve productivity are sweeping into every market, and this panel will explore the myriad impacts of this on direct investors in CLOs.

- How important a factor is machine learning and optimization technology when picking a CLO manager?

- How can investors pick through the tangle of claims about AI to work out whether it’s really making an impact on CLO performance?

- What new tools are available to help structured credit investors themselves?

- What are the biggest remaining time-sinks for investors that technology could solve?

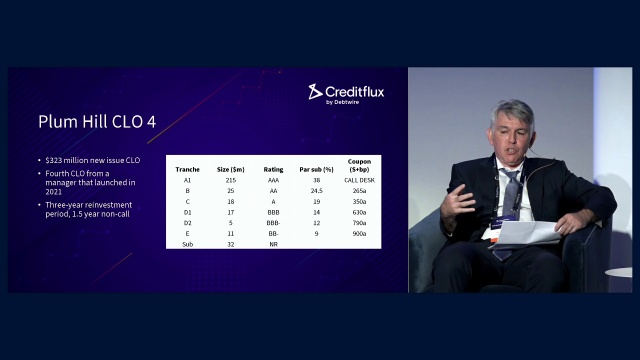

Panel: Would you buy it?

Four top CLO funds walk us through their investment process as they consider our CLO investment case studies. From relative value to manager due diligence, what are the key questions every CLO investor should ask before they buy?

- Primary vs secondary

- US vs Europe

- Mezz vs Equity

- BSL vs MM

Networking drinks reception

Confirm cancellation

An error occurred trying to play the stream. Please reload the page and try again.

CloseSign-up to join the ION Analytics Community to:

- Register for events

- Access market insights

- Download reports

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow