What do vegans and private equity monoliths have in common? If nothing else, a fondness for oat milk.

When Blackstone Group paid €176 million for Sweden's Oatly last year, it was no one-off and it paid off—shares in Oatly jumped almost 30% following its US stock market debut last week, valuing the company around the US$13 billion mark. Many Nordic acquisitions in the consumer food space are being guided by an increasing awareness of environmental issues and a younger generation that is opting for healthy plant-based options over animal products.

Take for instance UK growth equity firm VGC's €5 million investment in Swedish milk company Sproud, a similar, albeit smaller deal.

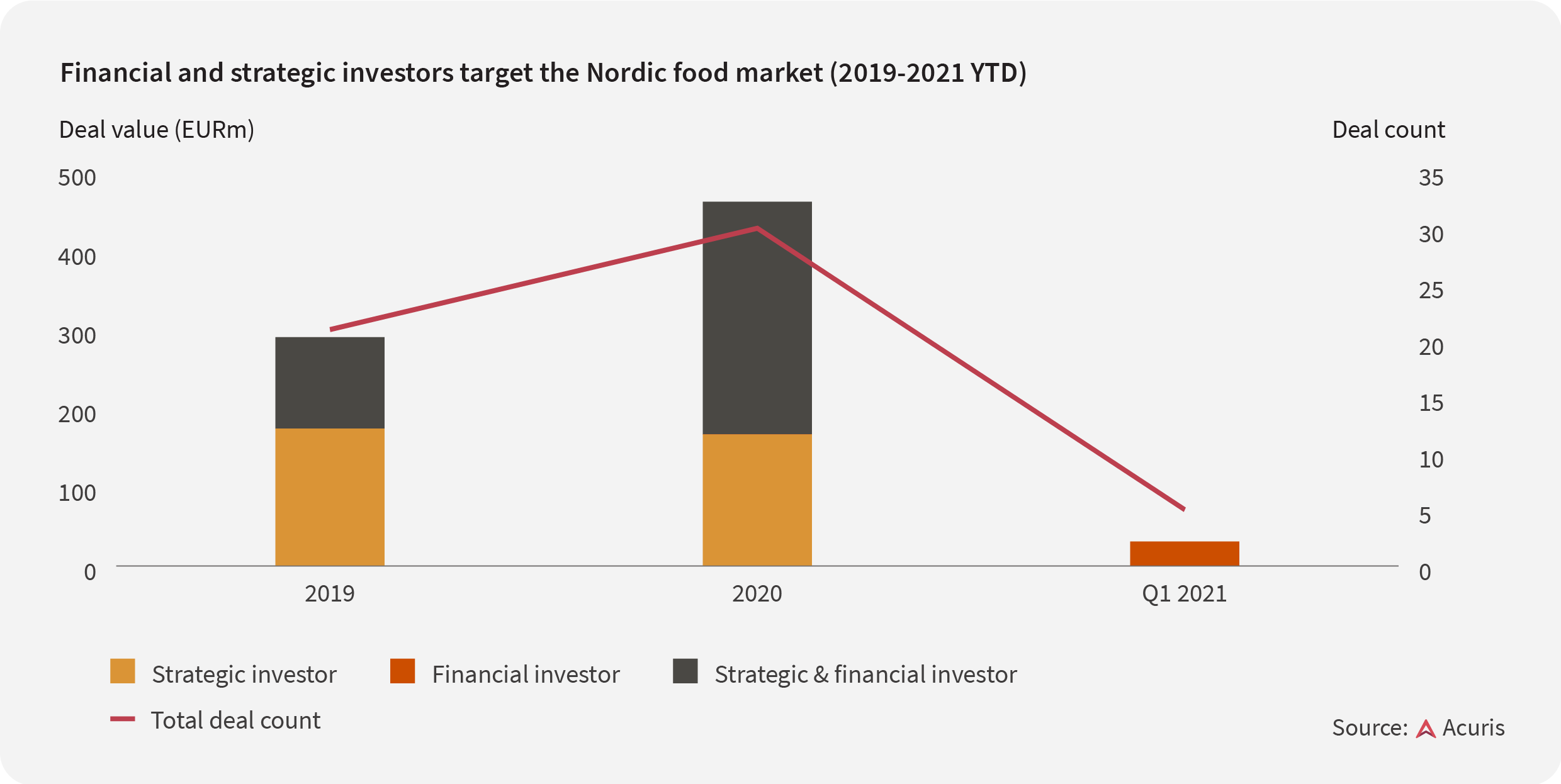

And it doesn't stop at milk. Mergermarket data shows that, of the €462 million in Nordic food industry M&A deals last year, the healthy food segment took a 46% slice of the pie. Food tech—an emerging area of technology that focuses on food preservation and waste—claimed 26%.

One strategic name that has been on a shopping spree of late is Bayn Group (or Humble Group as it is self-effacingly rebranding itself). Over the past year, the listed Swedish ingredients group has demonstrated a sweet tooth for companies selling healthy (or healthier) treats. Recent acquisitions include Tweek, Pandy Foods and, last month, Grahns Konfektyr.

The company has said it sees potential in using Grahns' manufacturing sites to ramp up the production of Tweek's and Pandy's tooth-friendly sweets as it builds out a portfolio of “fast-moving consumer goods products of the future”.

More M&A activity is expected in the Nordic food retail space, motivated by a need to digitalise operations to improve efficiencies and sustainability, as shoppers pay closer attention to their carbon footprints.

Like other territories, the Nordic retail food market is dominated by a small handful of big groups: ICA Gruppen, Coop and Reitan Group and United Nordic. After a year of rampant sales, as locked-down consumers loaded supermarket balance sheets with cash, there are few options for consolidation—at least, not ones that wouldn't agitate antitrust regulators.

This means that selective deals giving companies a foothold in healthy and vegan eating as well as waste and emissions reduction are expected to be increasingly popular.

For example, ICA—which last month opened its first “dark store” just outside Gothenburg using Ocado Group's technology—is actively seeking tech acquisitions. And Sweden's Coop has collaborated with the VC Norrsken Foundation and its Bloomer Accelerator programme, helping to scale up start-ups that are relevant to the cause.

As an early adopter of everything environmentally and socially sustainable, the Nordics may offer a clue of what's to come in Europe. The renewed emphasis on policymaking that is due to result from the UN Climate Change Conference this coming November suggests that we should expect more of the same.

Recommendations are powered by your interests. To add your interests please sign in

1 - KR - Welcome Remarks_Edited 2 - EN - Private markets Changing Strategies_Edited 1 - EN - Welcome Remarks_Edited 2 - KR - Private markets Changing strategies_EditedNow in its third year, the Mergermarket Private Equity Forum New York has become a must-attend event for the private equity community. It’s designed to help you navigate the complexities of dealmaking with confidence, offering exceptional insights, practical strategies, and meaningful connections. Whether you’re an LP looking to expand your portfolio, a GP showcasing your expertise, or a private equity professional seeking collaborations, the forum is your platform for success in today’s dynamic market.

An error occurred trying to play the stream. Please reload the page and try again.

Close