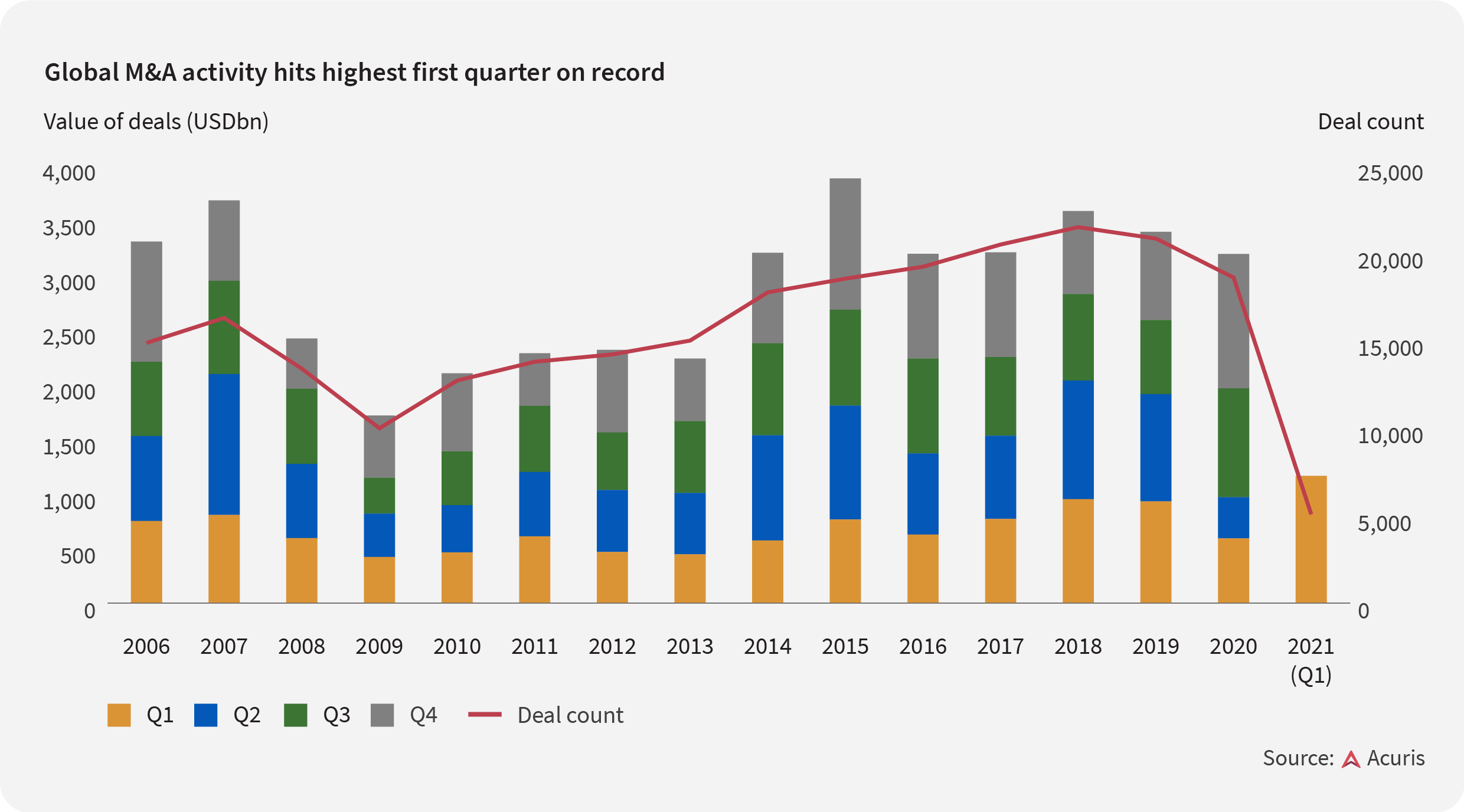

Investment bankers have good reason to pop corks and clink glasses based on the latest global M&A data—Q1 2021 saw US$1.16 trillion in deals, the most active first quarter on Mergermarket record.

This remarkable comeback has been spurred by a resurgent appetite for cross-border transactions, private equity's bulging pockets, the attack of the SPACs as well as vaccine roll-outs, President Biden’s big spending plans, interest rates… you name it and it probably contributed to the feeding frenzy.

North America definitely stole the show this quarter. The region, dominated by US activity, reached its highest market share in 14 years, netting 54.4% of global deal value, up from 48% in Q4 2020. The region is the M&A comeback kid—back in Q2 2020, North America's deal share fell to a mere 21.5%.

The return of cross-border deals certainly didn’t hurt. A record US$516.6 billion of these country-to-country transactions were recorded in the first quarter, with two massive US deals leading the pack: AerCap Holding’s US$31 billion bid for GE Capital Aviation Services and the planned US$28.6 billion merger of Canadian Pacific Railway and Kansas City.

While deals greater than US$5 billion surged in the latter half of 2020 to claim 44.5% of all deal value, this has since fallen back to 36.4% in the first quarter. Even so, the US$2 billion-to-US$5 billion range has become a real sweet spot. A total of US$274 billion was invested across 91 deals in this bracket, accounting for 23.6% of all value, up from 19.5% in Q4 last year.

It’s no secret that private equity has deep pockets and hasn't been shy to spread the love. The US$296.6 billion in buyouts (invested across 1,156 deals) makes Q1 2021 the most active quarter for PE of the past two decades, notwithstanding the mid-credit boom of Q2 2007. Even with this elevated activity, the voluminous dry powder at the industry's disposal shows little sign of diminishing.

Over the past three quarters, exit value has averaged US$212.9 billion—or 140% of the historical average dating back to 2001. If history is any measure, satisfied investors with few options to make big returns will plough these returns back into the asset class. Therefore, expect PE's return to the fray to be lasting.

And, of course, you can’t mention M&A these days without mentioning SPACs. M&A tied to special purpose acquisition companies spiked in the first quarter of the year, with 99 deals worth US$219.5 billion globally, dwarfing the whole of 2020. Whether SPACs will stay the course or not is up for debate of course—new blank cheque listings ground to a halt in April.

Regulators have pointed out that the warrants that are inherent in the SPAC structure should, in some cases at least, be accounted for as liabilities rather than equity. Until that crease is ironed out, the second quarter of 2021 may not be able to bring the heat.

Recommendations are powered by your interests. To add your interests please sign in

Scream for ice cream – Unilever and the case for a near-EUR 20bn asset sale Explore how Brazil's sports betting law brings legal certainty to investors and is expected to foster M&A M&A Activity in the UK Supermarket space Highlights from the Global M&A Dealmakers Sentiment Report 2024The must-attend event for the Nordic private equity and M&A community!

Hotel At Six, Stockholm

An error occurred trying to play the stream. Please reload the page and try again.

Close