Things are on the up and up. Confidence among Europe's corporates surged in the second quarter and is now higher than at any point since the onset of the pandemic, according to the European Union Industry Confidence indicator. In fact, it's higher even than the most recent peak in 2018.

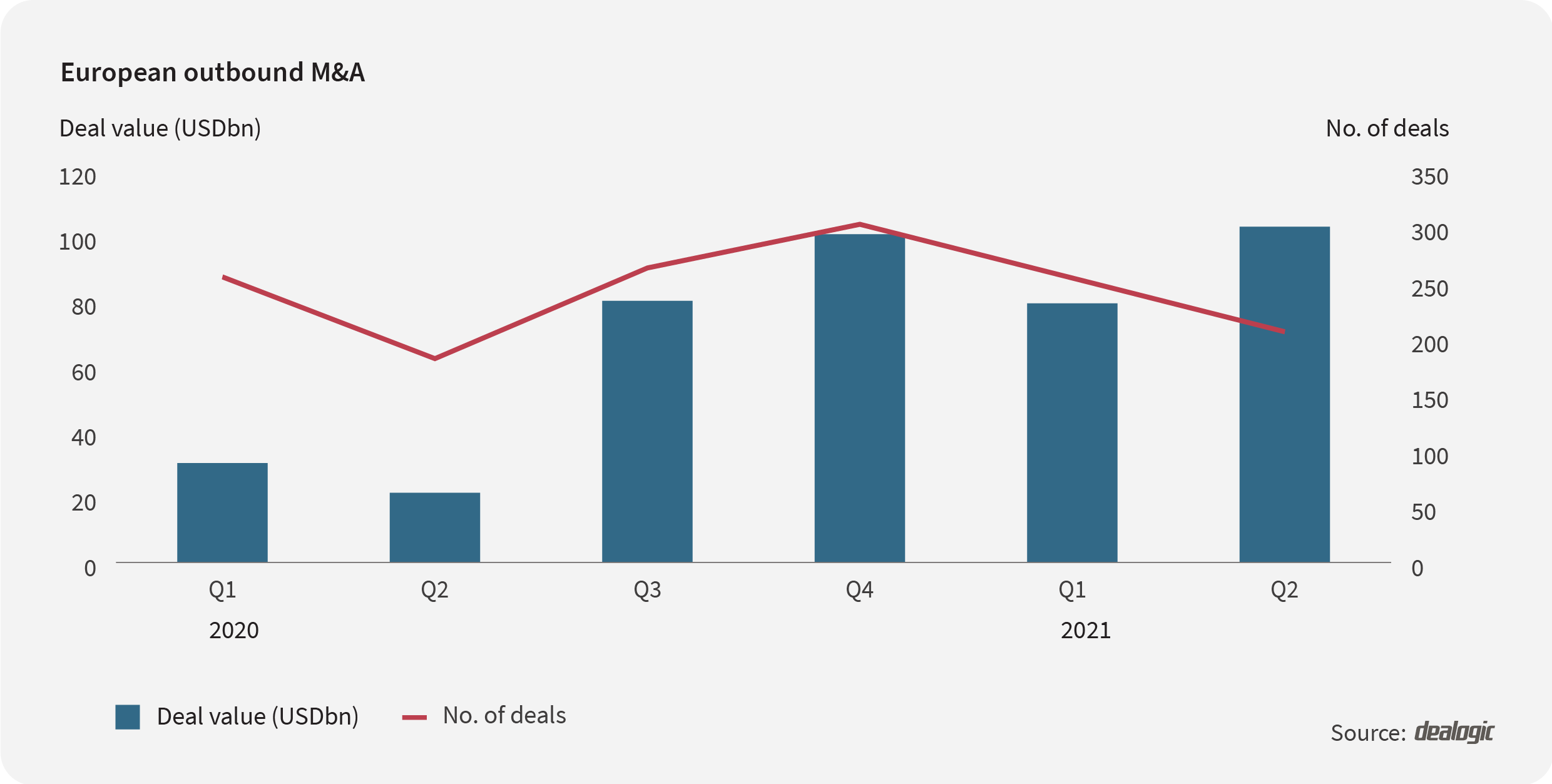

With spirits lifting, companies once again have their designs on rivals in other regions. Outbound M&A in Europe reached US$182.1 billion in H1 this year—3.5x the US$51.7 billion tallied in the same period in 2020.

Incoming M&A has also made strides, more than doubling in value from US$87.2 billion to US$181.5 billion as foreign parties eye Europe's recovery, which is lagging North America and Asia but assuredly picking up pace. The story here is that non-EU acquirers are buying big, with deal volume increasing by a relatively modest 15.8% despite the leap in invested dollars.

These interlopers have some reason for caution. In March, the European Commission published new merger guidance. At issue is the fact that transactions involving companies that have high competitive potential but low revenues are not reviewed at the EU or national level. Policymakers are concerned that strategic assets in the digital, technology, pharmaceutical and biotech sectors may be snaffled up without proper oversight.

Now the Commission is recommending that sensitive deals be referred under Article 22 of the merger rules, regardless whether they fly under the thresholds. In other words, buyers should expect more friction.

Of course, this isn't exclusive to Europe. The US continues to be sensitive to inbound M&A in strategic sectors. In early June, the Senate passed the US Innovation & Competition Act, which includes the Strategic Competition Act. The latter frames China as a direct threat to America's strategic interests. Europe's attitude to the world's second-largest economy is not much warmer. A bilateral investment and trade agreement was suspended by Europe in May over China's continued use of education camps.

Corporates are hungry for cross-border deals to achieve growth. Heightened protectionism means their ambitions are not without hurdles.

Recommendations are powered by your interests. To add your interests please sign in

1 - KR - Welcome Remarks_Edited 2 - EN - Private markets Changing Strategies_Edited 1 - EN - Welcome Remarks_Edited 2 - KR - Private markets Changing strategies_EditedNow in its third year, the Mergermarket Private Equity Forum New York has become a must-attend event for the private equity community. It’s designed to help you navigate the complexities of dealmaking with confidence, offering exceptional insights, practical strategies, and meaningful connections. Whether you’re an LP looking to expand your portfolio, a GP showcasing your expertise, or a private equity professional seeking collaborations, the forum is your platform for success in today’s dynamic market.

An error occurred trying to play the stream. Please reload the page and try again.

Close