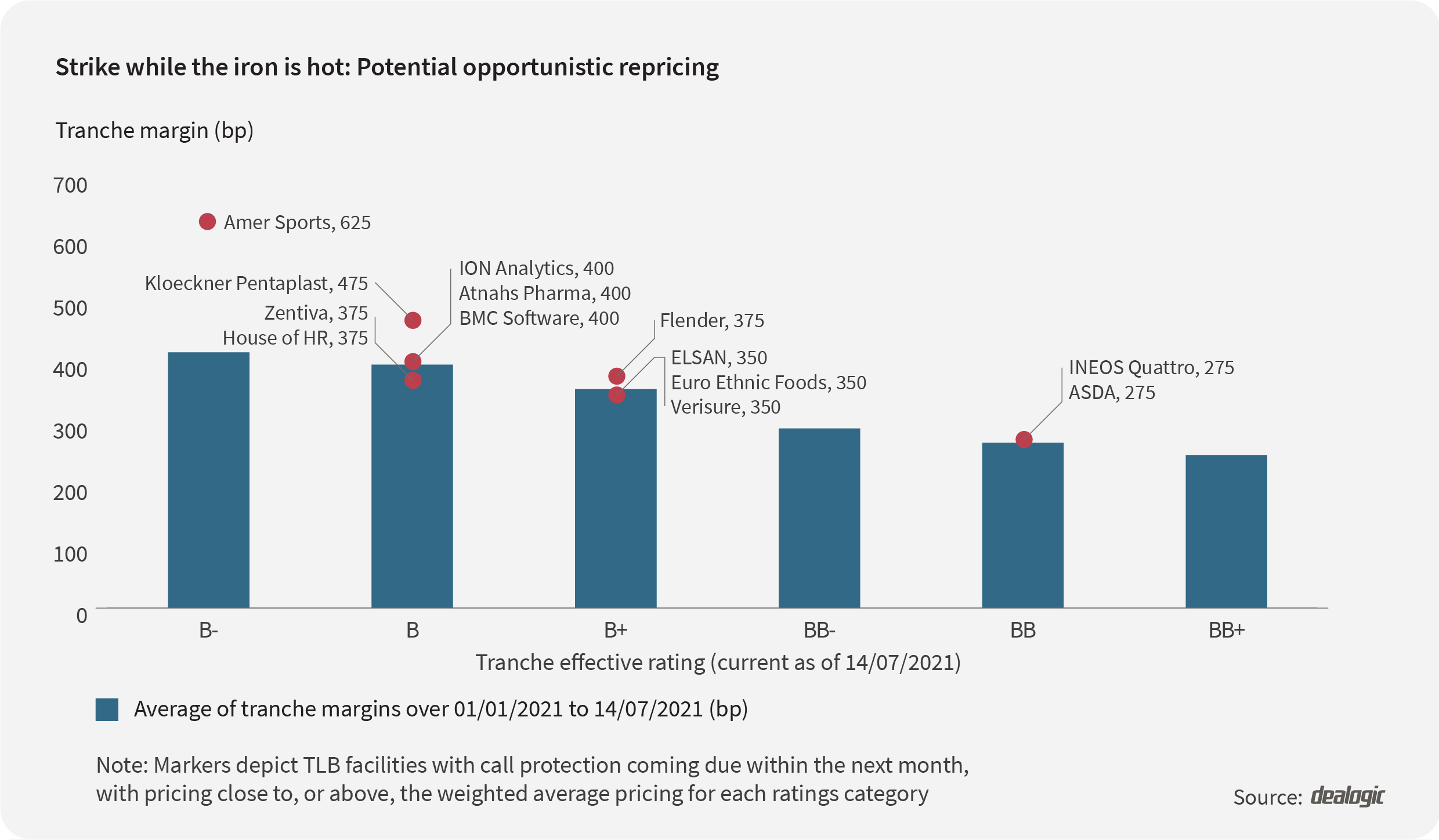

In addition to the M&A bonanza that has ensued as European economies roared back to life since the beginning of the year, corporates have also been keeping an eye on opportunistic repricings as loan pricing has edged lower.

Now, with the six-month soft call protections on first lien term loan B (TLB) tranches expiring on a selection of deals, borrowers will likely be eyeing a return to debt markets to lock in better rates. The ongoing price tightening has revealed opportunities in several deals that have call protection coming due imminently, according to analysis by Debtwire Par.

The greater the pricing differential on current TLBs versus what's available, the greater the incentive for borrowers to reprice. This teases out some obvious contenders who are most likely to make a return to the market to bring down their borrowing costs.

At the top of the list is Amer Sports, a B- credit whose €100 million loan is priced well above the average for its ratings bracket. The Finnish sporting goods company behind brands such as Wilson and Salomon, is paying 625 basis points (bps) over EURIBOR compared with a peer group average of 416bps. That paper will start a soft-call period come 18 August following a 12-month non-call provision. Still, with a more than two percentage point premium, a repricing may be worth the cost of early redemption.

In the B rating category, plastic packaging products manufacturer Kloeckner Pentaplast’s €600 million TLB currently pays 475bps, a 79bps premium to the current weighted average margin. This makes the company another strong repricing contender.

The further up the rating scale you go, however, the less repricing opportunity there is. The loans of Elsan, Euro Ethnic Foods, Verisure, INEOS Quattro and Asda, all B+ and above, are nearing the end of their six-month soft call protections but are nonetheless already priced near to perfection.

The closing of the pricing gap in the lower credit ratings suggests that investors are growing more confident in the recovery and are more optimistic about the prospects of harder hit credits than they were at the start of the year. Those with a lower credit rating should time their loan financing efforts wisely. If the trend of falling borrowing costs continues then there will be no shortage of deal supply, even if investor demand for paper is running high.

Recommendations are powered by your interests. To add your interests please sign in

1 - KR - Welcome Remarks_Edited 2 - EN - Private markets Changing Strategies_Edited 1 - EN - Welcome Remarks_Edited 2 - KR - Private markets Changing strategies_EditedNow in its third year, the Mergermarket Private Equity Forum New York has become a must-attend event for the private equity community. It’s designed to help you navigate the complexities of dealmaking with confidence, offering exceptional insights, practical strategies, and meaningful connections. Whether you’re an LP looking to expand your portfolio, a GP showcasing your expertise, or a private equity professional seeking collaborations, the forum is your platform for success in today’s dynamic market.

An error occurred trying to play the stream. Please reload the page and try again.

Close